This post was originally published on this site

It’s the second anniversary Wednesday of the lows set in the U.S. stock-market plunge triggered by the COVID-19 pandemic in 2020.

Stocks have stumbled in 2022, but the S&P 500

SPX,

has more than doubled, rising 101.65% through Tuesday’s close, since the March 23, 2020, pandemic bottom at 2,237.40 — it’s best two-year rolling performance since 1937, according to Dow Jones Market Data.

The Dow Jones Industrial Average

DJIA,

is up 87.22% from its low of 18,591.93 hit on the same day, while the Nasdaq Composite

COMP,

has risen 105.65% from its low of 6,860.67, the data show. The Dow’s performance since the bottom marks its best two-year rolling performance since 1987.

The market’s performance “reminds us how volatile emotional investing decisions can be, particularly as we consider how the markets have unexpectedly doubled in two years despite COVID-19 lockdowns, historic levels of inflation and war in Ukraine,” said Mark Hackett, chief of investment research at Nationwide, in a note.

The S&P 500 closed at a record on Feb. 19, 2020 but stocks soon began to slide as alarm rose over the spread of COVID-19. The selloff soon accelerated into a white-knuckle panic that took the S&P 500 and Dow Jones Industrial Average

DJIA,

which had both traded at all-time highs in early February, into a bear market — a decline of 20% or more from a recent peak — at record speed. At the March 23, 2020, closing bell, the S&P 500 had dropped nearly 34% from the record close set a little more than a month earlier.

The chaos wasn’t confined to stocks. The Treasury market nearly seized up. The U.S. dollar

DXY,

soared amid a global scramble for the world’s reserve currency. The Federal Reserve moved quickly to backstop credit markets and worked with other central banks to expand or establish dollar swap lines, moves that were credited with helping to steady the ship. Those moves were in addition to the Fed’s extraordinary monetary policy easing measures and fiscal stimulus from Congress.

The stock-market bottom didn’t spell the end of volatility across markets. A soon-to-expire oil futures contract in April 2020 traded, and closed, in negative territory for the first time ever, for example.

The S&P 500’s rise from the low has been led by the energy sector, which has soared in 2022 as crude prices

CL.1,

BRN00,

surged toward 14-year highs in response to Russia’s invasion of Ukraine. Since March 23, 2020, energy sector stocks rose nearly 220% through Tuesday’s close, according to Dow Jones Market Data.

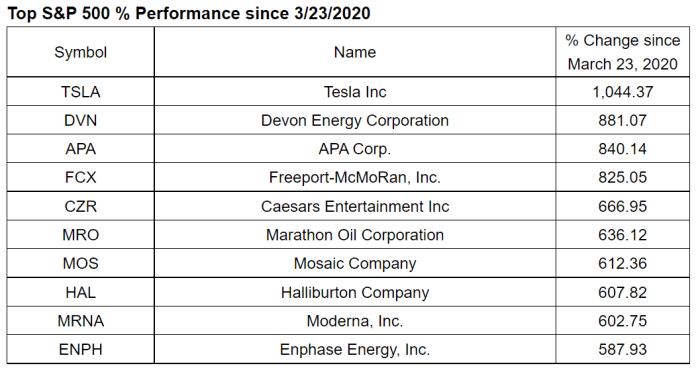

Among individual stocks, Tesla Inc.

TSLA,

led the way higher, up 1,044% over that stretch. The next closest gainer was Devon Energy Corp.

DVN,

with a gain of 881% (see table below).

Dow Jones Market Data

The pandemic, meanwhile, has taken a huge toll on lives while amplifying political divisions in the U.S. and other countries. Shock waves continue to reverberate through the global economy. The Fed and most other major central banks are now moving to rapidly unwind the extraordinary easy money measures put in place as they deal with a surge in inflation fueled in part by pandemic-related supply-chain bottlenecks.

While the underlying economic picture in the U.S. remains strong, Russia’s invasion of Ukraine last month has contributed to a surge in commodity prices, which has stoked fears of a possible return of stagflation — a pernicious combination of high inflation and stagnant economic activity.

The Nasdaq Composite slumped into a bear market earlier this month, while the Dow and S&P 500 have entered correction territory — defined as a drop of 10% from a recent peak. Stocks have since bounced from recent lows, however, with the S&P 500 trading less than 6% away from its all-time high.