This post was originally published on this site

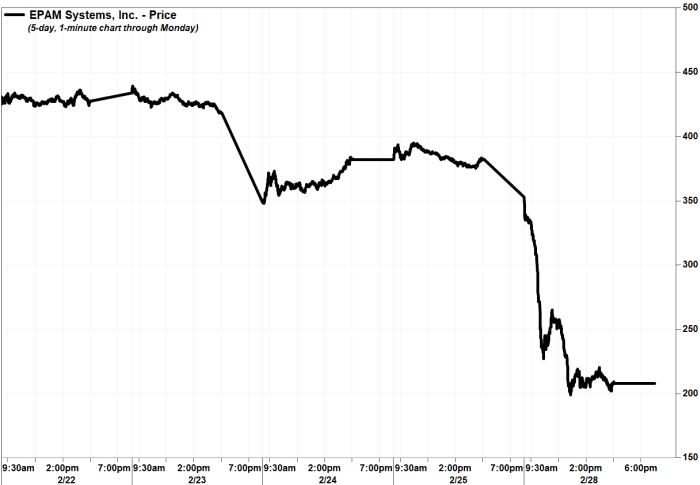

Shares of EPAM Systems Inc. suffered a record selloff in very volatile trading Monday, after the provider of digital transformation services pulled its financial guidance given “heightened uncertainties” resulting from Russia’s invasion of Ukraine.

The stock

EPAM,

plummeted 45.7% to $207.75, the lowest close since April 2020, to pace the S&P 500 index’s SPX decliners by a wide margin. The stock suffered the biggest one-day percentage decline since it went public in February 2012, passing the previous record drop of 23.6% on March 3, 2014.

Trading volume in the stock, which had been halted for volatility three times on Monday, swelled to 10.2 million shares, compared with the full-day average of about 700,000 shares.

The stock had tumbled 13.7% last week, including an 8.6% selloff on Thursday when Russia’s invasion of Ukraine was launched.

FactSet, MarketWatch

Late Friday, EPAM disclosed in its 10-K filing with the Securities and Exchange Commission that its largest delivery centers are located in Ukraine, Belarus and Russia.

“We have significant operations in the emerging market economies of Eastern Europe and more than half of our global delivery, administrative and support personnel are located in Ukraine, Belarus and Russia,” the company stated in its 10-K.

The company said it has about 14,000 employees in Ukraine, including about 13,000 delivery personnel as of Feb. 24. As of Dec. 31, the company said it had 9,416 delivery personnel in Belarus and 8,933 in Russia.

“The company is proactively working to relocate its employees to lower risk locations in Ukraine and neighboring countries,” the company said in a Monday statement.

The company also stated Monday that it was withdrawing its financial guidance for the first quarter and for 2022 given “heightened uncertainties” resulting from Russia’s military action in Ukraine.

The company had said in its fourth-quarter earnings report released Feb. 17 that it expected first-quarter revenue of $1.17 billion to $1.18 billion and 2022 revenue of at least $5.15 billion, which compared with the FactSet consensus at the end of January for first-quarter revenue of $1.11 billion and 2022 revenue of $4.87 billion.

EPAM said in its 10-K that in 2021 it derived $168.04 million in revenue from Central and Eastern Europe (CEE), which included revenue from customers in Russia, Belarus, Kazakhstan, Ukraine and Georgia, or 4.5% of total revenue of $3.76 billion.

In Russia alone, EPAM generated $165.41 million in revenue and $32.55 million in operating profit, or 4.5% of its total operating profit of $729.07 million.

Among other exposure to the Russia-Ukraine conflict, EPAM said it had $232.6 million in cash and cash equivalents, or 16.1% of the total, in banks in Russia, Belarus and Ukraine.

As of Dec. 31, the company had $78.29 million in long-lived assets in Ukraine, $75.52 million in Belarus and $16.61 million in Russia, representing a combined 72.1% of the company’s long-lived assets of $236.21 million.

“The impact to Ukraine, as well as actions taken by other countries, including new and stricter sanctions by Canada, the United Kingdom, the European Union, the U.S. and other countries and organizations against officials, individuals, regions, and industries in Russia, Ukraine and Belarus, and each country’s potential response to such sanctions, tensions, and military actions could have a material adverse effect on our operations,” the company said in its 10-K.

See also: Russian central banks lifts interest rates to 20% as ruble plunges over Western sanctions.

Piper Sandler analyst Arvind Ramnani downgraded EPAM to neutral from overweight, and slashed the stock price target to $410 from $776, citing the effect of productivity on revenue and the effect of operational, relocation and travel costs on margins.

EPAM shares have sunk 65.1% over the past three months, to make it the worst performer among components of the S&P 500 over that time. Meanwhile, the SPDR Technology Select Sector exchange-traded fund

XLK,

of which EPAM is a component, has shed 7.2% over the past three months and the S&P 500 has slipped 3.1%.