This post was originally published on this site

The Federal Reserve should raise interest rates more aggressively than it did in the 2007-’09 Great Recession to stamp out the highest U.S. inflation in 40 years, the president of the Cleveland Federal Reserve said Thursday.

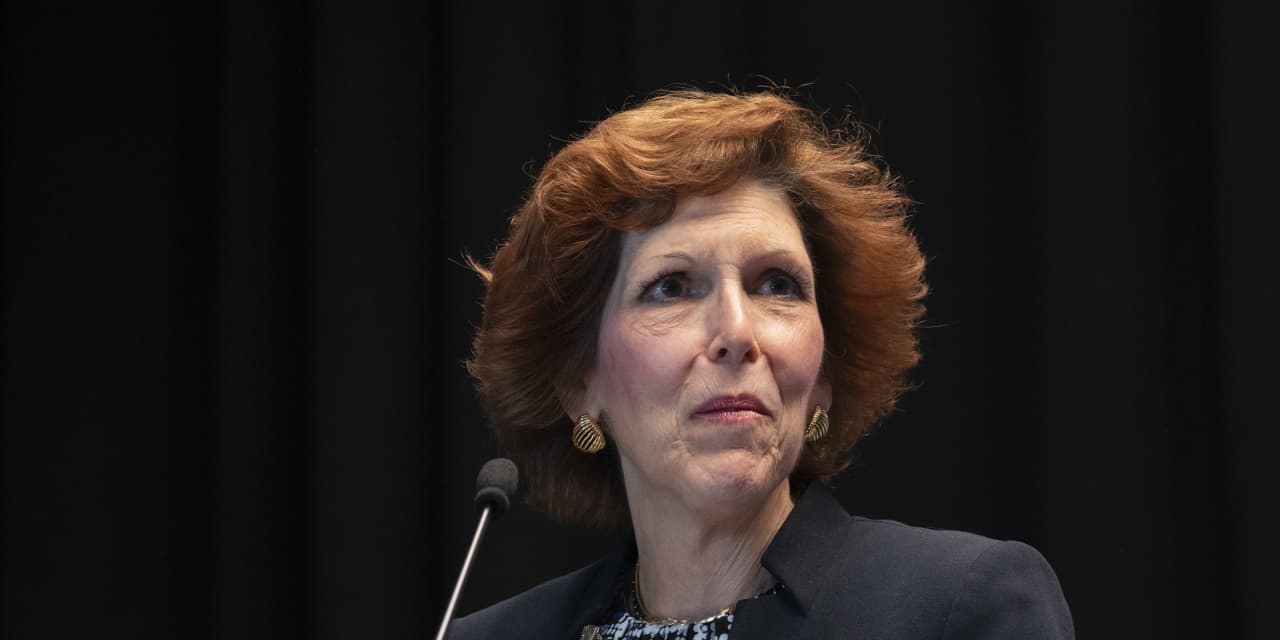

Loretta Mester said she will support an increase in the Fed’s benchmark short-term rate in March — “barring an unexpected turn in the economy” — as well as “further increases in the coming months.”

For more: Read Mester’s speech.

Mester also said the Fed should move to reduce “the size of its balance sheet soon and more quickly than last time,” referring to the central bank’s more leisurely pace of asset sales long after the end of the Great Recession.

Over the past two years the Fed doubled the size of its balance sheet to $9 trillion from $4.5 trillion to help drive down long-term interest rates. It accomplished its goal by buying huge amounts of Treasury bonds and mortgage-backed securities.

Mester offered few new details on asset sales, however, and said the Fed would have to tread cautiously to avoid causing dislocation in financial markets.

Nonetheless, Mester said a swifter Fed response is necessary now because the U.S. has rebounded far more rapidly after the 2021 recession compared to the slow and weak recovery that followed the Great Recession. Inflation has also roared to life after a decade of being largely invisible.

“This time is very different,” Mester said. She is a voting member this year of the central bank panel that sets interest rates.

Mester said she expects inflation, now at a 40-year high of 7.5%, to run above the Fed’s 2% goal this year and next.

If high inflation persists, she said, she would support even more aggressive rate hikes later this year.

One of the big challenges for the Fed, Mester said, is how it communicates its approach to investors. She suggested the Fed pare back so-called forward guidance, a strategy adopted after the Great Recession to signal the likely path of interest rates.

“Instead, we will need to convey the overall trajectory of policy and give the rationale for our policy decisions based on our assessment of the outlook and risks around the outlook, which are informed by economic and financial developments,” Mester said.

Mester said a new approach would help prevent Wall Street

DJIA,

SPX,

from misreading the Fed’s intention and spawn volatility in financial markets.

Such a change should not be viewed as the central bank “backing away from transparency,” she said.

Mester made her remarks in a virtual speech to the New York University Stern Center for Global Economy and Business.