This post was originally published on this site

It’s a scam as old as the ages, targeting lonely people with promises of love — and it’s on the rise.

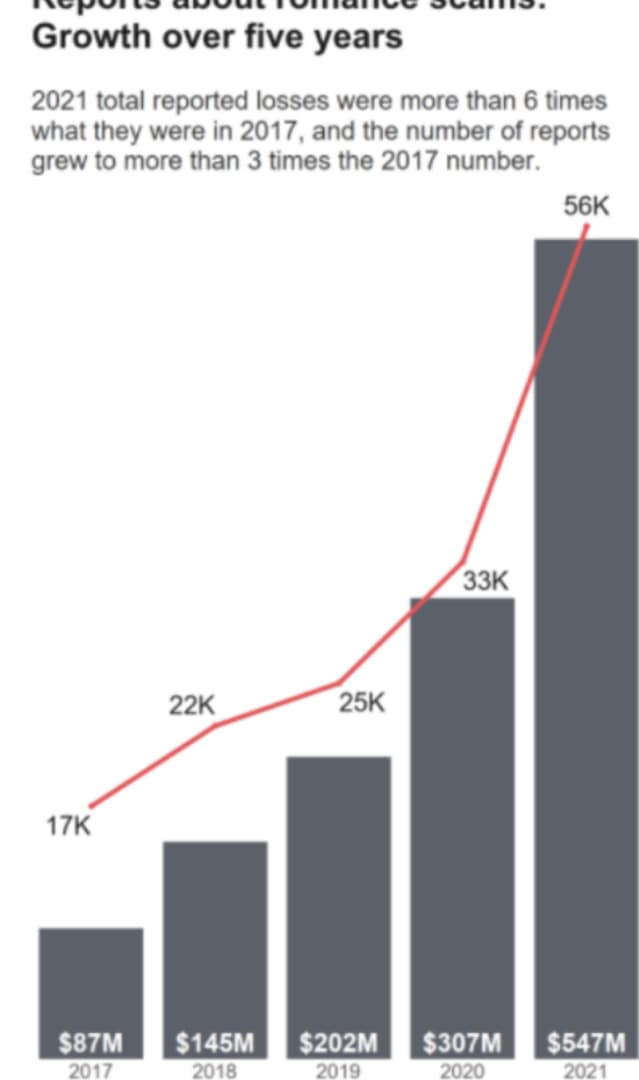

The classic romance scam — in which a lovelorn victim is conned into sending money to a stranger they’ve met online — shot through the roof last year, with an 80% jump in reported cases to an all-time high, the Federal Trade Commision said.

Over 56,000 such cases were reported last year, up from 33,000 in 2020, and at least $547 million was stolen, up from $307 million the prior year, the FTC said.

““Romance scammers are masters of disguise.””

People over 70 are the most frequent victims, but the report said the biggest rise over the last year came among people ages 18 to 29.

Researchers say there was no definitive cause for the uptick that could be gleaned from their data, but they suspected that it could be partially attributed to the coronavirus pandemic making lonely people isolated at home more susceptible to such scams.

They also pointed to frauds involving phony cryptocurrency investments presenting new tools for romance scammers.

Federal Trade Commission

The basic structure of a romance scam is relatively consistent, experts say. A person looking for love on dating sites is the typical target, but unsolicited messages via social media platforms have become increasingly common. More often than not, the victim is elderly and a widow or widower.

“Romance scammers are masters of disguise,” the report says. “They create fake online profiles with attractive photos swiped from the web. Sometimes they even assume the identities of real people. They may study information people share online and then pretend to have common interests. And the details they share about themselves will always include built-in excuses for not meeting in person,”

After a victim is roped into a conversation, eventually requests for money soon follow.

A cautionary tale

For Kate Kleinhart, a widow from Pennsylvania, the scam began with a message on Facebook from “Tony,” who said he was a surgeon working for the United Nations in Iraq.

“Tony became romantic much more quickly than I did and I kept trying to put him off, saying we didn’t know each other. But Tony had his kids get in touch with me through email and they started calling me mom, which is my Achilles’ heel, because I didn’t have children of my own. That put me head over heels,” she testified before Congress last year.

Soon, the children began asking for money to buy small things. They’d request Kleinhart buy gift cards and text them photos of the front and back plus the receipt.

“From then, there was always some kind of an emergency or some urgent need for money,” she said.

“The loss that hurts the most was losing his love and losing the family I thought I was going to have and what my new future was going to be.’”

“Tony” eventually said he wanted to get married and asked her to start looking for a house for them. All the while she kept sending him gift cards as he promised to pay her back when he returned to the states, showing her bank accounts that said he had $2 million in savings.

Kleinhart said she ultimately used up what was left of her late husband’s life insurance and began dipping into her own pension and Social Security. In all, she sent “Tony” and his children $39,000.

“Tony” then said he was coming home, but he didn’t show up. Then a call came from someone claiming to be a lawyer saying someone had placed drugs in “Tony’s” bag and he had been arrested. He needed $20,000 right away. It was only then that Kleinhart said she realized she had been had.

“I had sent him a total of $39,000, which to some people is not much but for someone in my position it’s a great deal. I am still paying for that today,” she said. “But the loss that hurts the most was losing his love and losing the family I thought I was going to have and what my new future was going to be. That is much harder to deal with than losing the money.”

Tell-tale signs

Experts at the FTC said that the biggest tell-tale signs of a potential scam are people asking to be sent gift cards or cryptocurrency

BTCUSD,

They also said that people should never send money or follow investment advice from anyone they have never met in person.

The FTC also recommends doing a reverse image search on any photos you’ve been sent or that are being used as profile pictures to see if they turn up elsewhere. Scammers often steal pictures from other places. Lastly, if your relatives say they are concerned about a new relationship online, listen to them.