This post was originally published on this site

More worries about China’s growth, along with jitters around President Vladimir Putin’s next move in Ukraine, are poised to take a bite out of Wall Street at the start of the week. That’s in addition to other worries.

“The global investment community is slowly waking up to the idea we have touted for a long time: That there is a post-COVID-recovery-euphoria ‘hangover,’ coupled with associated inflation and now a European war and fresh inflation impetus as well as the world’s biggest port being closed,” said Clifford Bennett, chief economist at ACY Securities.

It’s worth listening these days to seasoned money managers who have been through economic downturns involving scorching inflation, as well as geopolitical tensions.

Michael Cuggino, president and portfolio manager of the nearly 40-year old multiasset Permanent Portfolio Family of Funds

PRPFX,

is back with some fresh advice and our call of the day.

Cuggino spoke to MarketWatch late last year, where he warned that a new generation of investors was facing uncharted waters involving high inflation and rising interest rates, both of which have been unfolding further in recent months.

In a recent interview, he explained that they are managing all the fresh uncertainty by doing what they always do — “driving down the middle of the road.” That’s particularly important now because so many questions remain unanswered with regard to growth, inflation and geopolitics, he said.

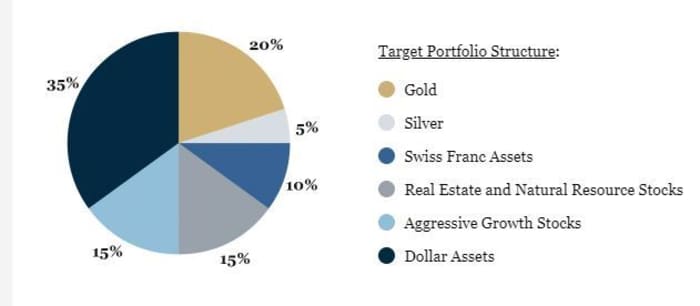

The fund is divvied up into roughly 42% stocks, 36% bonds and straight commodity exposure. Year to date, it’s down about 4%, versus a 13% slump for the S&P 500

SPX,

though it has trailed the index on a 3 and 5-year basis.

Permanent Portfolio Family of Funds

Cuggino said lower-volatility equities, exposure to raw materials and high-quality bonds have given his fund some cushion over these bumpy few months. “We recommend staying very diversfied…but even with diversification, if the whole world is volatile, you’re going to be impacted by that at some level,” he said.

Cuggino worries about where inflation will end up and how long it will stick around, and really at what point consumers just start cutting way back. Should inflation prove extremely stubborn, investors will want to stick to industries that can control cost structure and pricing power, he said, adding that “that theme runs through our equities, regardless of the industry.”

How far the Fed will raise interest rates, the midterm elections, and concerns over the Chinese economy are also simmering topics. Some investors argue the coming Chinese slowdown means the commodity rally has gone too far, while others say it just means stimulus is ahead when COVID-19 shutdowns end, Cuggino noted, adding: “I think both are plausible, so broadly speaking, we have exposure in both those areas.”

As for the range of stocks the fund is invested in, U.S. miner Freeport-McMoRan

FCX,

is his top holding, while the fund has a toe in tech with Nvidia

NVDA,

and Meta Platforms

FB,

with Lockheed Martin

LMT,

and Costco

COST,

among other big holdings.

The buzz

As Russia’s Victory Day parade gets under way, Putin said the West forced his country into the monthslong and bloody invasion. The holiday marks Russia’s defeat of Nazi Germany in 1945.

Ukraine, meanwhile, has ordered nationwide curfews due to fears Russia will step up attacks during the holiday, after a deadly weekend. Japan will join a G-7 effort to ban Russian oil, while the European Union’s planned embargo is running into snags via objections from Hungary.

Uber

UBER,

CEO Dara Khosrowshahi reportedly told staff in an email that the ride-share company plans to cut costs and treat hiring as a “privilege.”

Tyson Food

TSN,

will report results ahead of the open, with results from movie-theater chain and meme favorite AMC Entertainment

AMC,

and online videogame group Zynga

ZNGA,

due after the close.

Wholesale inventories are ahead, in a week that will shine a spotlight on inflation, with consumer prices due Wednesday. China, meanwhile, saw grim data with exports rising an annual 3.9% in April, the lowest in two years and down from a 14.7% pace in March. Shanghai also tightened up its lockdowns as COVID-19 spreads.

The markets

Uncredited

Stock futures

ES00,

NQ00,

are sinking, as Treasury yields

TMUBMUSD10Y,

TMUBMUSD02Y,

climb, along with another surge for the dollar

DXY,

across the board. Oil

CL00,

is tumbling as Saudi Arabia cut prices for Asia and Europe. Bitcoin

BTCUSD,

is hovering around $33,000 after a weekend of selling. Asian equities mostly sold off, while European equities

SXXP,

are also under pressure.

The chart

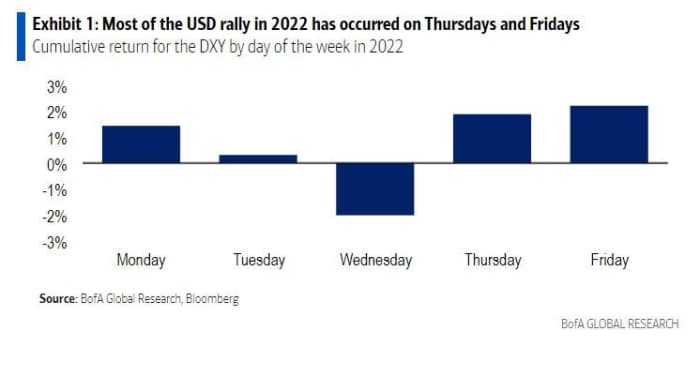

Bank of America strategists Howard Du and Vadim Iaralov say end-week is looking like an increasingly fraught time for investors.

“Day-of the-week seasonality in 2022 shows the USD tends to advance and U.S. equities tend to selloff on Thursdays and Fridays. Retracements have occurred more on Wednesday for the USD and Monday afternoon for U.S. equities,” they say.

Bank of America

Random reads

In case you missed it, here’s U2’s Bono and The Edge, performing with Popular Ukrainian band Antytila in a Kyiv subway station/bomb shelter over the weekend.

A couple stands to net thousands of dollars for a painting exchanged for a few cheese sandwiches.

Rampant mistaken identify plagues famed Formula 1 icon broadcaster in Miami.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.