This post was originally published on this site

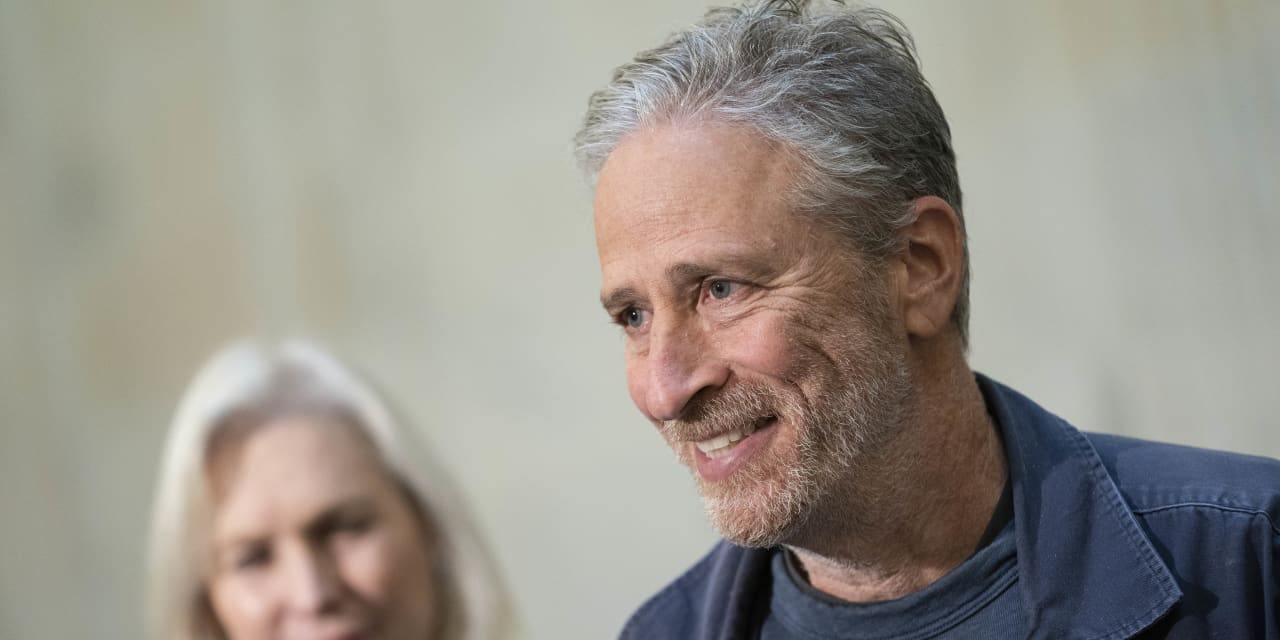

Jon Stewart lavished praise on the social-media investment movement that drove up prices in meme stocks like GameStop Corp.

GME,

and AMC Entertainment Holdings Inc.

AMC,

and focused the country’s attention on a controversial aspect of the U.S. stock market called payment for order flow in an episode of his show The Problem With Jon Stewart, airing Wednesday.

Investors who gather on forums like Reddit’s WallStreetBets have “crowdsourced a way of rooting out corruption,” Stewart said during a segment of the show in which he interviewed Securities and Exchange Commission Chairman Gary Gensler.

Stewart’s hour-long show included an in depth explanation of payment for order flow, the controversial practice whereby market makers pay stock brokers for the privilege of executing the orders of retail investors, away from more thoroughly regulated venues like the New York Stock Exchange or Nasdaq.

Supporters of the practice say that these payments enable brokers to offer zero commissions, while opponents argue that it creates a conflict of interest that will lead brokers to route orders to market makers which pay them the most, rather than offer the best prices for traders.

In an interview with MarketWatch in February, Gensler suggested that the SEC was taking a close look at the practice and could move to reform it by requiring more transparency into those payments.

“When just under half of the market is a dark market, when it goes to wholesalers or dark pools, then the investing public says that limited transparency, it’s harder to have that confidence,” Gensler told MarketWatch. “So that’s one of our projects.”

In his interview with Gensler, Stewart argued that the SEC didn’t have enough resources to police markets, and that major reforms are needed to protect retail investors.

“With all the financial shenanigans that have gone on over the years, the only person we’ve really brought to heel is Martha Stewart, and that’s gotta tell you something about how tilted this thing is,” Stewart said, referring to a 2004 investigation into stock trades made by the television personality.

The Apple

AAPL,

TV host argued that statistics showing that the widening gap in stock market wealth between wealthier and poorer Americans is evidence that the SEC is failing it it mission to protect investors.

“The retail investor, they’re at a real disadvantage, and you’re the sheriff, and you’re outgunned,” Stewart said. “I walked into your coffee room today, and there’s a little sign that said ‘coffee donations welcome.’”

Gensler agreed that the SEC could use more resources, noting that SEC staff shrank by 5% during the Trump Administration, during a period of rapid growth in financial markets.

“How outmanned are you?” Stewart asked the SEC Chair. Are you an abacus in the calculator world? Are you analog in a digital world?”

Gensler said that the SEC spends “about $350 or $400 million annually on technology, which is probably what one of the 5 or 6 largest banks spend in a few weeks on technology.”