This post was originally published on this site

The stock market doesn’t always quickly bounce back after it’s rocked by a geopolitical crisis. That seems obvious, but it’s worth emphasizing, given the bullish exuberance that has led some investors to view Russia’s invasion of Ukraine as a stock-buying opportunity.

An historical example is the U.S. market’s performance in the wake of the 1973-74 OPEC oil embargo, which was precipitated by the Arab-Israeli Yom Kippur War in October 1973. It wasn’t until February 1976 that the Dow Jones Industrial Average

DJIA,

was higher than where it stood at the end of that war.

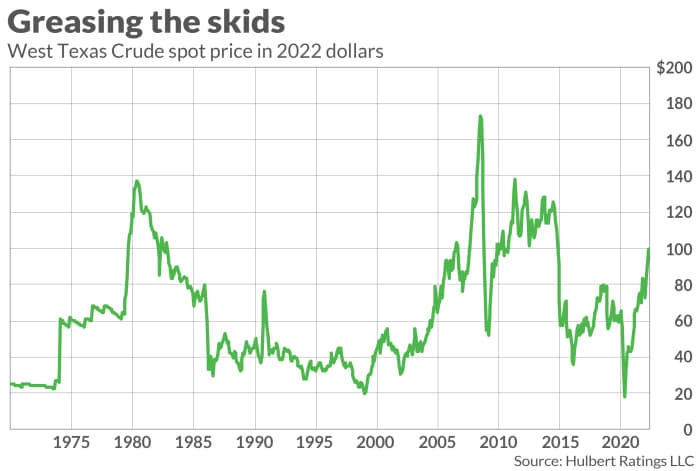

The Yom Kippur War isn’t the only historical analogy to the war in Ukraine. But in many ways the two are eerily similar. Perhaps the most ominous parallel is to what happened to the price of oil. In the wake of the October 1973 war and subsequent oil embargo, the price of West Texas Intermediate crude oil

WBS00,

more than doubled, as you can see in the chart below. Similarly, the current price of oil is more than double where it stood at the end of 2020. (All prices in the chart are expressed in 2022 dollars.)

Even more ominously, the oil price increase in late 1973 wasn’t temporary. Oil prices stayed at a high level for the remainder of the 1970s. In inflation-adjusted terms, in fact, this most-recent spike in oil has propelled its price to higher than where it was in late 1973 and 1974.

Another worrisome parallel has to do with the U.S. stock market’s valuation. The Yom Kippur war came near the peak of the so-called Nifty Fifty era. The Nifty Fifty was a group of 50 or so blue-chip U.S. stocks that dominated the market and were considered such solid values that investors could buy and hold them regardless of valuation. It took more than two decades for a portfolio of such stocks to surpass its peak value in the early 1970s, according to research by Jeremy Siegel of the Wharton School.

The stock market currently is, by almost all valuations measures, far more richly valued today than in 1973. The Cyclically Adjusted Price/Earnings Ratio (CAPE), which was made famous by Yale University (and Nobel laureate) Robert Shiller, got no higher than the high teens in the early 1970s. The CAPE today is in the high 30s.

There are many differences between the geo/political/social/economic situation that prevailed in 1973 and today, and drawing parallels is an inexact science at best. Nevertheless, what happened in the wake of the 1973 Yom Kippur War is a reminder not to be overconfident that the stock market’s current weakness is a great buying opportunity.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

Also read: Gas prices are way up, but real cost of driving a mile was higher for most of the past century