This post was originally published on this site

Wall Street is returning from a three-day weekend that started with diplomacy hopes, and ended with Russian President Vladimir Putin ordering troops into separatist regions of eastern Ukraine.

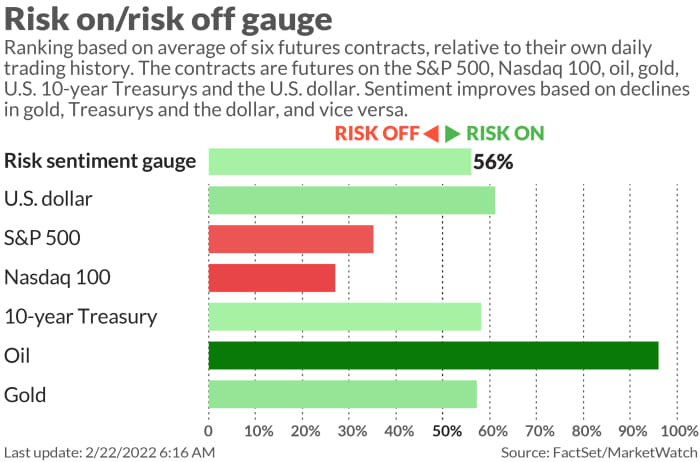

Investors have been responding in classic fashion — selling riskier assets and hiding in the havens. After hours of volatile futures trading, stocks are lower in early U.S. trading.

Read: What war in Ukraine would mean for markets as Putin orders Russian troops to separatist regions

Some sage advice comes from Pepperstone’s head of research, Chris Weston, who reminds us that “trading in a headline-driven market is not for everyone, it requires a dedication to being in front of the screens, an understanding of what is noise and what is signal and an ability to keep emotions in check.”

From the updates being fired off by Wall Street banks to worried clients, we grab our call of the day from JPMorgan strategists who zero in on the front-and-center concern right now.

“Russia-Ukraine tension is a low earnings risk for U.S. corporates, but an energy price shock amid an aggressive central bank pivot focused on inflation could further dampen investor sentiment and growth outlook,” said strategists led by Dubravko Lakos-Bujas, in an early Tuesday note.

Amid an uncertain and potentially rocky path of this current crisis, with possibly higher market volume, “tightening monetary policy , in our view, still remains the key risk for equities as central banks attempt to aggressively re-anchor inflation expectations lower,” said the JPMorgan team.

This view has ebeen echoed elsewhere. Neil Shearing, group chief economist at Capitol Economics estimating in a worst-case scenario, oil prices could rise to $120 a barrel.

“In normal times, central banks would tend to look through an energy-led rise in inflation, but given the current high rates of inflation, and corresponding concerns about it feeding higher inflation expectations, it’s possible that this adds to the list of reasons for policy makers to raise interest rates,” said Shearing.

On the other hand, Lakos-Bujas and the team said investors could see the Russia-Ukraine crisis “force a reassessment of the Fed tightening path, resulting in central banks turning less hawkish, while policy makers may consider additional fiscal stimulus,” such as a gas tax cut in the U.S.

As for indirect risks, JPMorgan sees those as possibly “more substantial, which could include slower global growth and consumer spending due to higher oil and food prices, negative second-order effects through Europe, supply chain distortions, credit and asset write-downs and cybersecurity risks,” they said.

When it comes to U.S. company exposure, JPMorgan calculated that direct Russia exposure is about 0.6% for the Russell 1000

RUI,

with Ukraine roughly at 0.1%.

The buzz

President Joe Biden signed an executive order restricting American dealings in two Ukraine separatist regions. That’s after Putin, in a rambling and fiery speech on Monday said he’d recognize the independence of Luhansk and Donetsk and send what he called were peacekeepers.

Germany, heavily reliant on Russian energy, halted certifying the crucial Nord Stream 2 pipeline, following Putin’s actions. That sparked a critical response from Dmitry Medvedev, deputy chair of Russia’s security council:

Uncredited

Away from that crisis, Home Depot

HD,

is climbing on a profit and sales beat and a dividend lift, while Krispy Kreme

DNUT,

reported mixed results. Macy’s

M,

stock is surging after an earnings beat, dividend hike and $2 billion share buyback plan. Palo Alto Networks

PANW,

Virgin Galactic

SPCE,

and Mosaic

MOS,

are due to report after the close.

Watch U.S.-listed China tech stocks, after a rough start to the week in their home country on fears of more regulatory crackdowns, and as the government ordered banks and state-owned firms to report any exposure to fintech Ant Group , with owner Alibaba

BABA,

and Tencent

700,

taking hard hits.

Data ahead includes a pair of home-price indexes — S&P Case-Shiller and Federal Housing Finance Agency —along with the Markit manufacturing and services purchasing managers indexes and consumer confidence data.

Federal Reserve Gov. Michelle Bowman said she was open to interest-rate hikes by more than a quarter-point at the next meeting in March.

The markets

Uncredited

U.S. stocks

DJIA,

COMP,

are down to start the day’s trading, as investors flock to bonds

TMUBMUSD10Y,

and gold

GC00,

which tapped May 2021 highs, while crude

CL00,

is up over 3% and natural gas

NGH22,

is up the same. Asian stocks tumbled, with the Hang Seng

HSI,

down 3% on tech weakness, while European stocks

SXXP,

are now flat.

The Russian ruble

RUBUSD,

is down 1.5% against the dollar and the country’s MOEX index is down 4%. Cryptocurrencies

BTCUSD,

are also taking a hard hit.

The chart

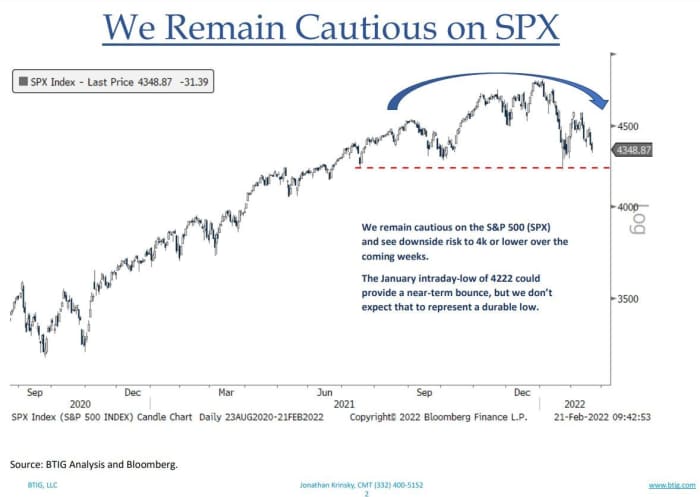

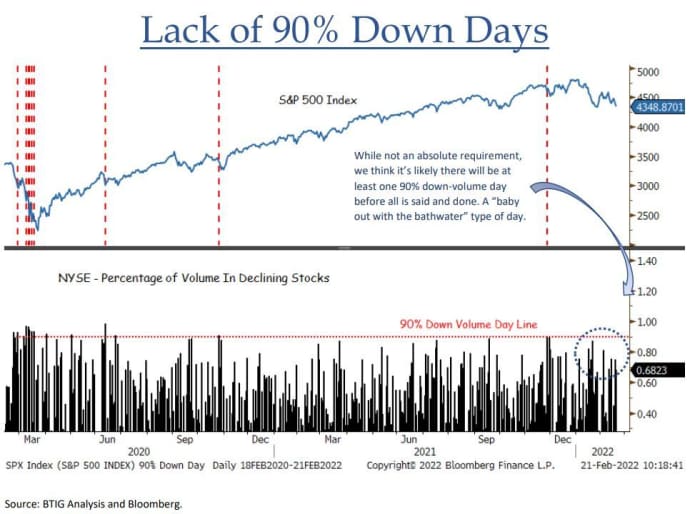

Jonathan Krinsky, BTIG’s chief market technician, expects the S&P 500 to drop below 4,000 over the coming weeks, because capitulation hasn’t happened.

Uncredited

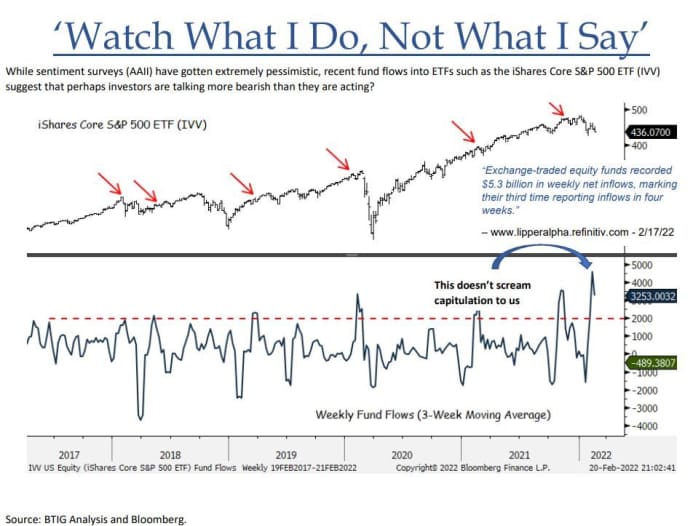

Krinsky notes pessistic sentiment surveys, but strongish flows into exchange-traded funds (

IVV,

), suggesting “investors are perhaps talking more bearish than they are acting.”

Uncredited

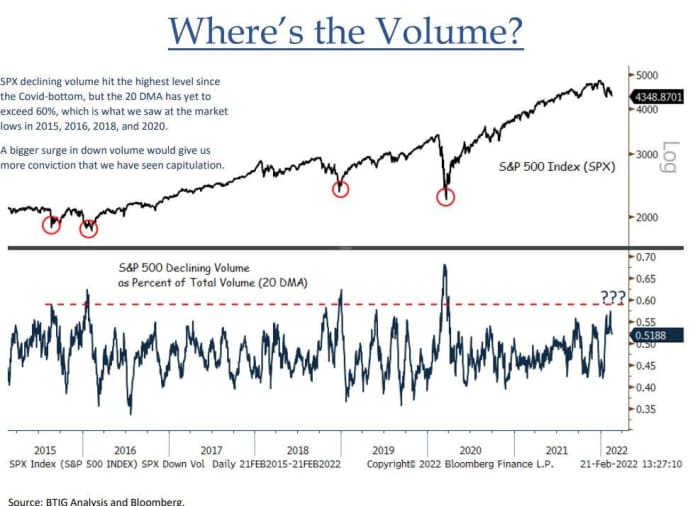

And markets have “yet to see the 20 DMA [daily moving average] of down volume spike nor a single 90% down volume day. A bigger surge in declining volume would give us more conviction that we have seen capitulation,” he said.

Uncredited

Krinsky said their favored sectors remain value and cyclicals over growth, but recognizes that “in order to get full capitulation, such as a 90% down volume day, we likely need to see the ‘baby get thrown out with the bathwater.’

Uncredited

In this respect, Krinsky sees retail {

XRT,

) as particularly vulnerable, but is constructive on many food and beverage names (

PBJ,

) and aerospace

ITA,

The tickers

These were the most active tickers on MarketWatch as of 6 a.m. Eastern Time.

Random reads

Underwater burials. The good, the bad and the ugly.

The world’s endangered species have a new ally: AI.

A clone of a clone of a tree used by Sir Isaac Newton for his famed gravity find is being replanted following recent storms.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.