This post was originally published on this site

Talk about a Manic Monday.

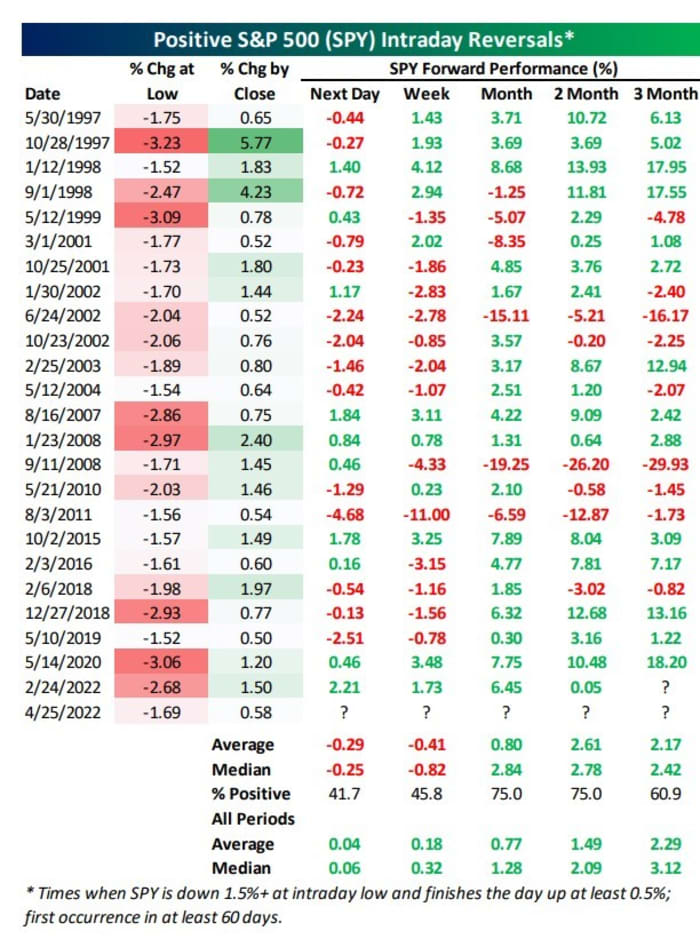

The turnaround in U.S. stocks on Monday, when the S&P 500

SPX,

erased a 1.7% decline to close 0.6% higher, was an unusual one.

According to Bespoke Investment Group, there have been only 56 days in which the SPY exchange-traded fund

SPY,

that tracks the S&P 500 erased an over 1.5% decline to finish up at least half of one percent, since the inception of that fund. And it was only one of 25 days in which it happened without at least two months since the prior one.

Bespoke Investment Group

Historically, these reversals aren’t bullish. The next day, the SPY on average slips by 29 basis points, and stocks are also negative a week later.

And while stocks are more positive in the months after, the typical gain is smaller than usual.

In European morning trading, U.S. stock futures

ES00,

NQ00,

were weaker.