This post was originally published on this site

What’s the state of the market? That’s what many on Wall Street want to know, amid a continuing war in Eastern Europe, doggedly high inflation, stomach-churning volatility in stocks and other assets, and a Federal Reserve that is slowly draining Wall Street’s punchbowl of easy money.

“We’re calling the state of the markets today fragile,” Greg Bassuk, CEO at AXS Investments, an asset-management firm for alternative investments, told MarketWatch in a Friday interview.

There are likely quite a number of investors who would agree with Bassuk, as President Joe Biden on Tuesday is set to deliver what some are referring to as one of the most important such addresses to the nation in recent memory, with inflation at a 40-year high and the COVID-19 pandemic lingering.

“Biden needs to convey that he is ‘doing everything he can to protect the world order.’”

On top of that, shades of Cold War-era tensions are emerging with Russia’s long-feared siege of Ukraine stretching into the weekend and putting major cities at risk.

“This State of the Union could be one of the most important ones in recent memory,” said Thomas Martin, senior portfolio manager at GLOBALT Investments in Atlanta. Biden needs to convey that he is “doing everything he can to protect the world order,” he said.

The problem is that the world order feels as if it is in flux, shifting beneath investors’ feet, as of late.

And it isn’t just Biden on display next week, Federal Reserve Chairman Jerome Powell will deliver scheduled testimony to Congress on Wednesday and Thursday on monetary policy.

The planned events come after the S&P 500

SPX,

put in its largest intraweek comeback, up 0.8% after being down 5.4% at the week’s nadir, since 2008, as Russian President Putin announced a “special operation” into Ukraine that most of the rest of world calls an invasion.

Read: Russia’s credit rating cut to junk by S&P as other agencies mull or take downgrade action

The Nasdaq Composite Index

COMP,

down 7.1% at the week’s low, ended up 1.1% for its largest weekly comeback since August of 2015, according to data compiled by Dow Jones Market Data. The Dow Jones Industrial Average

DJIA,

also marshaled a rebound, paring its weekly loss to about 0.1% from a 5% drop.

But the market appears to be hardly out of the woods.

Chris Zaccarelli, chief investment officer for Independent Advisor Alliance, said that investors are likely going to be fixated on the inflation battle as they watch for remarks from Biden and Powell.

“Going forward, markets are going to find that the Fed’s battle against inflation—in terms of raising interest rates and reducing the size of their balance sheet—is going to be a much bigger threat to investors then war between Russia and Ukraine,” he said.

Zaccarelli said the more it looks as if the “Fed’s hands are tied, and they are forced to tighten monetary policy to fight inflation, the more volatility we are likely to see [markets] over the course of this year.”

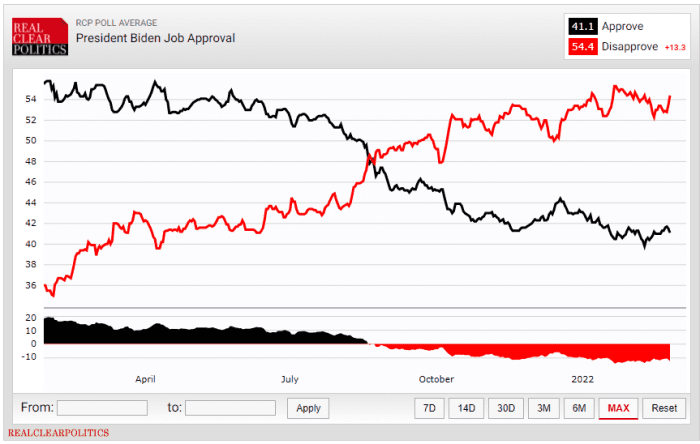

It is worth noting that Biden’s speech comes as his approval rating is around its low of 40% and his disapproval rating is near its high, as average Americans feel the sting of higher prices on goods and services.

RealClearPolitics

Biden last week said that he would do “everything in my power to limit the pain the American people are feeling at the gas pump. This is critical to me.”

“Biden’s got a tough row to hoe,” said GLOBALT’s Martin.

Equally, Powell also has a tough task ahead of him, with many expecting that the Fed will commence a series of increases to benchmark interest rates as soon as next month to combat inflation. Those rates currently stand at a range between 0% and 0.25%.

The concern on Wall Street is that the Federal Reserve could end up tightening financial conditions at the same time inflation stays high, and the U.S. economy slips into recession.

It is unclear what impact the crisis in Europe will have on policy decisions but it inserts another layer of uncertainty into financial markets.

“‘Going forward, markets are going to find that the Fed’s battle against inflation—in terms of raising interest rates and reducing the size of their balance sheet—is going to be a much bigger threat to investors then war between Russia and Ukraine.’ ”

There are some signs, however, that supply-chain bottlenecks that had been one of the contributing factors to higher prices, are starting to recede.

“We are starting to see inventories rise,” which had been pulled forward by corporations in anticipation of shortages, and that’s a good sign, said Martin. The consumer is coming back and to pre-COVID levels, he said.

And he added that inflation itself becomes a cure for inflation, in the form of buyers’ strikes.

But can either Biden or Powell inject more confidence into market?

AXS’s Bassuk is hoping the president and Powell can.

“Because consumers need greater confidence to go back to work, start spending again,” he said. “Investors need the likelihood that there will be more stability in the market and a light at the end of the tunnel from this roller coaster,” he said.

Jobs data and the week ahead

And if next calendar wasn’t already jam packed, the jobs report for February is due on Friday, and the meeting of the Organization of the Petroleum Exporting Countries (OPEC) on Wednesday will prove a key event as U.S. benchmark oil

CL.1,

touched $100 a barrel last week and natural gas prices

NG00,

surged.

The average estimate for job creation this month is 415,000, according to a survey of economists polled by The Wall Street Journal. The unemployment rate is forecast to fall to 3.9% and average hourly earnings are estimated to rise 0.5% on the month.

Monday

- Trade in goods, advance report for January, 8:30 a.m. ET

- Chicago PMI for February at 9:45 a.m.

- Atlanta Fed President Raphael Bostic speaks 10:30 a.m.

Tuesday

- IHS Markit manufacturing PMI final read for February due at 9:45 a.m.

- ISM Manufacturing Index due at 10 a.m.

- Construction spending 10 a.m.

- Atlanta’s Bostic speaks again at 2 p.m.

- Biden’s SOTU is scheduled for the night

Wednesday

- OPEC+ holds meeting

- ADP private-sector employment report for February due at 8:15 a.m.

- Chicago Fed President Charles Evans speaks at 9 a.m.

- St. Louis Fed President James Bullard speaks at 9:30 a.m.

- Powell’s House testimony commences at 10 a.m.

- Beige Book at 2 p.m.

Thursday

- Initial jobless claims 8:30 a.m. for week ended Feb. 26

- Productivity and labor costs for the fourth quarter at 8:30 a.m.

- IHS Markit services PMI final for February at 9:45 a.m.

- ISM Services report and factory orders due at 10 a.m.

- Powell speaks to the Senate at 10 a.m.

- New York Fed President John Williams speaks at 6 p.m.

Friday

- Nonfarm-payrolls report due at 8:30 a.m.

- Chicago Fed President Charles Evans speaks at 8:45 a.m.