This post was originally published on this site

As investors remain focused on the threat of a Russian invasion of Ukraine, RBC Capital Markets told investors that stock-market drops ahead of war tend to resemble “growth scares.”

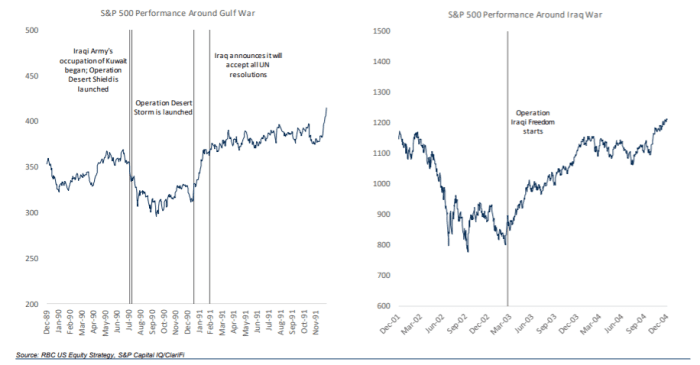

“On Russia/Ukraine, there’s no past conflict that provides a good template for how low stocks could trade if an invasion occurs,” RBC analysts led by Lori Calvasina, head of U.S. equity strategy, said in a research note Monday. “But we have found it interesting that stock market declines around the two Iraq wars were similar to the kinds of drops we see around recessions” and growth scares.

Read: What a Russian invasion of Ukraine would mean for markets as Biden warns Putin of ‘severe costs’

The S&P 500 index fell more than 19% from peak to trough during the 1990 Gulf War, a drawdown that also was associated with a recession that year, according to the RBC analysts. The U.S. stock benchmark’s 33% drop around the second Iraq war in 2003 came as “investors were also wrestling with the aftermath of the Tech bubble, as well as the accounting scandals that marked the early 2000s,” they said.

RBC CAPITAL MARKETS RESEARCH NOTE DATED FEB. 14, 2022

The S&P 500 index is down so far in 2022 amid market jitters over high inflation and expectations the Federal Reserve will seek to battle it this year by tightening its monetary policy.

“The Fed is mostly priced in to the S&P 500,” the RBC analysts said, but “a Russian invasion of Ukraine may not be and currently presents one of the key risks to the stock market.”

See: Inflation and armed global conflict have investors worried about Jay Powell’s trigger finger

The S&P 500

SPX,

was down modestly Monday morning, after closing sharply lower Friday amid a White House warning that Russia may soon invade Ukraine and that all Americans should leave the country in the next 24 to 48 hours.

Market worries over Ukraine appeared to ease somewhat Monday after Russian Foreign Minister Sergei Lavrov, speaking in a meeting with Russian President Vladimir Putin, suggested that Moscow should continue to talk with NATO and the European Union.

“We continue to think that the Jan. 27 lows have a good chance of holding, assuming recession is avoided,” the RBC analysts wrote. “But if we are wrong, a growth scare” amounting to a 15% to 20% drop from this year’s high “is probably the right way to gauge potential downside risk.”

The S&P 500 ended Friday about 7.9% below its record close on Jan. 3, according to Dow Jones Market Data.

The Cboe Volatility Index

VIX,

was elevated Monday morning, trading around 30, according to FactSet data, at last check. That’s up from about 27 on Friday and above its long-term average just below 20.

“The escalation of Russia and Ukraine tensions come at a time when the stock market is already vulnerable given inflation worries and the potential for Federal Reserve tightening,” George Ball, chairman of Houston-based investment firm Sanders Morris Harris, said in emailed comments Monday.

See: Russia’s top diplomat says talks should continue because U.S. has offered missile deployment limits

“If an armed conflict between Russia and Ukraine is somehow avoided, a short lived relief rally is likely, but there are still too many worries on the horizon for any type of longer lasting upward move higher in stocks,” Ball said. “It is time for investors to raise cash.”

According to Ball, “an investor who usually holds 5% of their portfolio in cash, with the remaining in stocks and bonds, should raise the cash position to 10%-20% of their portfolio, with the remainder divided in the normal 60/40 fashion between stocks and bonds.”

“Cash is the ultimate king when markets are volatile,” Ball said.