This post was originally published on this site

Russia’s invasion of Ukraine on Thursday had U.S. investors focused on the cost of food and energy in America, and the likely implications for financial markets.

With Russia and Ukraine’s outsize role in global commodities, prices shot higher for wheat, corn and oil, as Moscow attacked its neighbor in the largest military operation in Europe since World War II.

Ukraine’s military also suspended commercial shipping at its ports, threatening grain supplies, according to a Reuters report.

“It’s not just oil, it’s wheat,” said Jack McIntyre, a portfolio manager with Brandywine Global Investment Management’s global fixed income team, by phone.

“The challenge is you have a world with a lot of inflation pressures to start with,” McIntyre said. “Now, you are adding to it.”

The word is ‘stagflation’

Tempers have been flaring in the U.S. as the cost of living has climbed to 40-year highs, driven in part by supply-chain disruptions and higher food and energy prices.

That’s prompted President Joe Biden and Federal Reserve Chairman Jerome Powell to shift their focus to tackling inflation from providing easy credit and pandemic backstops for the economy over the past two years.

Adding to that, stocks, a major driver of financial gains for investors for much of the COVID crisis, have stumbled since the central bank started began signaling late last year to expect tighter financial conditions in 2022.

“Politically, Biden is in a tough spot with the angry consumer,” McIntyre said. “This is a growth tax in the form of higher food and energy costs.”

The concern on Wall Street is that the Federal Reserve could end up tightening financial conditions at the same time inflation stays high, and the U.S. economy slips into recession.

“From a broad-based standpoint, right now, this is taking the 50-basis-point rate hike off the table in March,” said Jake Remley, a fixed-income portfolio manager at Income Research + Management.

“Now, the word is ‘stagflation,’ and stagflation is politically really undesirable,” Remley said, adding that Russia’s attack on Ukraine has amplified fears of a 1970s-type situation of rising U.S. prices as the economy slows.

Fed officials have signaled the first increase to policy rates since 2018 could happen as early as next month, followed by a reduction of its nearly $9 trillion in bond holdings. The next Fed policy decision is expected after the conclusion of its two-day meeting from March 15-16.

For its part, the European Central Bank likely will remain “extremely cautious” about tightening financial conditions, Remley said, given the region’s heavy reliance on Russian supplies of natural gas and other commodities from Ukraine.

See: Why Russia’s invasion of Ukraine could lift oil prices to a 14-year high

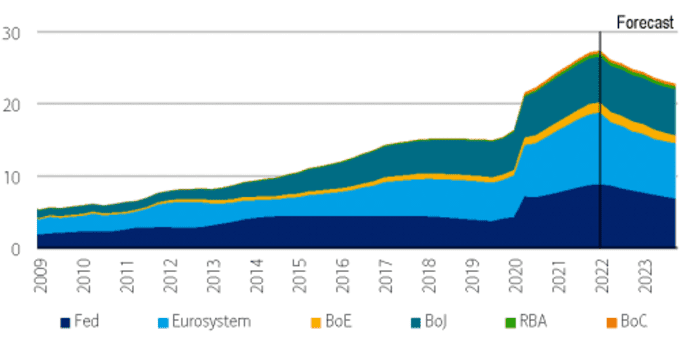

Major central banks slashed rates and ramped up bond purchases in early 2020 to keep credit flowing during the pandemic, but recently have started talking about potentially smaller balance sheets, last pegged near a combined $25 trillion (see chart). Investors are watching the Ukraine situation to see if the central banks will get dovish again.

Major central banks now have combined $25 trillion-plus balance sheets.

BofA Global Research

Stock-market correction

Another wild card for markets is whether Russia will contain its military conflict to Ukraine.

Biden responded to the attack with a series of new sanctions against Russia’s largest banks, companies and elite families, keeping them from doing business in Western markets and freezing trillions of dollars in assets.

Biden said the sanctions would punish Moscow for its current hostilities, but also serve as a warning shot to Russia about expanding its military operations beyond Ukraine’s borders into NATO territory.

“It’s going to be a cold day for Russia,” Biden said Thursday of the new restrictions, adding that they also were designed to minimize the impact on U.S. consumers and its allies.

U.S. stocks responded with a late-day rally, but with the major benchmarks still finishing in or near correction territory, defined as a close of at least 10% below its last record finish.

The Dow Jones Industrial Average

DJIA,

ended the session on the cusp of correction territory, or 9.7% below its Jan. 4 record high, according to Dow Jones Market Data. The S&P 500

SPX,

was in 10.6% off its peak and the Nasdaq Composite

COMP,

closed 16.1% off its Nov. 19 record finish.

U.S. crude

CL00,

prices briefly traded as high as $100.54 barrel on Thursday, but settled closer to $93 a barrel, while 10-year Treasury yields

TMUBMUSD10Y,

slumped below 2% as bond prices rose.

Biden promised Thursday to “do everything” in his power to limit the pain people are feeling at the gas pumps, adding the U.S. and its allies were closely monitoring the potential for collective releases from their strategic petroleum reserves.

And for bonds? “It’s hard to predict geopolitical risks,” Remley said, adding that even at current low yields, having some bonds in a portfolio can help reduce downside risks when they flair up.

“They are doing it today,” he said.