This post was originally published on this site

“‘I think a recession, at this stage, is almost inevitable. The probability of a recession in 2023 is certainly very very high, because of the challenges of getting this roaring inflation under control and having so few tools to control the supply side of the economy ‘”

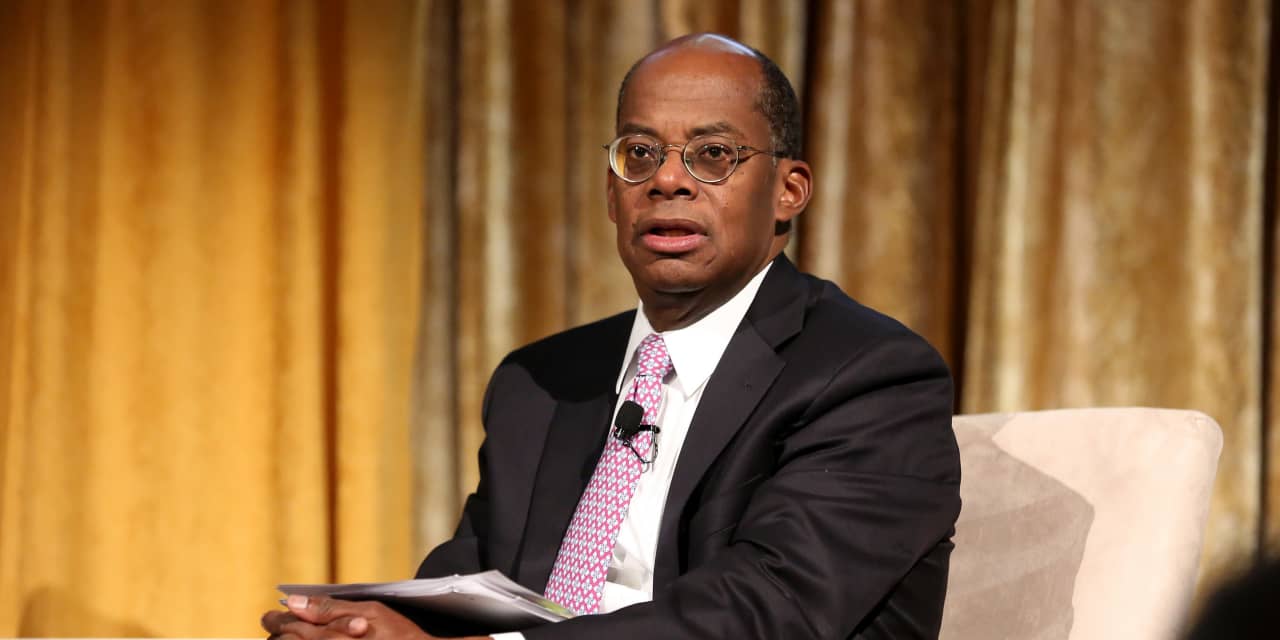

For months, former Fed Governor Roger Ferguson has worried the risks of a recession were rising. Now, he said, a recession in 2023 is nearly unavoidable, with the chances “definitely over 50%,”

What changed? In an interview Monday on CNBC, Ferguson said it was fresh signs of spreading global economic weakness, including in China.

“The rest of the world is also slowing pretty dramatically,” just when the Fed as other central banks are starting to raise interest rates to try to curb inflation.

“It’s a witches brew,” Ferguson said.

Ferguson was a governor and then vice chairman of the Federal Reserve from 1996 until 2006 and was the CEO of Teachers Insurance and Annuity Association [TIAA] from 2008 until 2021.

Despite the signs of slowing from abroad, the Fed has no choice but to continue to raise rates, Ferguson said. “They’ve got to maintain credibility, which to date they’ve done reasonably well,” he said. The central bank will validate the market’s expectation of several half-percentage-point rate hikes this year, Ferguson added.

Read:Fed’s half-percentage -point interest rate hike seen as baked in cake

All that means a recession will follow.

“The probability of a recession in 2023 is certainly very very high, because of the challenges of getting this roaring inflation under control and having so few tools to control the supply side of the economy,” he said.

A mild recession would be the best-case scenario.

If the economy could escape with only two quarter of negative GDP, it “would be a win, quite frankly,” Ferguson said.

Stocks

DJIA,

SPX,

were lower Monday on renewed concern about the economic impact of looming Fed rate hikes The yield on the 10-year Treasury note

TMUBMUSD10Y,

rose closer to 3%.