This post was originally published on this site

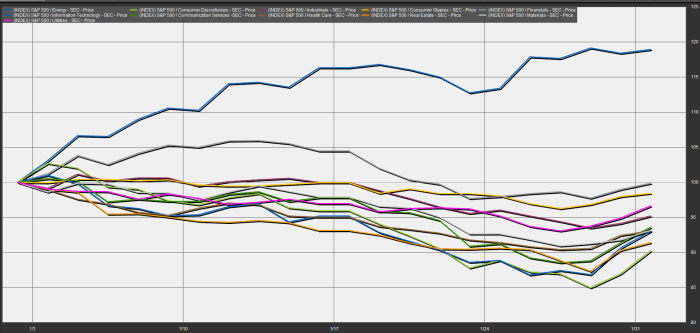

Energy outperformed the 10 other sectors of the S&P 500 by a spectacular margin in January, which raises the question: can its strong momentum fuel further gains?

To be precise, the S&P 500’s energy sector

SP500.10,

posted an 18.97% return in January (in blue in attached chart).

FactSet

It was the only sector to finish in positive territory in January and it did so by a wide margin. The rally for energy came as U.S. benchmark crude, West Texas Intermediate oil trading on the New York Mercantile Exchange

CL.1,

CL00,

rose by more than 17% in January, as traders followed the threat of a Russian conflict in Ukraine.

WTI and Brent, the international benchmark, both ended January at their highest levels since early October 2014.

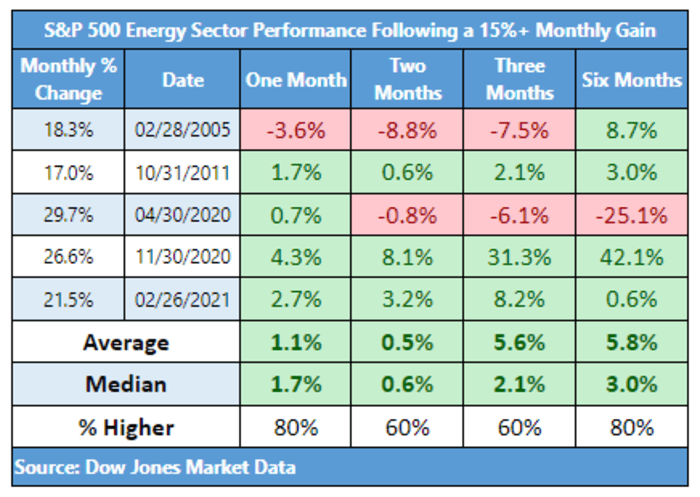

Advances of 15% or better are a rarity for the energy sector, which is supported primarily by the performance of oil and gas producers, including Exxon Mobil Corp.

XOM,

Chevron Corp.

CVX,

Williams Cos Inc.

WMB,

and others.

However, the sample size of data, albeit a tiny one, indicates that the oil sector can continue to extend its gains, which may be good news for investors looking to cyclical stocks and value areas of the market for returns with the prospect of higher interest rates capsizing the values in shares of once-surging technology and growth-oriented companies.

It is worth noting that the sizable outperformance for energy in January was only the energy sector’s best gain in 11 months, with the sector notching a 21.47% return in February, FactSet data show.

The folks at Dow Jones Market Data note that of the five times that the energy sector has posted a gain of at least 15% it has continued to rise—if only modestly at first—in the following one-, two-, three-, and six-month periods.

The average gain is 1.1% in the following month, with the advance six months out at around 5.8%. The energy sector has tended to rise anywhere between 60% and 80% of the time after a big rally, moreover.

Dow Jones Market Data

So far, the energy sector has been off to a strong start in February, with the sector up 2.9%, which was leading its peers again, as the Dow Jones Industrial Average

DJIA,

the S&P 500

SPX,

and the Nasdaq Composite

COMP,

indexes struggled to find purchase higher on Tuesday.

The Energy Select Sector SPDR Fund XLE, which tracks the S&P’s energy sector, finished January up 18.77%, for its best month since February, and was up 2.9% on Tuesday; while the SPDR S&P Oil & Gas Exploration & Production ETF XOP, which booked an 11.19% January return, for its best monthly gain since September, was rising nearly 3%.

To be sure, the energy sector is ridden with pitfalls and tailwinds, including the prospect of military conflict, issues with supply and demand and a host of other idiosyncratic factors that could influence oil and hence shares of companies in that area.

—Ken Jimenez contributed to this article