This post was originally published on this site

One major investment bank is challenging the popular assumption that high U.S. inflation will abate to more normal levels by year-end, and says price gains are more likely to remain elevated for the next two to three years.

Speaking ahead of Thursday’s U.S. consumer-price index report, which is expected to show a 7.2% gain for January, Jonathan Golub, chief U.S. equity strategist at Credit Suisse Securities, says economists and policy makers alike are underestimating the likely duration of the current inflation spell. He’s skeptical of the year-end consensus forecast of economists for CPI to drop below 3%, as well as the central bank’s forecast for its preferred measure — known as PCE — to fall to 2.6%.

“My read is that the consensus continues to underestimate inflation, and I think that even if it starts waning and heading down to 3% or 4%, that’s less important than the fact that we’re going to continue to underestimate the duration,” Golub said via phone.

Too much pandemic-era fiscal and monetary stimulus — coupled with higher wages resulting from labor shortages, at a time of full employment in the U.S. — are the biggest reasons for his take, Golub says. And he isn’t alone in thinking inflation is likely to prove durable.

Last month, Michael Tran of RBC Capital Markets pointed to the insatiable demand for goods by American consumers as one reason why supply-chain bottlenecks may “never” let up. Others have cited climate change, the Russia-Ukraine crisis, and even a Supreme Court decision last year allowing evictions to resume across the U.S. as just some of the reasons why inflation risks outside the Fed’s control are gaining momentum.

In a note released on Monday, Credit Suisse’s Golub lays out a case for more persistent inflation in the U.S. that’s likely to benefit stocks. Last month, he and others at Credit Suisse

CS,

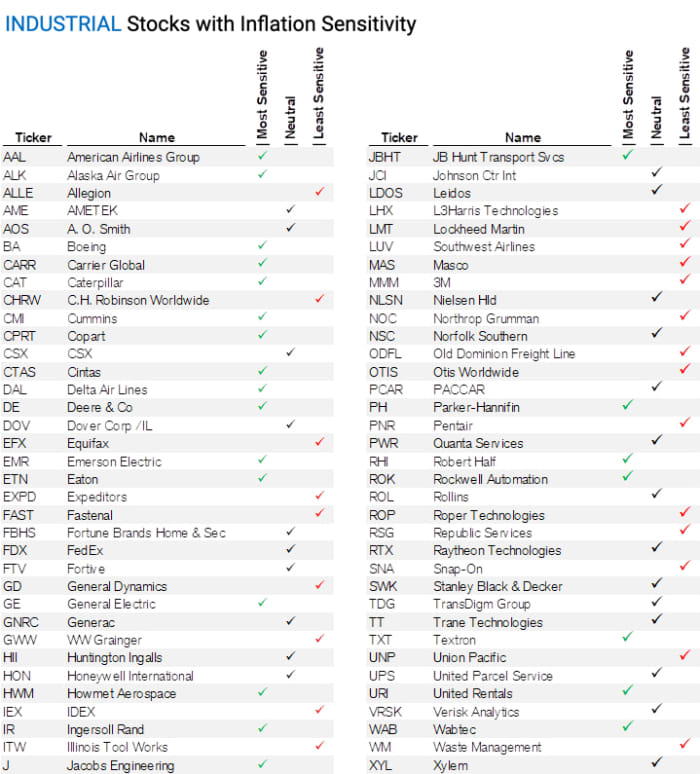

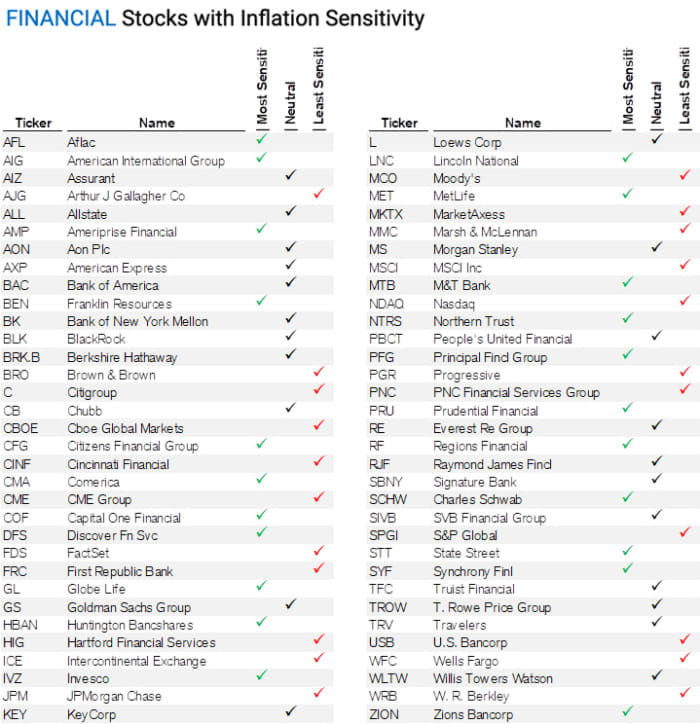

broke down the entire S&P 500 index by companies and sectors to identify which are the most sensitive to inflation and therefore likely to outperform.

Credit Suisse

Golub’s logic is as follows: Widely held expectations that inflation will fall back to more normal levels will leave the Fed’s policy stance more accommodative than many think, while higher actual inflation is good for corporate profits, he says. “All else equal, this allows for more overheating” of the U.S. economy.

Stronger profit growth should come as companies pass on higher prices, while Fed officials will likely be inclined to “tighten in as much of a benign way as they can” — all of which should be “a positive for risk assets,” Golub said. Moreover, the stock market is more likely to benefit than average Americans from decisions by policy makers to let inflation run too hot, he says.

Credit Suisse

“The Fed will be looking to tighten enough to get off zero” with the fed funds rate, “but not so much as to damage demand,” he says. “Even when they’re done with tightening, they’re still going to be incredibly easy.” He adds that the fed funds rate, currently between zero and 0.25%, would need to already be substantially higher than it is now to bring down current levels of inflation and “bring the market to equilibrium.”

For now, future traders are pricing in a greater likelihood of a half percentage point move in March than was the case a week ago — as well as a chance that the fed funds rate target could get as high as between 2% and 2.25% in December, based on the CME FedWatch Tool.

On Wednesday, Treasury yields were mixed, with the 10-year rate

TMUBMUSD10Y,

pulling back from 2%, while all three major stock indexes

DJIA,

SPX,

and

COMP,

were higher ahead of Thursday’s inflation report.