This post was originally published on this site

What happens to companies financed in the booming high-yield or “junk-bond” market on the off chance that U.S. inflation pegged at 7.9% in February soars to 10% and stays there?

That’s a question Oleg Melentyev’s credit team at BofA Global explored in a client note Friday, with a look at past instances when American inflation climbed that high, and stuck around for a while.

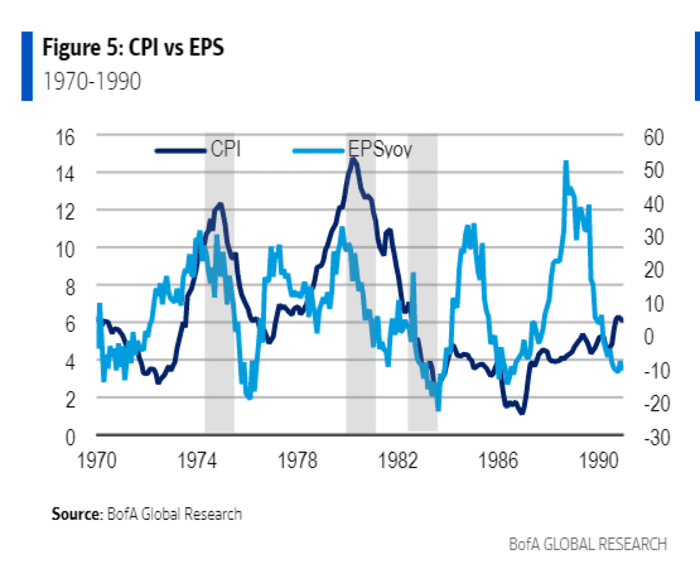

A key takeaway was that corporate earnings initially held up in the 1970s when inflation twice surged above 10% for a sustained stretch. It also took time for the higher costs of living to translate into tumbling corporate earnings.

This chart shows corporate earnings per share (EPS) growth plunged mostly in the wake of the 1973 to 1975 recession, a period when the popular inflation tracker, the consumer-price index (CPI), rose to about 12%, as crude oil

CL00,

prices soared following the Arab oil embargo.

Inflation climbs above 10%, then corporate earnings plunge

BofA Global Research

“The troughs in earnings growth were in the -20% context in 1976 and 1983, i.e. in the aftermath of recessions,” Melentyev’s team wrote.

To be sure, past corporate earnings growth was much higher than in recent decades, averaging about 15% per year in the 1970s, but only 6.2% since January 2000, according to BofA.

The modern day junk-bond market also didn’t exist until the 1980s when risky debt offerings helped spur a bonanza of corporate takeovers, making it harder for analysts to draw easy comparisons with the past.

Still, Melentyev’s team thinks defaults in the event of a recession could stay low because issuers can repay old debts with inflated cash flows.

Spreads in the energy-heavy U.S. junk-bond market narrowed this week as investors poured nearly $2 billion in funds into the sector, but also with a dearth of new issuance for investors to buy, according to BofA data.

See: Junk-bond issuance pauses as Russia threatens Ukraine, with spreads at their widest level in a year

Junk-bond spreads, or the premium paid above the risk-free Treasury rate, fell to about 343 basis points above the Treasury

TMUBMUSD10Y,

rate on Thursday, down from around 421 basis points roughly two weeks ago, according to the ICE BofA US High Yield Index.

High oil prices also have been a boon for energy companies, the biggest segment the U.S. junk-bond market.

Crude oil prices slipped back below $100 a barrel on Friday, a day after President Joe Biden authorized the largest-ever release of U.S. oil reserves to help American’s facing high prices at the gas pump in the wake of Russia’s invasion of Ukraine.

The biggest U.S. junk-bond exchange-traded funds

HYG,

JNK,

ended the week up 0.8% on Friday, according to FactSet. That compares with the S&P 500 index’s

SPX,

0.1% weekly gain and the Nasdaq Composite Index’s

COMP,

0.7% climb since Monday. The Dow Jones Industrial Average

DJIA,

fell 0.1% for the week.