This post was originally published on this site

As Social Security hurtles toward a $20 trillion black hole, the thing to understand is that if America’s main pension plan fails it won’t be by accident.

It will be by design.

The entire program is based upon the policy of investing every single nickel of your retirement dollars in abysmal investments whose only single merit is that they are helping prop up the Washington, D.C., spending bonanza.

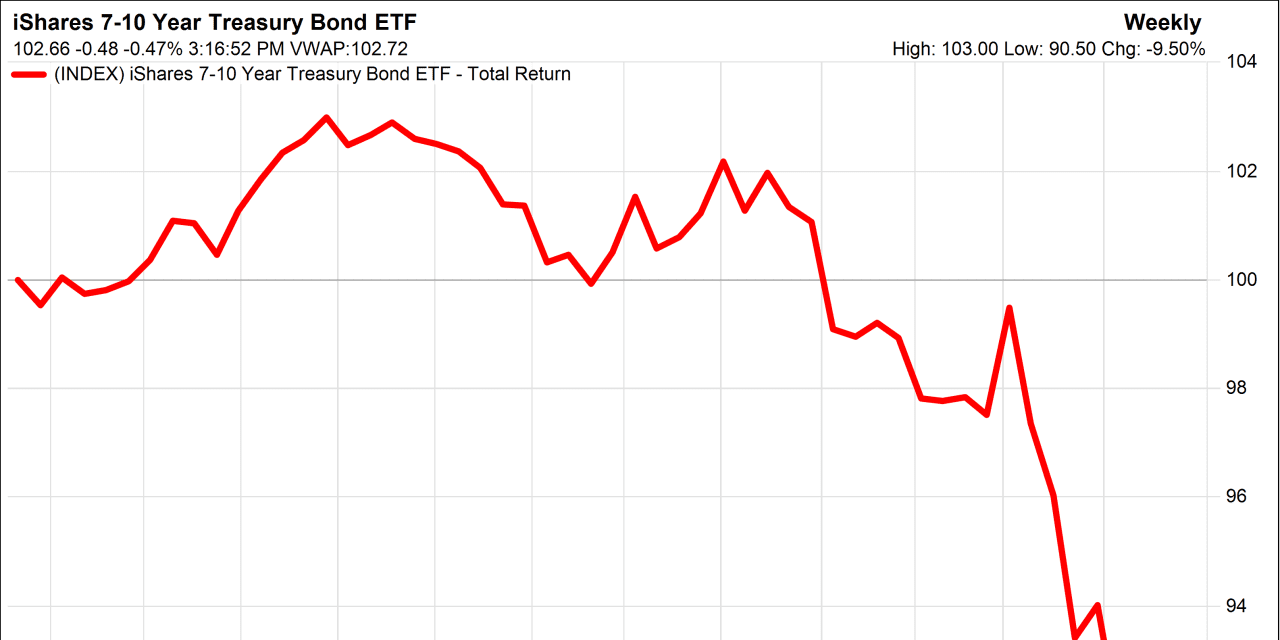

Every dollar of yours that’s invested in the Social Security trust fund is invested in low-yielding government bonds. The same bonds that the market is currently dumping in a panic because they are such a money-losing disaster.

This isn’t me talking, just in case you wonder. This is the federal government itself. The Social Security Administration here reports that it is currently investing all your new FICA taxes this month in special U.S. Treasury notes paying 2.5% interest.

Inflation, as you may have heard, is currently running at 8.5%, even if you believe the latest numbers. So your new FICA taxes are losing you 6% a year.

Last month, when inflation was 7.9%, your FICA taxes were invested 2% a year.

The U.S. Labor Department reports that for the whole of 2021, “From December 2020 to December 2021, consumer prices for all items rose 7.0 percent.”

The interest on your Social Security dollars during that time? Oh, 1.4%.

Gee, I wonder why the system is in trouble?

This is no accident. The Social Security system was set up in the 1930s to help finance Franklin Roosevelt’s New Deal. The entire trust fund is required by law to be invested in Treasury bonds and nobody in Washington wants to change the system—for obvious reasons.

Politicians of all stripes like taking your hard-earned money and spending it on pork barrel projects that help them get re-elected. They figure, probably correctly, that by the time you realize what’s actually happening it will be too late.

Defenders of this racket insist that There Is No Alternative. You can’t invest Social Security in anything other than Treasury bonds, they say. It’s simply impossible.

For some reason, which is never quite explained.

Amazing, really, that every other pension plan in America manages it. (As well as internationally.)

Across this country over 6,000 state and local public pensions are invested in the usual assets you expect in a pension plan: Stocks, real estate and so on. According to Boston College’s Center for Retirement Research these funds manage $4.5 trillion in total, meaning they are about 50% bigger than the entire Social Security trust fund. So much for the ludicrous claim that Social Security is simply too big to invest anywhere but in Treasury bonds.,

About 80% of these funds’ money is invested in stuff other than bonds: Mostly public stocks, but also private equity, real estate, commodities, hedge funds and the so on.

Last year these plans earned average returns of 29%.

According to Boston College, the average returns earned by state and local pension plans over the past 5 years have been 11.8% a year. Their average returns over 10 years have been 9.5%. Their average returns for 15 years have been 7.9%. Their average returns over the last three decades have been 8.88%.

Not once this millennium has Social Security earned 8.8% a year. Let alone anything higher.

The average annual return from 2000 through 2021 was less than 3.2%.

To put this in context, invest $1 at 8% a year for 30 years and you will end up with $12.60.

Invest it at 3.2% a year and you will end up with $2.60.

The hole in Social Security jumped another $3 trillion last year and it will widen again this year, no doubt. The Social Security trust fund is expected to start running out of money in about a decade, at which point the people in Washington will either start hiking our taxes, cutting our benefits, or (one suspects) both. When that happens, expect the usual excuses, finger pointing, obfuscation, and lies.