This post was originally published on this site

A stock split for a rapidly growing company can be a catalyst for its shares. Even though the split doesn’t really change anything, a lower price can make a stock more attractive to some investors and make it eligible to be included in certain indexes and funds that track them.

Shares of Tesla Inc.

TSLA,

were up 8% in afternoon trading March 28 after the company said it would ask shareholders to approve a plan to increase its number of shares. Tesla said the move would be needed “to enable a stock split.”

What might be more important for long-term investors considering Tesla’s stock is that its gigafactory in Berlin has opened, adding an estimated 500,000 electric vehicles to the company’s annual production capacity.

The opening of Tesla’s third factory, during a time of such high demand for its vehicles, raises a very interesting question, considering that its stock was down 4% for 2022 through the close March 25: How much more of a profit can Tesla earn on this increased capacity?

The answer is that the consensus 2022 earnings-per-share estimate for Tesla, among analysts polled by FactSet, has increased 24% to $10.87 from $8.78 at the end of 2021.

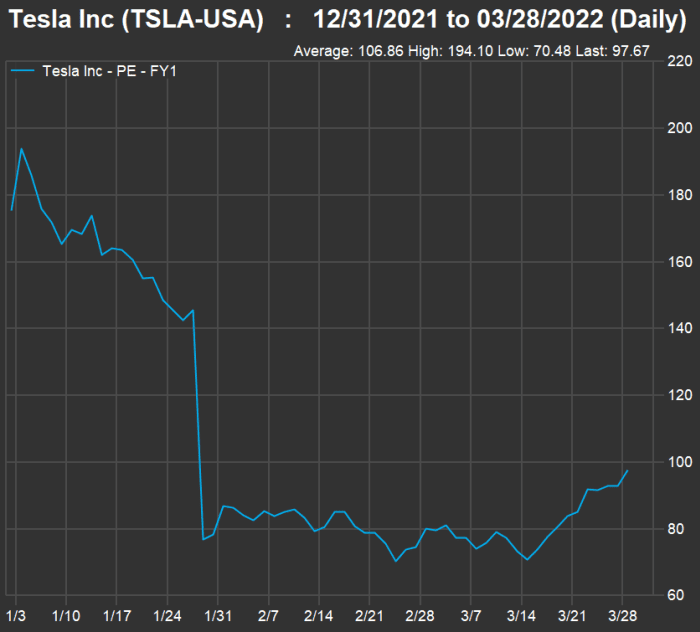

To illustrate how dramatic that increase is, let’s look at a chart. Keeping in mind that Tesla’s stock with the early gain March 28 is essentially flat this year, check out what has happened with its forward price-to-earnings ratio (based on the increasing consensus 2022 EPS estimate):

FactSet

Tesla’s P/E has been nearly cut in half. A P/E of 97.7, based on expected earnings for 2022, is very high when compared to a weighted P/E of 20.2 for the S&P 500

SPX,

But as we have seen with Amazon.com Inc.

AMZN,

over the decades, a high P/E for a rapidly growing company won’t necessarily place a drag on its stock.

A look at consensus sales-per-share and EPS estimates for Tesla and the index illustrates how much more growth analysts expect for Tesla:

Sales

First, here are consensus estimates for Tesla’s annual sales, in millions, with an expected compound annual growth rate (CAGR) through 2024:

| Sales – 2021 | Est. sales – 2022 | Est. sales – 2023 | Est. sales – 2024 | Est. 3-year CAGR | |

| Tesla Inc. | $53,823 | $83,697 | $108,482 | $134,051 | 35.6% |

| Source: FactSet | |||||

Compare that to the same for the S&P 500, based on weighted consensus estimates for sales per share:

| Est. sales per share – 2021 | Est. sales per share – 2022 | Est. sales per share – 2023 | Est. sales per share – 2024 | Est. 3-year CAGR | |

| S&P 500 Index | $1,574.08 | $1,708.54 | $1,803.62 | $1,906.69 | 6.6% |

| Source: FactSet | |||||

Earnings

Now let’s make the same comparison for EPS estimates:

| EPS – 2021 | Est. EPS – 2022 | Est. EPS – 2023 | Est. EPS – 2024 | Three-year Est. EPS CAGR | |

| Tesla Inc. | $4.90 | $10.87 | $14.31 | $15.18 | 45.8% |

| S&P 500 Index | $206.28 | $225.51 | $247.74 | $275.00 | 10.1% |

| Source: FactSet | |||||

For the index, the 2021 EPS and sales numbers are estimates, because many of the companies in the S&P 500 have fiscal years that don’t match the calendar year.

Other large increases to EPS estimates this year

Among the sectors of the S&P 500, energy has been this year’s best performer because the price of West Texas crude oil

CL.1,

based on continuous forward-month contracts, increased 49% through March 25. So that sector has also had the largest increase in EPS estimates.

Leaving the energy sector aside, these 11 companies, including Tesla, have had their consensus EPS estimates for calendar 2022 increase by more than 20%:

| Company | Ticker | Industry | Estimated EPS – 2022 | Estimated EPS – 2022 – Dec. 31, 2021 | Increase |

| Equity Residential |

EQR, |

Real Estate Investment Trusts | $1.93 | $1.16 | 66.0% |

| CF Industries Holdings, Inc. |

CF, |

Chemicals: Agricultural | $15.78 | $9.93 | 58.9% |

| Mosaic Company |

MOS, |

Chemicals: Agricultural | $11.08 | $6.98 | 58.7% |

| Host Hotels & Resorts, Inc. |

HST, |

Real Estate Investment Trusts | $0.40 | $0.28 | 42.9% |

| AvalonBay Communities, Inc. |

AVB, |

Real Estate Investment Trusts | $5.50 | $4.14 | 33.0% |

| Weyerhaeuser Company |

WY, |

Real Estate Investment Trusts | $2.50 | $1.90 | 31.4% |

| Hologic, Inc. |

HOLX, |

Medical Specialties | $4.81 | $3.78 | 27.4% |

| Tesla Inc |

TSLA, |

Motor Vehicles | $10.87 | $8.78 | 23.8% |

| Pfizer Inc. |

PFE, |

Pharmaceuticals: Major | $7.37 | $6.07 | 21.6% |

| Mid-America Apartment Communities, Inc. |

MAA, |

Real Estate Investment Trusts | $3.92 | $3.24 | 21.0% |

| Advanced Micro Devices, Inc. | AMD | Semiconductors | $4.01 | $3.34 | 20.1% |

Click on the tickers for more about each company.

Click here forTomi Kilgore’s detailed guide to the wealth of information available for free on the MarketWatch quote page.

Don’t miss: The Federal Reserve’s big policy shift points to good times for bank stocks