This post was originally published on this site

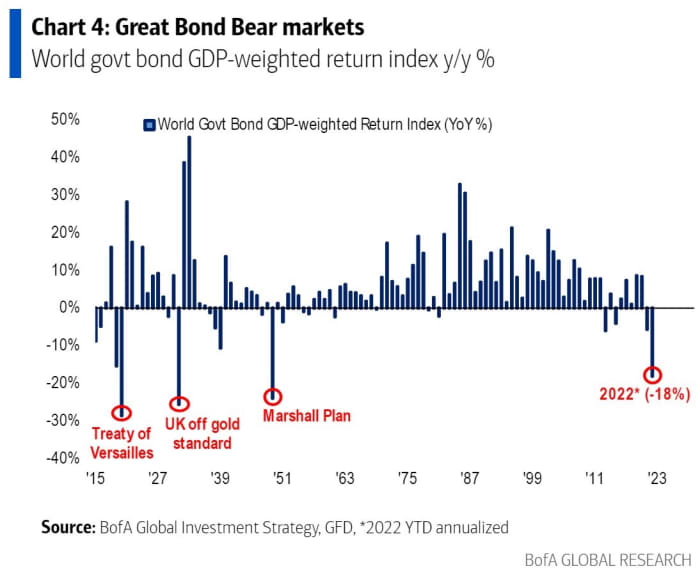

The third great bond bear market is underway, Bank of America strategists have declared.

The return on government bonds is on track for its worst year since 1949, the year after the Marshall Plan was enacted, according to data compiled by Bank of America. The measurement was of global bonds weighted by world GDP.

The yield on the 10-year Treasury

TMUBMUSD10Y,

has shot up 84 basis points this year. Yields move in the opposite direction to prices.

The previous bond bear markets were from 1899 to 1920, and from 1946 to 1981.

Michael Hartnett, chief investment strategist at Bank of America, in his weekly flow show report declared the big picture is one of “deflation to inflation, globalization to isolationism, monetary to fiscal excess, capitalism to populism, inequality to inclusion, US dollar debasement.” He said long-term yields will surpass 4% by 2024.

He noted the class of negative yielding bonds has quietly vanished, from some $18 trillion down to less than $2 trillion.