This post was originally published on this site

Do Republican investment advisors outperform Democratic ones?

Given how intensely polarized the U.S. has become, it was perhaps inevitable that partisanship would creep into the investment advisory arena. And it most certainly has. Numerous studies have confirmed that Republican advisers tend to invest more in companies run by Republican-friendly CEOs, for example, just as Democratic advisers invest more in Democratic-leaning firms.

But do these differences lead to any difference in performance?

A good place to start in answering this question is with two exchange-traded funds that were created around the time of the 2020 U.S. presidential election: The American Conservative Values ETF

ACVF,

and the Democratic Large Cap Core ETF

DEMZ,

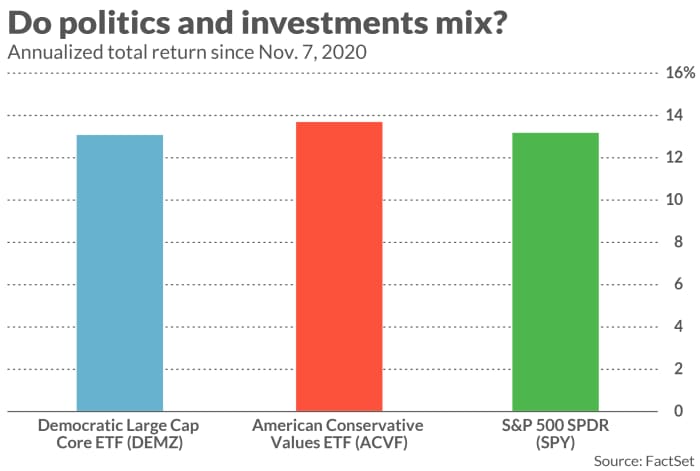

Since Nov. 7, 2020, the first date for which FactSet has performance data for both ETFs, ACVF has produced a 14.4% annualized return, while DEMZ has produced a 14.2% annualized return. (See the chart below; data through April 29.)

Given the variability in their returns, these two ETFs are in a statistical dead heat.

I didn’t include in the chart another ETF that focuses on Republican themes: Point Bridge GOP Stock Tracker

MAGA,

It is older than these two newer ETFs, having been launched in September 2017. There is no corresponding Democratic-leaning ETF that was launched around the same time, so there’s no head-to-head comparison. Since inception through April 29, MAGA is up 11.9% annualized, lagging the S&P 500’s 13.7% comparable return.

Investing and politics don’t mix

We shouldn’t be surprised by these results, as they are consistent with what researchers have found over the years. Consider a study that appeared in the August 2020 issue of the Journal of Quantitative and Financial Analysis, entitled “Partisan Bias in Fund Portfolios.” It was conducted by M. Babajide Wintoki of the University of Kansas and Yaoyi Xi of San Diego State University. They found that, while “fund managers are more likely to allocate assets to firms managed by executives and directors with whom they share a similar political partisan affiliation, … this bias is not associated with improved fund performance.”

Another major study appeared a decade ago in the Journal of Financial Economics, entitled “Red and blue investing: Values and finance.” It was conducted by Harrison Hong of Princeton University and Leonard Kostovetsky of the University of Rochester. They divided U.S. equity mutual fund managers into two groups based on their contributions to candidates for federal elections. A manager was considered Democratic-leaning if the manager made significantly more contributions to Democratic candidates, and Republican-leaning if the manager tilted towards Republican candidates. (The researchers ignored for purposes of their comparison those mutual-funds managers who made no contributions to either party.)

Though they found significant differences in the stocks owned by Democratic- and Republican-leaning managers, the researchers found that “the overall performance of Democratic and Republican managers does not significantly differ.”

A similar result was reached in a study that appeared in 2017 in the Journal of Banking and Finance, entitled “Hedge fund politics and portfolios.” Its authors were Luke Devault of Clemson University and Richard Sias of the University of Arizona. They employed a similar methodology as Hong and Kostovetsky, classifying a hedge-fund manager as Democratic-leaning (or Republican-leaning) if he made significantly more contributions to Democratic (or Republican) candidates.

As was the case with mutual funds, the portfolio of the average hedge fund managed by a Democratic-leaning was significantly different than the average Republican-managed hedge fund. Despite these differences, Sias, in an interview, said that he and his co-author found no significant difference in the performances of Democratic and Republican hedge-fund managers.

Profit over partisanship

These results make sense. If the stock-selection criteria employed by Democratic managers really did lead to beating the market, Republican managers would waste no time employing those criteria themselves, and vice-versa.

Profits have the upper hand over partisanship, in other words. Wall Street’s money managers are some of the most hyper-competitive people on the planet, going to great lengths to gain just a few basis-points advantage over their competitors. There’s little doubt that they would happily sacrifice their political biases if it helped them come out on top in the performance sweepstakes.

This is one of the reasons why the betting markets are generally more reliable than opinion polls. Talk is cheap. But when our money is on the line, we tend to become less partisan and more objective.

One investment implication you might draw from these studies that it’s OK to align your portfolio with your political affiliation, since doing so shouldn’t lead your portfolio to underperform. Another way of putting this: You don’t have to invest in companies or funds whose politics you find particularly distasteful in order perform just as well as those companies or funds you find repugnant.

This implication might be going too far. The studies cited above are based on averages of many different funds, and there’s wide variation among individual funds’ results. There’s no guarantee that, in your individual circumstance, aligning your portfolio with your political beliefs won’t lead to underperformance — as has been true for the MAGA ETF, for example.

In any case, the stronger investment implication I draw from these studies is that you’re on shaky ground if you think that investing in companies whose politics match yours leads to beating the market.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com