This post was originally published on this site

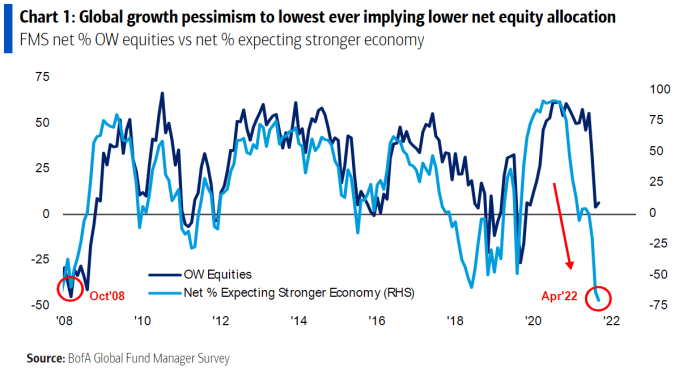

Global fund managers have never been more pessimistic on the outlook for economic growth, a monthly Bank of America survey found, potentially pointing to a further fall in stock-market holdings.

The disconnect between global growth expectations and equity allocation “remains staggering,” BofA analysts wrote Tuesday (see chart below).

BofA Global

“Investors got slightly more bullish on equities. Though still at depressed levels, equities are nowhere near ‘recessionary’ close-your-eyes-and-buy levels,” the analysts wrote.

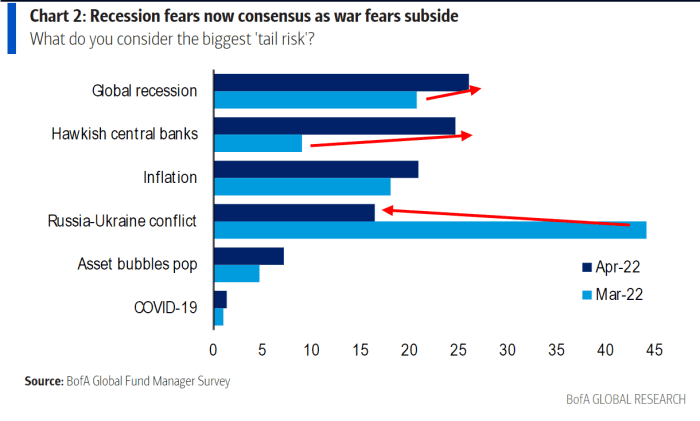

Meanwhile, recession fears have become the consensus, the analysts said, topping the list of fund manager fears as concerns around the Russia-Ukraine war faded (see chart below).

BofA Global Research

The survey found 26% of respondents saw global recession as the top “tail risk,” while 25% identified hawkish central banks; 16% saw the Russia-Ukraine war as the top worry, down from more than 40% in March.

While managers are gloomy, stocks have proven relatively resilient in the face of those worries, having bounced back from early March lows. The S&P 500

SPX,

finished 8% below its record close from Jan. 3 on Tuesday after back-to-back losses, while the Dow Jones Industrial Average

DJIA,

was off less than 7% from its Jan. 4 record finish.

The Nasdaq Composite

COMP,

heavily populated with tech and other growth stocks that are more sensitive to rising interest rates, ended 16.5% below its record close from November.