This post was originally published on this site

For Robinhood Markets Inc. investors wondering whether the trading app’s stock has finally bottomed after a nearly six-month drubbing, Mizuho analyst Dan Dolev listed a number of reasons that he believes the answer is: “Yes, indeed.”

The stock

HOOD,

rallied 1.6% in premarket trading Tuesday, putting it on track for a third straight daily gain.

A big bounce was kicked off on Friday, after the stock tumbled as much as 14.4% to a record intraday low of $9.94 in the wake of disappointing fourth-quarter results, before reversing course to close up 9.7%. It shot up another 11.2% on Monday.

Helping fuel the reversal, a federal judge threw out a negligence lawsuit over the company’s handling of last year’s “meme stock” frenzy.

MemeMoney: Here’s the bull case for Robinhood’s stock, but it’s not an ideal scenario for everyone

Opinion: Robinhood is about to not celebrate a very unhappy anniversary

Mizuho’s Dolev reiterated the buy rating he’s had on the stock since he started covering it soon after it went public in late July of 2021, while trimming his price target to $19 from $20.

He named three reasons he believes the worst is behind the company.

Monthly active users — or MAUs — appear to have found a bottom: Dolev said it appears “the rate of decline in MAUs is beginning to abate,” as fourth-quarter MAUs fell by a “less severe” 1.6 million from the sequential third quarter after declining by 2.4 million in the third quarter. That followed a 3.6 million increase in the second quarter.

Dolev also noted that “resurrected accounts,” or reactivated accounts among people who had previously closed them, totaled approximately 200,000 in the fourth quarter to mark the largest gain since Robinhood became a public company.

Notable stabilization of average revenue per user: Fourth-quarter ARPU fell 39% from a year ago to $64, but “remained consistent” on a sequential basis. Third-quarter ARPU had dropped 36% from a year ago to $65, but was down 42% sequentially.

“A major drag on [Robinhood’s stock] in prior quarters has been steep declines in ARPU,” Dolev wrote in a note to clients. “Here, it is nice to see ARPU stabilize in 4Q in the mid-$60s.”

Looking ahead, Dolev noted that management sees opportunities to increase average revenue per user and monetize accounts.

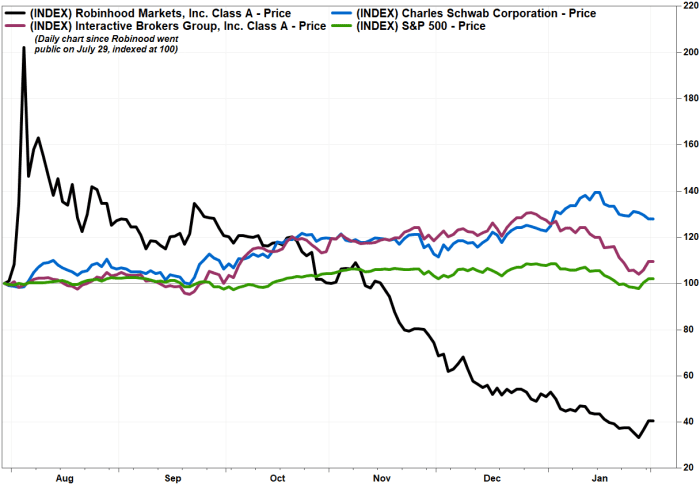

Peer comparison shows idiosyncratic improvement: Dolev pointed out that account growth “accelerated nicely” in the fourth quarter, improving to positive 1.3% from negative 0.4%. “This compares with more modest improvements for [Robinhood’s] peers,” which include Charles Schwab Corp.

SCHW,

and Interactive Brokers Group Inc.

IBKR,

FactSet, MarketWatch

Robinhood’s stock had plunged 59.4% over the past three months through Monday, while shares of Charles Schwab have gained 7.1% and Interactive Brokers have declined 8.4%. The S&P 500 index

SPX,

has slipped 2% over the past three months.