This post was originally published on this site

After Thursday’s shocking inflation reading showing year-over-year consumer price growth of 7.5%, an interest-rate hike could come quite literally at any time, though the most likely timing would be the two-day scheduled Federal Open Market Committee meeting ending March 16.

There’s already been quite a bit of analysis on how assets perform during Fed rate-hike cycles. But what about, specifically, the first increase?

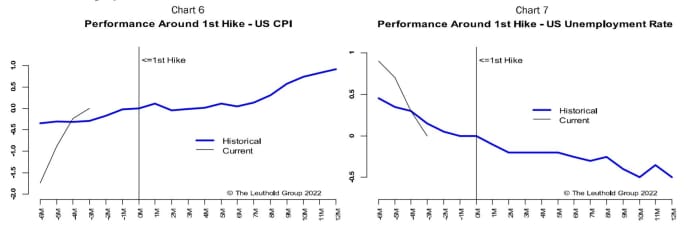

Chung Wang, senior analyst at Leuthold Group, points out the first hikes have usually occurred before the peak of inflation. This time around, arguably, Jerome Powell & Co. may be starting the cycle at, or possibly even past, the peak in inflation. The unemployment rate also shows a trajectory much steeper than the historical pattern.

As for the stock market, Wang notes that the first hike doesn’t usually kill a bull market — however it often marks a top in the performance of U.S. stocks relative to the rest of the world. That’s been the case this year — the S&P 500

SPX,

has dropped 6% this year, while the iShares MSCI All-Country world index ex-U.S.

ACWI,

has dropped 1%.

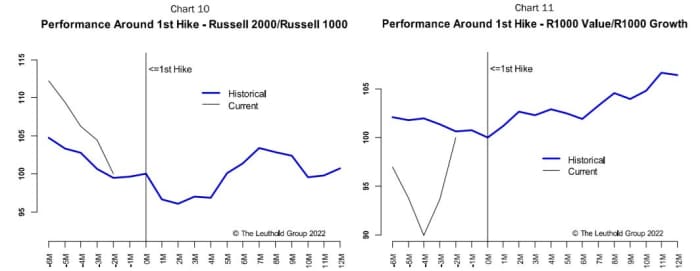

Small caps

RUT,

typically suffer ahead of the first hike — Wang says that’s because they’re assets that are particularly sensitive to liquidity — but rebound and stabilize afterwards. Value also tends to outperform growth after the first hikes. Gold and a commodities index (which is heavily weighted toward oil) also do quite well after the first hike.

The U.S. dollar

DXY,

is one asset that actually tends not to be boosted by the first hike. “While the dollar typically strengthens in anticipation of the first rate hike, it generally peaks around the announcement of the rate hike, a classic example of ‘buy the rumor, sell the news,’” he says.

The Dow Jones Industrial Average

DJIA,

slumped 526 points on Thursday, as the yield on the 2-year Treasury

TMUBMUSD02Y,

shot up by the largest amount in a single day in more than 12 years.