This post was originally published on this site

Shares of Chevron Corp. eked out a gain to another record close Friday, even after J.P. Morgan analyst Phil Gresh recommended investors sell on a relative basis, given the oil giant’s outsized outperformance in recent weeks.

The stock

CVX,

pulled back as much as 2.9% soon after the opening bell, then battled back to close up a little less than 0.1% at $170.90. It has gained in 10 of the past 11 sessions.

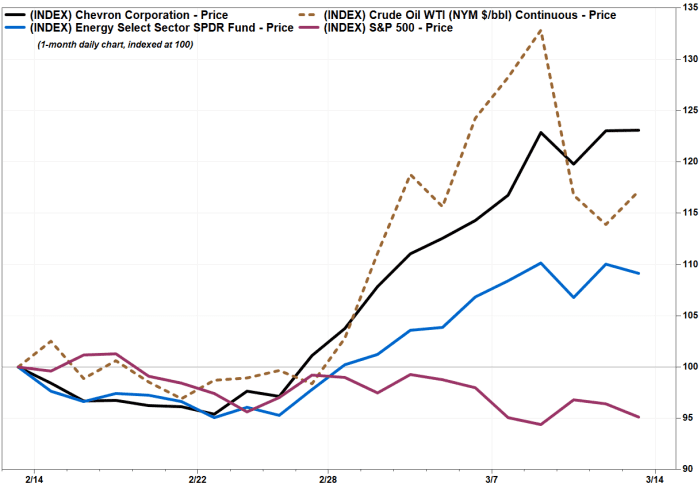

That’s the main reason why J.P. Morgan’s Gresh downgraded Chevron to underweight from neutral, saying that while he believes the company is a “high-quality global oil major,” valuation looks increasingly full after the recent rally. He said the stock appears to have “materially” outperformed its oil price beta.

The stock has soared 23.1% over the past month through Friday, while continuous crude oil futures

CL00,

have climbed 8.2%, the SPDR Energy Select Sector exchange-traded fund

XLE,

has gained 9.2% and the S&P 500 index

SPX,

has lost 4.9%.

FactSet, MarketWatch

“[Chevron] now screens as the most expensive company in our coverage and the most expensive of the global majors,” Gresh wrote in a note to clients. “While some of this could be due to its limited Russia exposure and modest Venezuela exposure, both of which could be positive in this environment, we see the least upside in the stock from here (~2% total return potential, group average ~25%).”

Over the past month, Chevron’s stock has only been outperformed among the energy ETF’s components by shares of Occidental Petroleum Corp.

OXY,

which have soared 34.8%, and Baker Hughes Co.

BKR,

which have run up 29.2%. But those stocks have rallied off a much lower base, and Occidental’s is trading near a less-than three-year high while Baker Hughes’ is near a five-year high.

Keep in mind that Gresh’s bearish rating is a relative call, as “underweight” at J.P. Morgan means the analyst expects the stock will underperform the average total return of the stocks in the analyst’s coverage over the next six to 12 months.

Meanwhile, Gresh reiterated his overweight ratings on Exxon Mobil Corp.

XOM,

and Cenovus Energy Inc.

CVE,

while keeping neutral ratings on Occidental Petroleum, Canadian Natural Resources Ltd.

CNQ,

CNQ,

ConocoPhillips

COP,

Imperial Oil Ltd.

IMO,

Montrose Environmental Group Inc.

MEG,

and Suncor Energy Inc.

SU,