This post was originally published on this site

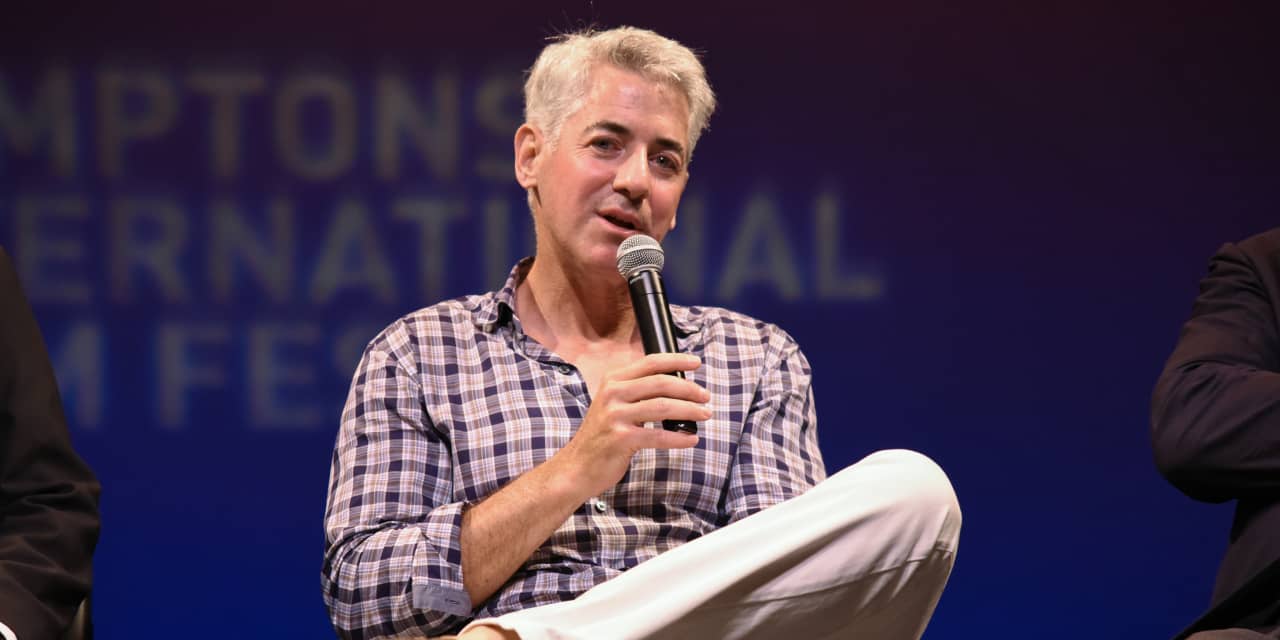

Pershing Square Holdings Ltd. Chief Executive William Ackman, in a letter to shareholders, said Wednesday he sold the hedge fund’s investment in Netflix Inc.

Ackman said he had high regard for Netflix’s

NFLX,

management, but added “in light of the enormous operating leverage inherent in the company’s business model, changes in the company’s future subscriber growth can have an outsized impact on our estimate of intrinsic value.”

Ackman said planned changes by Netflix, including incorporating advertising and being more aggressive in going after non-paying customers, while sensible, make it difficult to predict their impact on the company.

See also: Are you sharing a Netflix password? Not for long …

“We require a high degree of predictability in the businesses in which we invest due to the highly concentrated nature of our portfolio,” he wrote.

He added, “While Netflix’s business is fundamentally simple to understand, in light of recent events, we have lost confidence in our ability to predict the company’s future prospects with a sufficient degree of certainty.”

Ackman said the loss on the investment reduced year-to-date returns by four percentage points. “Reflecting this loss, as of today’s close, the Pershing Square Funds are down approximately 2% year-to-date,” he wrote.

For more: Netflix stock logs worst drop since 2004 — narrative is ‘dunzo for now’

Netflix shares touched a 52-week low on Wednesday, after the company said it lost subscribers in the first quarter. The stock ended the day with a 35.12% loss, closing at $226.19 a share. Earlier in the session, it touched a 52-week low of $212.51 per share.

Write to Stephen Nakrosis at stephen.nakrosis@wsj.com