This post was originally published on this site

Before the COVID-19 pandemic struck the globe, the personal computer had become a staid, boring product with dwindling sales, as consumers spent their money on new smartphones every couple of years while letting their home laptops and old towers collect dust.

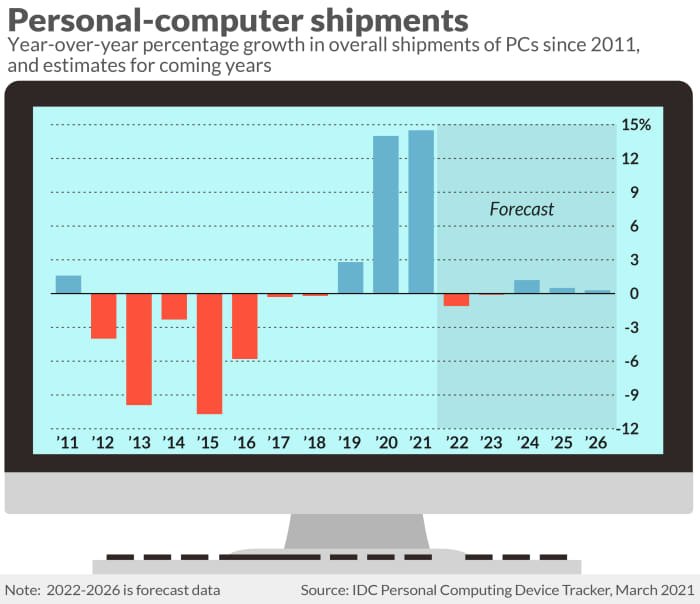

That changed in a dramatic way when people retreated into their homes to avoid the virus and realized they suddenly needed to do everything—work, school, socialize—remotely. The industry was surprised: PC shipments had declined for seven consecutive years from 2012 to 2018, yet they jumped 14% in 2020 and another 14.5% in 2021, a sudden surge unseen since 2007, the year the iPhone was introduced.

“The consumer market had been slowing and slowing and slowing and then, all of a sudden, we hit 2020 and people are at home, and surprisingly, consumers were buying PCs for work, gaming, content consumption, another screen at home,” said Ryan Reith, an IDC analyst.

As Zoom

ZM,

meetings became ubiquitous for remote work and school, consumers scrambled to equip themselves and their children with computers and suddenly necessary peripherals, such as webcams and headphones — if they could find and afford them. Component shortages and overwhelming demand left scraps at electronics and office supply stores, even as inflation hit in 2021, pushing prices higher.

For more: The pandemic has brought the personal computer back to life, with help from Zoom

But the renaissance of the PC might have been a relatively short era. On Wall Street there is now little expectation that PCs will continue to be a big source of growth for companies like HP Inc.

HPQ,

and Dell Technologies Inc.

DELL,

even as Warren Buffett’s Berkshire Hathaway Inc.

BRK.A,

BRK.B,

makes a big bet on HP stock. IDC now forecasts that global PC industry sales will fall 1.1% in 2022 and 0.1% in 2023, as consumers largely have their new machines and students are back on school campuses.

“It’s really a consumer and education slowdown,” Reith said. “If you think about all the consumers that purchased in the last two years, whether they were first-time buyers or they had not used a PC in the last whatever number of years, it’s going to take another few years before they buy another one.”

Yet the activities that became pandemic staples have affected the design of PCs for the better. Remote videoconferencing and streaming are here to stay and many consumers now expect most PCs to handle the most graphically intensive videogames previously played only on consoles.

The Zoom culture became so prevalent that in the first month of the stay at home orders Saturday Night Live did a hilarious skit mimicking a Zoom meeting of a small sales office. Two receptionists were unable to correctly position themselves in front of their laptop cameras, and one even took her laptop into the bathroom with her, while her boss frantically yelled “STOP!”

The latest computers and devices seem to be built to avoid such pitfalls, such as Apple Inc.’s

AAPL,

new Studio Display monitor that has studio quality microphones and HP’s suite of Presence technologies, including an AI camera and a privacy shutter. These tweaked designs, along with the greater acceptance of remote and hybrid work, are the legacy of the pandemic.

MarketWatch illustration

‘It’s essential! It’s officially on the essential list!’

On March 19, 2020, California Gov. Gavin Newsom ordered the state’s 40 million residents to stay in their homes due to the new pandemic threat, the nation’s first state lockdown order. Days later, Newsom issued a list of essential workers who were exempt from the lockdown, and among them were IT workers.

Newsom declared that IT workers were critical, especially those who played a role in helping people to work from home, citing, “workers who produce or manufacture parts or equipment that supports continued operations for any essential services and increase in remote workforce, including computing and communication devices, semiconductors, and equipment.”

Many states issued similar exceptions to their workforces, identifying essential workers who could continue to leave home to go to work, as well as lists of essential items consumers were able to leave their house to buy, like personal computers.

As the stay-at-home lockdown orders piled up, Alex Cho, president of HP Inc.’s personal systems business, was briefed by his team on how many businesses around the world had stalled, but that PCs were an exception. Cho realized at that moment that the personal computer had become a big deal again.

“I was sitting right here thinking, you know what, … it’s essential! It’s officially on the essential list!,” he said. “That’s when for us that phrase really was an inflection point of saying, ‘Wow, the world has changed.’ The PC is essential, it’s so essential for work, and for learning, even telehealth, and suddenly what we saw was this category was no longer this thing on the side.”

Across the world, there was a frenzied upgrade of home offices, or at least the ad-hoc offices that appeared on kitchen and dining room tables. Neither families nor retailers were prepared.

About a week into the stay-at-home orders, I went looking for a monitor and keyboard for my laptop to create a better workstation at home, to avoid being slouched over my work-issued laptop. By that time, there were two monitors left in a local Office Depot that was mostly occupied by swaths of empty shelves and office workers frantically searching for a sudden need, including the many techies in the Bay Area trying to find additional equipment. Fortunately my laptop was on the newer side, and it had a decent camera and audio, two key attributes in the Zoom age.

I was not alone, as the same scene played out in communities worldwide. Garrett Gwinnup, a computer technician at Boise Computer Depot in Boise, Idaho, said that business has been so strong during the pandemic that his boss bought the shopping center the store was in, expanded the store and is now the landlord for the other retail spaces.

“Previously desktops weren’t something you used a lot, but it has gone up tremendously since the beginning of COVID,” Gwinnup said. “He went from a very small store to a very large store in one year and a half.”

The PC — often the least used and oldest electronic gadget in the home, relegated to a corner — suddenly became the most important device in the house. In addition to the huge numbers working from home, children of all ages, including college students, added another element to the picture, creating nightmarish scenarios for parents working from home, with their offspring also stuck with them while their schools figured out how to conduct remote learning. Jerry Paradise, vice president, global commercial portfolio and product management at Lenovo Group Inc. HK:992 said in an email interview that more than 1.5 billion students were forced to stay at home at some point during the pandemic.

For more: The pandemic PC boom gave personal computers their biggest year in nearly a decade

“All of a sudden, your three kids needed to be online and on Zoom everyday,” said Maribel Lopez, principal analyst with Lopez Research. “You might have only had one machine at home, but you had five people who needed to use it.”

If a parent had a laptop from work, they were the lucky ones with a relatively newer machine. As the Zoom phenomenon began to take off as a way for companies to hold team meetings, and schools began to experiment with remote classes, it became clear the old PC was not up to the task.

Unfortunately, neither was the PC supply chain.

MarketWatch illustration

Booming sales and chip shortages

Memory chip maker Micron Technology Inc. MU reported earnings in late March 2020, just after the initial stay-at-home orders were issued. CEO Sanjay Mehrotra described for analysts on the company’s earnings conference call how Micron was sanitizing its manufacturing facilities and that its workers were social distancing on the line. The company, Mehrotra said, was dealing with border closures and a temporary shut down of its NAND assembly and test site in Malaysia, and a couple of sick workers.

Read also: Micron CEO optimistic even amid unprecedented times

It was merely the tip of the iceberg. As the pandemic wore on, supply chain disruptions and then semiconductor shortages became the biggest concerns among most hardware companies. When PC demand started to surge, it caught tech companies off guard. All over the world, each different segment of the manufacturing supply chain started to reel, as factories began to report COVID cases among their workers, disruptions that shut down production lines for brief periods.

Some of the major companies were better able to deal with supply constraints, thanks to advance purchasing of memory and central processing units (CPUs), but even giants with major power such as Apple couldn’t meet all the demand. CEO Tim Cook told analysts last October that its revenue in the September quarter would have been at least $6 billion higher, had it been able to meet all the demand, and in the December quarter it was an even greater shortfall.

Incredibly, the most challenging supply chain issue revolved around the paucity of small and seemingly inconsequential chips, some of which cost about $1 each, such as video drivers and audio drivers. These tiny chips, because they were on older manufacturing processes, are made by smaller, lesser known companies. In addition, these chips, especially the ones for screens, had huge competition from TVs, cars, anything with an LCD panel, said Mikako Kitagawa, a Gartner Inc. analyst.

“The reason why the PC industry was so supply constrained for the last 2 years, none of the people in the industry, HP, Dell, etc. had the components for the $1 chips, none of them built a business plan for that,” IDC’s Reith said.

Read more about the $1 chip that is behind record price increases for PCs.

Without even these seemingly minor but actually significant chips, companies could not ship their systems, but that didn’t stop PC makers from racking up big sales in an environment where consumers were willing to pay more. From December, 2020 to December, 2021, the prices of personal computers, peripherals and smart home assistants rose 2.8% unadjusted, according to the Bureau of Labor Statistics.

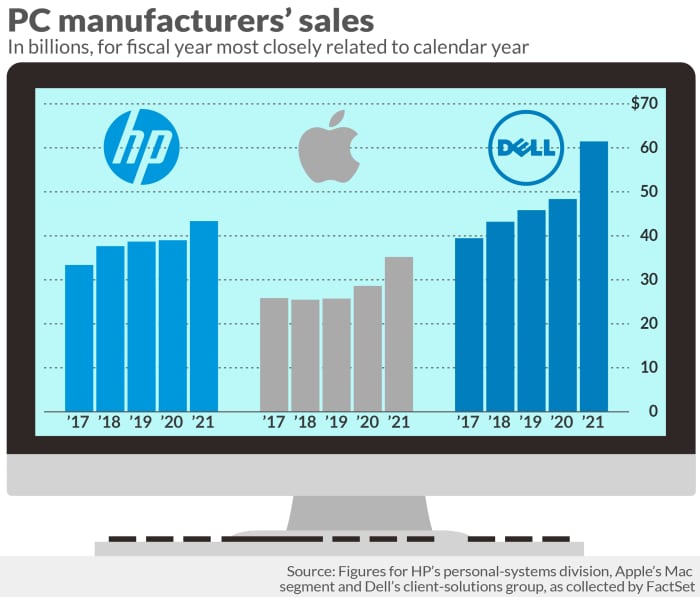

Nevertheless, Apple surpassed $30 billion in Mac sales for the first time ever in its 2021 fiscal year, rising 23% from the prior year to $35.2 billion. In the holiday season that ended in December, the first quarter of Apple’s 2022 fiscal year, Mac sales hit a quarterly record of $10.8 billion.

Read more about the Mac’s rebirth and its biggest growth rates ever

HP, with a similar fiscal year to Apple, posted record revenue in its personal-systems division of roughly $43.4 billion, growing more than 11% from the year before and pushing the company to its highest annual revenue total since splitting from Hewlett-Packard Enterprise Co. in 2015. Dell had never before topped $50 billion in annual sales, but it jumped all the way to $61.5 billion in 2021, growth of more than 27% year-over-year. Lenovo PC sales grew nearly 20% to their own record high of $54.4 billion.

The stocks of Lenovo, HP, and Dell soared in the triple-digits during the last two years, while these once-staid business segments blossomed in the pandemic. Apple, which trades mostly around iPhone and services sales, saw a huge resurgence of interest in the Mac.

Wall Street, though, is bracing for a slowdown. In recent weeks, there have been a series of downgrades in the sector, focusing on expectations for slower growth. Morgan Stanley analyst Erik Woodring lowered his price targets on HP and Dell, citing a downward risk on hardware budgets, and more consumer caution, especially in light of inflationary trends.

Read more about Wall Street’s fears about the end of the pandemic PC boom

In a note to clients, Woodring said there were three reasons he had become extremely cautious about consumer demand for PCs in 2022. He’s convinced demand was simply pulled forward in 2021 and the first half of 2022; Morgan Stanley’s survey work indicated worsening consumer sentiment due to inflation; and he sees growing evidence of a supply-demand rebalance. “We believe PC and consumer hardware spending will be pressured as supply improves and demand normalizes after two years of above-trend growth.” Woodring wrote.

The new Mac studio boasts extensive connectivity to support a variety of new workflows.

Apple

What does the return to the office mean for PCs?

Even if the boom is over, however, it will leave its mark, as all the major PC makers continue to roll out new machines with features geared to doing so much more from home than before the pandemic.

“Audio and video and being able to show up, with a level of audio and video and fidelity that isn’t distracting, is now of much higher importance,” HP’s Cho said on a Zoom chat with MarketWatch. “People recognize this is important, especially if I am going to do this on an ongoing basis. That is also driving a whole new wave of innovation and upgrades.”

See also: HP CEO says we’re still in a PC boom, and his company’s record sales prove it

In the past few months, many of the biggest PC makers launched products to include features for better videoconferencing, and features for hybrid work. For example, Dell’s recently added features across its portfolio of commercial systems that include a docking station with wireless charging for earbuds. HP’s recent entrants include better monitors and cameras that can reduce noise reduction, and an ability to enhance your on-screen image for meetings. Lenovo and ASUS have launched dual-screen laptops, with a second smaller screen on the keyboard area to act as a sort of mini, second monitor.

“Given that people are spending more time at home, and many are using the same device for their professional and personal lives, we have seen an increased interest in premium features,” said Paradise of Lenovo.In the past few months, demand for PCs has been coming from the commercial side of the business, as consumers have pretty much settled into the remote setups created months ago. But commercial demand is being driven by new needs, like shared drop-in desks, videoconferencing with remote workers, and audio improvements.

“These are huge shifts, secular changes, in how people are living and working,” Cho said. “People’s expectations are changing and the role of the office is changing.” He said one of his co-workers recently sent an out-of-office email response that said he was “in the office, collaborating with peers,” and his response time would be slow

“We are seeing a big uptick right now in the large enterprise space as companies return to the office and retrofit technology to ensure they’re ready for hybrid work,” said Lenovo’s Paradise. “There’s huge demand in return-to-office for high-end systems, corporate systems, desktops and notebooks, and videoconference systems.” He said in Lenovo’s fiscal third quarter, commercial sales jumped 23%.

More from Therese: As growth slows, where does Zoom go from here?

HP and Dell both observed big increases in commercial sales in the January quarter, with HP seeing that sector soar 26% in its first fiscal quarter, ended Jan. 31, while consumer revenue fell 1%. Dell saw even bigger growth, with a surge of 30% in commercial revenue, and a 16% jump in consumer revenue, up from a year ago.

Analysts believe commercial sales will outpace consumer this year, but that consumer sales will pick up a bit again in the fall. “We will see a lull around the summer and then some pick up for back to school,” said Lopez, of Lopez Research.

Some components will continue to be in short supply. Right as companies were catching up, a new wave of covid briefly shut down some manufacturing in some areas of China in December and January. The war in Ukraine is also expected to have an impact on some raw materials and gases used for making semiconductors.

Paradise of Lenovo, though, said he believed that the “worst of the supply chain shortages are behind us.”

Amid the weakening backdrop after a record year, PC growth is showing signs of slowing, and the strong commercial market is not enough to keep the overall category from slowing down. Corporate sales will keep growth up this year, but Micron’s CEO said during the company’s recent quarter earnings that he sees “flattish” unit shipments overall.

IDC, before the invasion of Ukraine and the recent lockdowns in China, had been expecting 2022 unit growth to fall 1%. “While I don’t have a new number for you right now, I would safely say we do not believe the market will be stronger than the -1% and even faces some slight downside risk because of the macro and geopolitical activities,” Reith said.

If those projections come true, the pandemic PC boom will truly have ended. But with machines built for a new era and a supply chain that has been tested and hopefully improved, the PC industry has changed permanently, as has consumers’ view of a tech product that was barely in their thoughts just a couple of years ago.