This post was originally published on this site

Hello and welcome to Financial Face-off, a MarketWatch column where we help you weigh financial decisions. Our columnist will give her verdict, then you can tell us in the comments what you think.

The face-off

When you buy a car, you typically pay 20% cash up-front, then pay off the balance in monthly payments (with interest, of course). With leasing, you may have to make a down payment depending on your credit score, and you then make monthly payments for the duration of the lease, usually two to three years.

Leasing vs. buying is a classic financial choice, but the COVID-19 pandemic has brought with it new and unusual wrinkles. It’s an extremely challenging time to buy a car. Inventory is low thanks to the global microchip shortage, and prices on both new and used models are at record highs.

The average new-car transaction price was $47,077 as of January 2022, up from an average of $43,332 in 2021. The average price for a used car in 2021 was $26,910, up from $22,337 in 2020.

“‘New car prices are through the roof, used car prices are through the roof.’”

Translation: Like some homes, cars are now selling for above the asking price.

“I’ve been doing this for well over a decade and I’ve never seen what we’re experiencing. New car prices are through the roof, used car prices are through the roof,” said Kelley Blue Book editor Matt Degen.

Prices are so high that some experts say it’s best to wait as long as you can before acquiring a new car.

But if your old clunker just quit, or your new job means you need to drive more, here’s how to decide whether to lease or buy, according to car-buying experts from Kelley Blue Book and Edmunds.com and more than a dozen financial advisers with the National Association of Personal Financial Advisors.

Why it matters

Brace yourself for sticker shock. The average monthly loan payment on a new car hit a record high of $636 in the third quarter of 2021, according to the credit reporting company Experian

EXPN,

and the average monthly lease payment was $506.

America’s most popular vehicle, the Ford

F,

F-150 pickup, had an average monthly lease payment of $542 or an average monthly loan payment of $768 in Q3 2021, Experian found.

That makes it sound like leasing is cheaper — and it is, if you only look at the monthly payment. But if you buy a car and hold on to it long enough to pay off the loan, buying will cost you less than leasing in the long run.

“It is the cheapest over the life of the car, especially if you’re going to own it for seven to 10 years. The math is going to play out in your favor and it will be cheaper than leasing over and over again,” said Ivan Drury, senior manager of insights at Edmunds.com.

The verdict

BUY. Yes, even at these prices.

My reasons

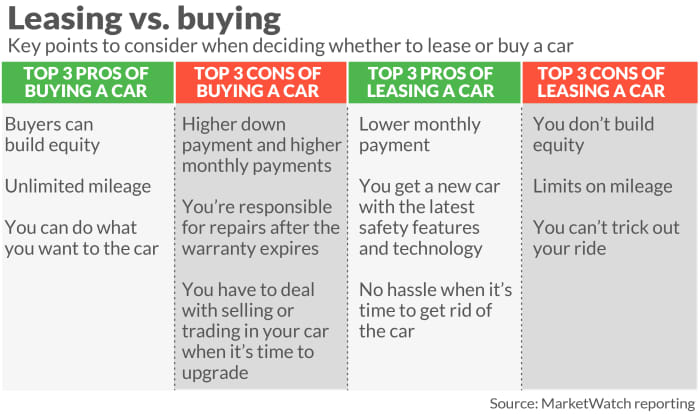

Buyers can build equity. After you pay off your loan, you own the car free and clear and it becomes an asset that you can either sell or use to defray the cost of your next car, said Degen, who paid all cash for his own personal car, which is now 20 years old.

Buying is better for someone who wants flexibility with yearly mileage and intends to keep the vehicle for longer than the term of the auto loan, said Scott Buttfield, a certified financial planner with Buttfield & Associates in Red Bank, New Jersey.

“The answer to this question is the universal answer to most financial planning questions: it depends,” Buttfield said.

Leasing is good for people who won’t put more miles on the car each year than the cap allows (see below), want a lower monthly payment, want a new car on a regular basis, and in general take good care of a car, Buttfield added, because leases require that cars be returned in good condition.

For someone who’s going to own a car for more than six years, buying is the better option. But if you need a new car every two or three years, leasing is better.

Money is relatively cheap to borrow right now for people with good credit, which can make buying more attractive. If you have bad credit, however, it can negatively affect what kind of lease deal you can get, including the size of your down payment and monthly payments.

Is my verdict best for you?

“The math is pretty easy: owning a car for the long term and keeping up with the maintenance plan is cheaper than leasing. The real issue is, ‘What kind of car user am I?’” says Josh Chamberlain, a certified financial planner with Chamberlain Financial Advisors in Decatur, Ga.

Most importantly, how much do you drive in a year? This is important because leases have limits on the number of miles you’re allowed to put on a car each year (typically around 10,000 to 15,000 miles). If you go over that, you have to pay a penalty per mile. Those can really add up.

“‘If you have commitment issues in any aspect of your life, leasing is good for you.’”

Are you the type of car owner who likes to personalize your vehicle with giant rims and a kickin’ speaker system? Leasing is not a good option for you, because you can’t make alterations to leased vehicles.

Other key questions: How important is it for you to have a lower monthly payment? Leasing provides that. How important is it to you to drive a nice, new car? Leasing is a way to get an entry-level luxury vehicle for a relatively low monthly cost. And you get to upgrade every few years.

“If you have commitment issues in any aspect of your life, leasing is good for you,” Drury said.

Is my verdict best for you? Tell us in the comments which option should win in this Financial Face-off. If you have ideas for future Financial Face-off columns, send me an email.