This post was originally published on this site

Shares of Tesla shot up Monday after the electric vehicle giant disclosed plans to enable a stock split, which would be the second in two years.

The company

TSLA,

said in an 8-K filing with the Securities and Exchange Commission that it will ask shareholders to approve an increase in the number of shares outstanding. The request will be made at its 2022 annual shareholders’ meeting expected in October.

The company said the stock split would be enacted in the form of a stock dividend. “Tesla’s Board of Directors…has approved the management proposal, but the stock dividend will be contingent on final Board approval,” the company stated.

The stock jumped 8.5% in afternoon trading, putting them on track for the highest close since Jan. 12. It had slipped 0.3% on Friday to snap an eight-day winning streak. Monday’s rally comes even after a report that Tesla will pause production in China amid new COVID-19 lockdowns.

Tesla had 1.033 billion shares outstanding as of Jan. 31. In the 2021 proxy statement, the company said it is authorized to have 2.00 billion shares outstanding.

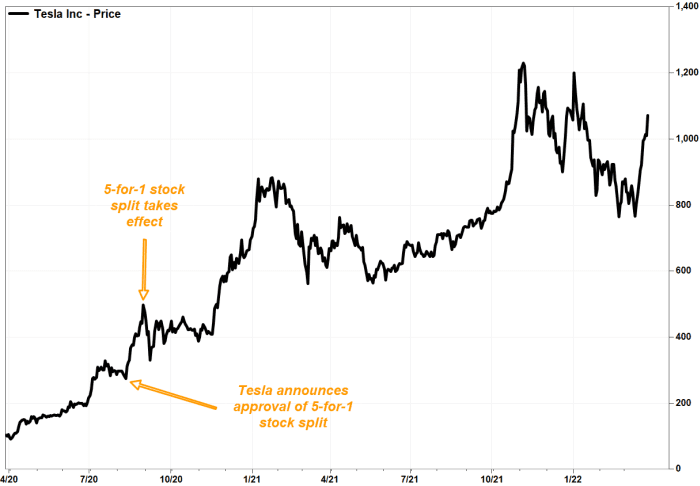

The company’s only other stock split, a 5-to-1 split, took effect on Aug. 31, 2020. At that time, the stock was trading at a pre-split-adjusted price of about $2,213. The stock closed Aug. 31 at split-adjusted $498.32.

To lower the stock price to around that level, Tesla would have to increase number of shares it is authorized to have outstanding by more than 1 billion, so it could enact a 2-for-1 split. To match the previous 5-for-1 split, the number of authorized shares outstanding would have to increase by more than 3 billion.

FactSet, MarketWatch

Although a stock split doesn’t change anything about a company’s fundamentals, it has historically helped boost the stock price, as it is viewed as a sign of management’s confidence that the stock will continue to perform well, as Mark Hulbert has written for MarketWatch.

Also read: Tesla is one of only 11 stocks in the S&P 500, excluding energy, that enjoys this critical support.

Tesla’s stock had soared 78% from the time the company said after the Aug. 11 close that it approved a 5-for-1 stock split through Aug. 31, but then fell 33.7% over the next week. The stock didn’t close back above the Aug. 31 closing price until Nov. 19.

Wedbush analyst Dan Ives said he believes a stock split would be a “smart strategic move” for Tesla, as it follows similar moves announced this year by Alphabet Inc.

GOOGL,

GOOG,

and Amazon.com Inc.

AMZN,

He believes a split will be a positive catalyst for Tesla’s stock going forward.

Read more: The stock split from Google’s parent may spark a wave, Bank of America analysts say.

Ives reiterated his outperform rating, which he’s had on Tesla’s stock since April 2021, and kept his price target at $1,400.

Tesla’s stock has gained 3.8% year-to-date through Friday, and has soared 77.2% over the past 12 months. In comparison, the S&P 500 index

SPX,

has gained 14.6% over the past year.