This post was originally published on this site

https://i-invdn-com.investing.com/news/LYNXNPEC29106_M.jpg

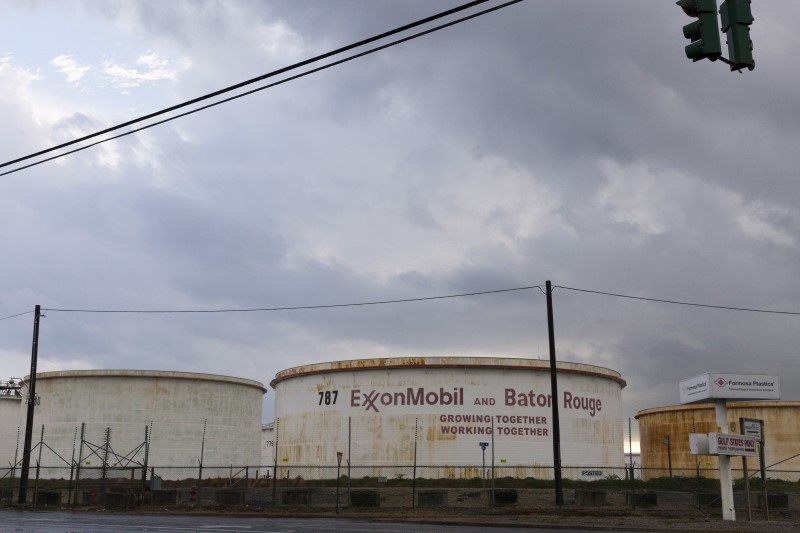

Exxon Mobil announced earnings per share of $2.07 on revenue of $90.5B. Analysts polled by Investing.com anticipated EPS of $2.23 on revenue of $81.3B.

Exxon Mobil shares are up 42% from the beginning of the year, still down 4.70% from its 52 week high of $91.50 set on March 8. They are outperforming the S&P 500 which is down 10.04% from the start of the year.

Exxon Mobil’s report follows an earnings missed by Chevron on Friday, who reported EPS of $3.36 on revenue of $54.37B, compared to forecasts EPS of $3.43 on revenue of $50.65B.

TotalEnergies SE ADR had beat expectations on Thursday with first quarter EPS of $3.4 on revenue of $63.95B, compared to forecast for EPS of $2.97 on revenue of $72.78B.

Stay up-to-date on all of the upcoming earnings reports by visiting Investing.com’s earnings calendar