This post was originally published on this site

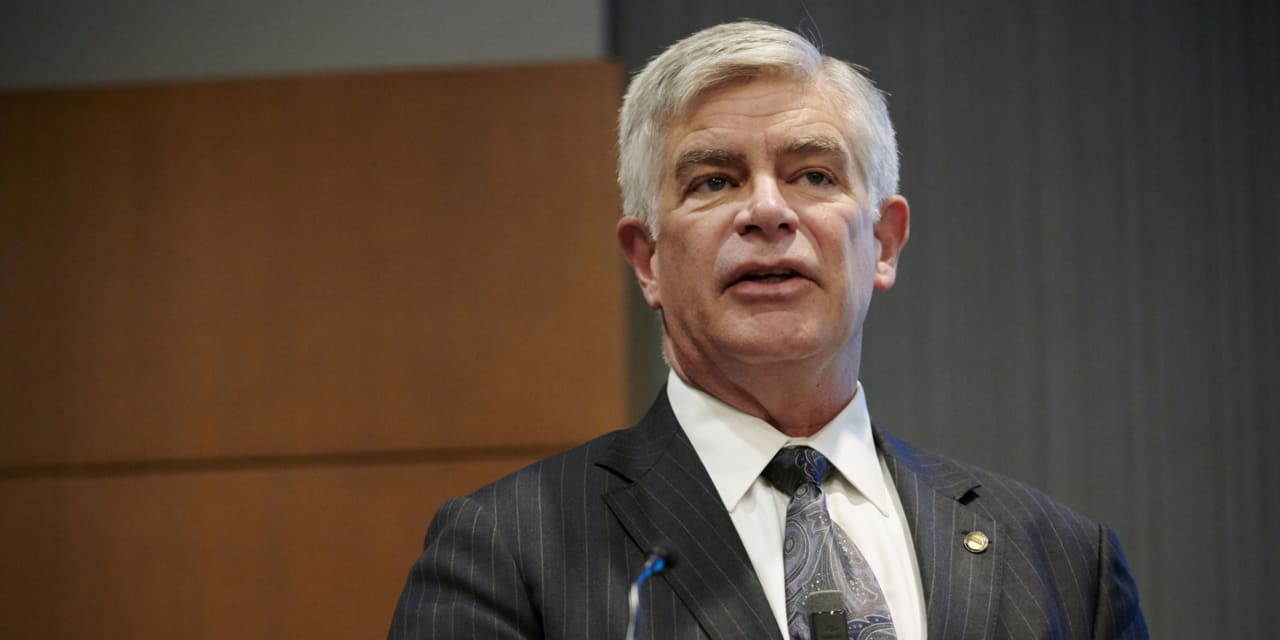

It would take another burst of inflation to justify an aggressive interest rate increase when the Federal Reserve starts to raise rates next month, said Philadelphia Fed President Patrick Harker on Tuesday.

“I would be supportive of a 25 basis point increase in March,” Harker said, in an interview with Bloomberg Television.

“Could we do 50 [basis points]? Yeah. Should we? I’m a little less convinced of that right now,” Harker added.

Pressed on what it would take to justify a larger rate hike in March, Harker replied: ” A fairly significant spike, from where we are now, on inflation.”

“If inflation stays where it is now, and continues to start to come down, I don’t see a 50 basis point increase,” he added.

Harker is a voting member of the Fed’s interest-rate committee currently. Several other Fed officials, including San Francisco Fed President Mary Daly and Atlanta Fed President Raphael Bostic, have downplayed the likelihood of a 50 basis point move in recent days.

In the interview, Harker said he now expects four quarter percentage point rate hikes this year. He said he wants the Fed to shrink its balance sheet in such a way that the market gets bored with the issue.

“I would like to get the Fed funds rate up and then start a process of [balance sheet] normalization that is like watching paint dry,” Harker said.

The yield on the 10-year Treasury note

TMUBMUSD10Y,

was down slightly on Tuesday morning.

Stocks

DJIA,

SPX,

were expected to open lower after their worst month since March 2020.