This post was originally published on this site

Fund managers have shifted the most into cash since the COVID-19 crisis first hit the West, according to a widely followed survey released Tuesday.

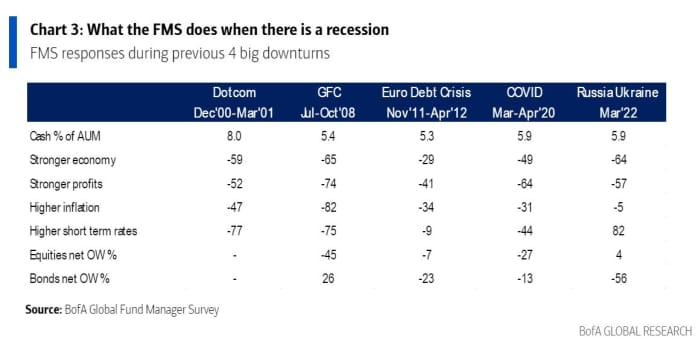

Cash levels surged to 5.9% in March from 5.3% after Russia’s invasion of Ukraine, Bank of America’s survey of global fund managers found, the highest level since March 2020.

Fund managers have moved into cash during other crises, too — as high as 8% during the dot-com selloff in 2001, and over 5% during both the global financial crisis of 2008 and the eurozone debt crisis in 2011 and 2012.

Like those other periods, expectations for both the economy and profit are deeply under the water. Global growth expectations plunged to their lowest level since July 2008, while inflation expectations are elevated, but fund managers are still overweight stocks.

“Equity allocations are not at ‘recessionary’ close-your-eyes-and-buy levels,” said analysts led by Michael Hartnett, chief investment strategist for Bank of America.

The allocation to commodities rose a record high 33% while a net 56% were underweight bonds.

Bank of America said 341 panellists with $1 trillion in assets participated in the March survey.

The S&P 500

SPX,

index has dropped three straight days and is down 13% from its record high in early January. A measure of global commodities

SPGSCI,

however, has climbed 22% this year.