This post was originally published on this site

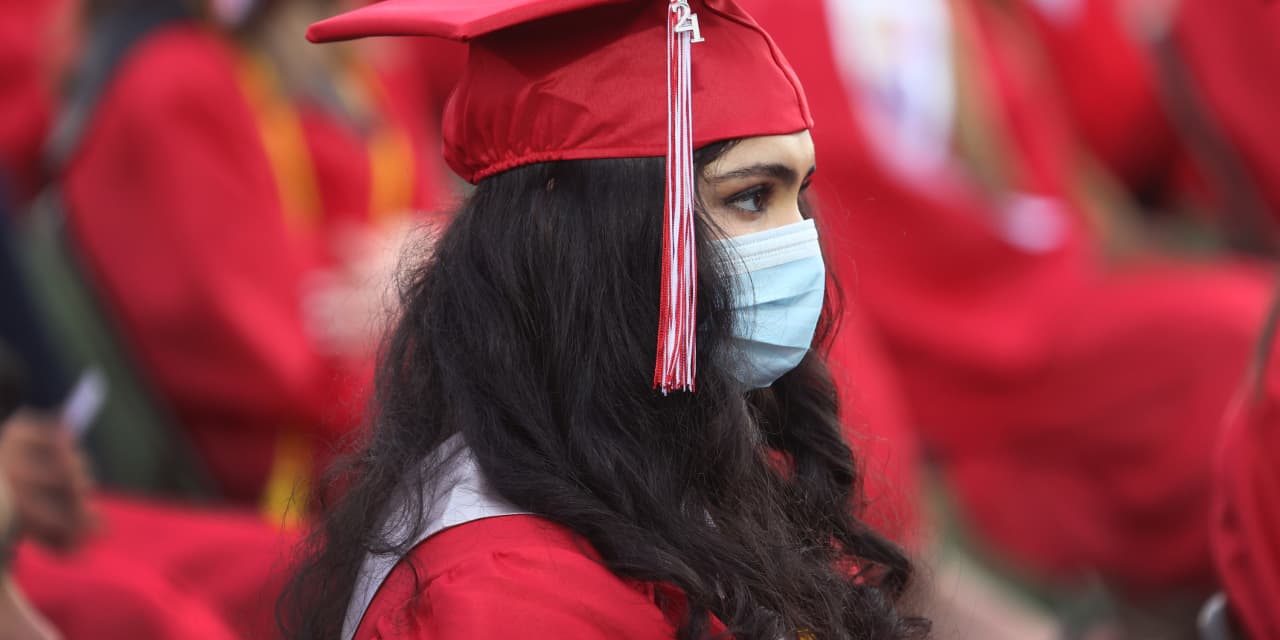

Young Americans are buckling under the weight of their student debt.

A large majority (74%) of Generation Z (ages 18 to 25) and 68% of millennials (ages 26 to 41) who took on student debt delayed a major financial decision because of this debt, according to a report published Wednesday by the personal-finance website Bankrate.

Those decisions include buying a home, saving for emergencies, putting money aside for retirement, paying off other debt, having kids, and buying or leasing a car.

“Savings is the biggest casualty of servicing student-loan debt, as saving for emergencies and saving for retirement top the list of financial decisions most often delayed as a result of student-loan debt,” Bankrate chief financial analyst Greg McBride said.

But many respondents were also aware of the potential long-term benefits. Some 59% of those who graduated with student debt said their education “had a positive impact on their earning potential or job opportunities,” McBride added.

The Bankrate study, conducted by YouGov from March 29 to April 1, surveyed 3,939 adults overall, including 1,442 people who either currently have or had student-loan debt for their own schooling.

The Education Department said Tuesday that it would instigate a new review of its student-debt portfolio in an effort to correct for past mistakes that denied millions of borrowers credit toward student-loan forgiveness.

This will lead to immediate cancellation of debt for approximately 40,000 borrowers under the Public Service Loan Forgiveness program, and at least three years of additional credit for more than 3.6 million borrowers seeking income-driven repayment, the department said.

“Student loans were never meant to be a life sentence, but it’s certainly felt that way for borrowers locked out of debt relief they’re eligible for,” Education Secretary Miguel Cardona in a statement. “Today, the Department of Education will begin to remedy years of administrative failures that effectively denied the promise of loan forgiveness to certain borrowers enrolled in [income-driven repayment] plans.”

Observers reacted to the news. Economist Robert Reich, a professor at UC Berkeley and former Secretary of Labor under President Bill Clinton, wrote on Twitter

TWTR,

: “America’s 735 billionaires could pay down **all** student loan debt in the nation and still be as rich as they were two years ago before the pandemic. Go figure.”

Academic Ashley D. Polasek wrote: “For years, I paid a third of my income against student loans—about $50,000. With diligence and the privilege of family help, I became student-debt free this year. Life is measurably better without the burden of this debt, and everyone should feel this relief. #CancelStudentDebt“

Many Republicans were less supportive. “If Biden forgives all student loans then is he going to refund all of those who paid what they borrowed back in a timely manner?” said Willie J. Montague, a pastor and Republican who is running for U.S. Congress in Florida’s 10th Congressional District.

High prices and rising interest rates don’t help young Americans get their foot on their housing ladder. The share of millennial renters who say they expect to always rent instead of own a home has spiked from 15% in 2019 to 22% in 2021, according to a separate report from the website Apartment List. What’s more, two-thirds of prospective millennial homebuyers reported having no down payment savings.

“Millennials are the nation’s largest generation but have the lowest homeownership rate, creating pressure that trickles down into the rental market where an increasing number of families must compete for vacant apartments,” the report found. “Rents prices are up 17% since the start of the pandemic, and certain popular cities across the country have seen prices rise more than twice that fast.”

The Bankrate report, meanwhile, offers some advice for future generations. Generation Z and millennials — more so than Generation X and baby boomers — told the researchers that they wish they had worked more while in school, got a degree in a different field, attended a cheaper school, and went to community college to save money and/or pay off their debt sooner.

The Education Department’s College Scorecard offers comparison shopping for colleges. Students and their families can look at the median earnings and student-loan debts of a particular school’s graduates, and even compare what a psychology major may expect to make versus an economics major’s earnings. It allows people to make informed investment decisions about their futures.

As Tim Ranzetta, the co-founder of Next Gen Personal Finance (NGPF), a nonprofit with a mission to bring personal-financial education to all students, told MarketWatch: “There’s never been more exhaustive detail out there to say, if I get a B.A. in commerce from the University of Virginia, this is the salary from that school in the short-term and long-term. When you’re talking about tens if not hundreds of thousands of dollars, you have to think about the return on investing.”