This post was originally published on this site

In 2020 alone, over 10 million new brokerage accounts opened and a vibrant ecosystem of financial media emerged to serve these new investors. FinTwit, TikTok financial advisors, Reddit forums, YouTube and blogs illustrate the array of resources available to guide and educate investors. Much of the content is impressive – far better than what was available two decades ago when I began my journey.

Unfortunately, the inevitable snake oil salesmen are creeping in to take advantage of the gold rush, and certain strategies may not be as effective as showcased.

The flaw with buying the dip

A now commonplace concept — essentially enshrined as a meme — is “buy the dip” (BTD). It suggests buying assets that recently dropped in price, hoping for a bounce to the prior level where you can profitably exit, or continue to hold with a low cost-basis. While BTD sounds like a wonderful strategy, it may be a hothouse flower and a product of the post-financial crisis bull run.

Whenever equity markets

SPX,

faltered over the past decade, the Federal Reserve and other central banks rode to the rescue, intentionally or not, providing free portfolio insurance that allowed risk-takers to thrive while punishing the timid.

As such, many made buying the dip part of their mental model of how markets work. Most traders and portfolio managers under 40 grew up with this regime, and algorithmic trading systems have been trained on a decade of data suggesting BTD is an ironclad law.

Now, with CPI inflation at 8.5% as of late March, central banks may not be as willing to step in with rate cuts or quantitative easing, should we face an economic rough patch.

Answer these questions

The next problem with BTD is that a realistic strategy requires more details than “buy when the price falls.” Some questions to consider: What constitutes a dip? What money are we using to buy? When do we sell?

Investors who held cash for almost any period over the last decade missed out on potential gains, and unless you bought near the lows in December 2018 or March 2020 likely lagged far behind “buy and hold” peers who invested when their paychecks arrived.

“ A drop of 3%, 5% or even 10% is not necessarily a generational buying opportunity. ”

To test this theory, the chart below plots dips of 1%, 3%, 5% and 10% from the highest closing prices over 22 trailing trading days (about 1 month), 66 days (about 1 quarter) and 256 days (about 1 year) as well as relative to the 50-trading-day and 100-trading-day simple moving averages, assuming bi-monthly pay periods.

The table below compares the total returns (including dividends but excluding commissions, fees, taxes, etc.) to a strategy that invests the cash immediately.

Return differential: waiting for a dip vs. investing immediately

| Dip size | 22-day high | 66-day high | 256-day high | 50-day sma | 100-day sma |

| 1% | 0.08% | 0.04% | 0.03% | -0.59% | -1.13% |

| 3% | -0.23% | -0.21% | -0.22% | -0.54% | -1.30% |

| 5% | -1.41% | -0.58% | -0.48% | -4.50% | -7.69% |

| 10% | -7.36% | -8.11% | -7.50% | -3.21% | -8.22% |

| Source: Exencial Wealth Advisors |

As you can see, there is little to no benefit in waiting for a dip compared to investing immediately. The bigger the dip we wanted, the more time we spent in cash and the greater our opportunity cost relative to buying as we received cash.

Consider these strategies instead

Savvy investors holding diversified portfolios will realize there’s another way to BTD.

1. Tactical rebalance. Rather than hoarding cash, you can make calculated adjustments to your asset allocation. For instance, if your portfolio consists of 60% equities and 40% bonds, you can tactically rebalance to 80% stocks and 20% bonds if the market drops 5% from an all-time high. Once the market regains the prior peak, you could rebalance back to 60/40.

2. Sell the dip and buy the rip. Buying all-time highs is scary because investors often assume what goes up must come down. However, financial markets exhibit serial autocorrelation: a tendency to trend in one direction over a prolonged period. Business cycles tend to last longer in the expansion phase and contractions are typically short but sharp. Shifting to an 80/20 portfolio when the market achieves an all-time high and rebalancing back to 60/40 when there’s a 10% drop will likely outperform BTD.

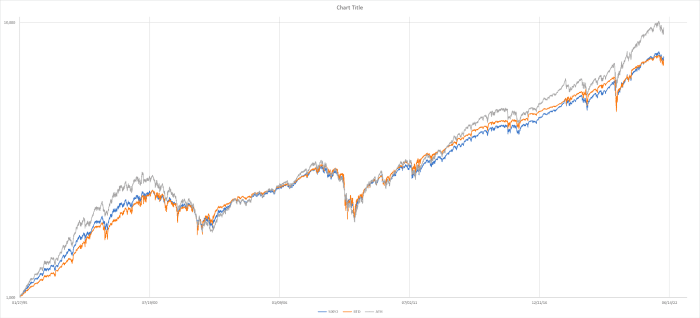

When taxes, fees and commissions are introduced, this strategy may not outperform buying and holding. Nonetheless, it may be counterintuitive to many that buying all-time highs and selling dips historically beats BTD by a significant margin. See this chart:

Exencial Wealth Advisors

Buying dips could potentially work at time horizons of a day to a week if implemented well and with proper risk management. However, over longer periods, following the market’s trend generally worked better. In practice, BTD is usually implemented haphazardly, using margin or risky instruments, like leveraged ETFs.

3. Buying when there’s blood in the streets. Many readers will know this adage from Baron Rothschild, an 18th-century British banker. If the contrarian approach of buying when the news seems dire works, why does BTD perform poorly when tested? The difference between buying the dip and “buying blood” is one of magnitude.

If stocks are down 50%, it may constitute a sentiment-driven overreaction, offering an opportunity to add exposure at favorable prices. A drop of 3%, 5% or even 10% is not necessarily a generational buying opportunity.

Here’s a surprise for many who are infatuated with BTD: many professional risk management systems do the exact opposite of BTD. Once you get a dip of about 10% or more, with a pickup in volatility and other risk metrics, it could be a sign that the market slipped into riskier, contraction territory. The crux of the problem with buying the dip is never knowing in advance when a 10% dip will turn into a 30%-40% bear market loss.

Your personal risk tolerance, income, time horizon and goals determine the optimal approach; though there are no “best” strategies, there certainly are bad ones. Losses are of course unpleasant, and those nervous about the current dip – or considering buying it – should consult their financial advisor and align their portfolios with their risk tolerance.

Have a realistic plan tailored to you, stick with it over the long haul and the results are exceedingly likely to meet your goals.

Jon Burckett-St. Laurent is a senior portfolio manager at Exencial Wealth Advisors, with over 17 years of experience in the financial services industry.

And: Want to beat the stock market over the next decade? Add bonds to your portfolio