This post was originally published on this site

Bond yields are rising again so far in 2022. The U.S. stock market has been fragile.

One thing feels assured: the days of making easy money are over in the pandemic era. Benchmark interest rates are headed higher and bond yields, which have been anchored at historically low levels, are destined to rise in tandem.

Read: Weekend reads: How to invest amid higher inflation and as interest rates rise

It seemed as if Federal Reserve members couldn’t make that point any clearer recently, as investors await the conclusion of the central bank’s two-day policy gathering.

Recent U.S. consumer-price and producer-price index reports likely have only cemented the market’s expectations of a more aggressive or hawkish monetary policy from the Fed.

See: Stock-market investors can’t count on the ‘Fed put’—why policy makers aren’t seen rushing to rescue

A decision on Wednesday will be announced at 2 p.m. Eastern Time, followed by a news conference with Chair Jerome Powell at 2:30 p.m. Eastern. The only real question may be how many interest-rate increases will the Federal Open Market Committee point to in 2022.

JPMorgan Chase & Co.

JPM,

CEO Jamie Dimon suggested that seven might be the number to beat, with market-based projections pointing to the potential for three increases to the federal-funds rate in the coming months.

Meanwhile, yields for the 10-year Treasury note

TMUBMUSD10Y,

yielded around 1.78% Wednesday, after posting its briskest pace of yield rises start to a year, in the first 10 sessions, since 1992, according to Dow Jones Market Data. Back 30 years ago, the 10-year rose 32 basis points to around 7% to start that year.

The 2-year note

TMUBMUSD02Y,

which tends to be more sensitive to the Fed’s interest rate moves, is above 1%.

But do interest rate increases translate into a weaker stock market?

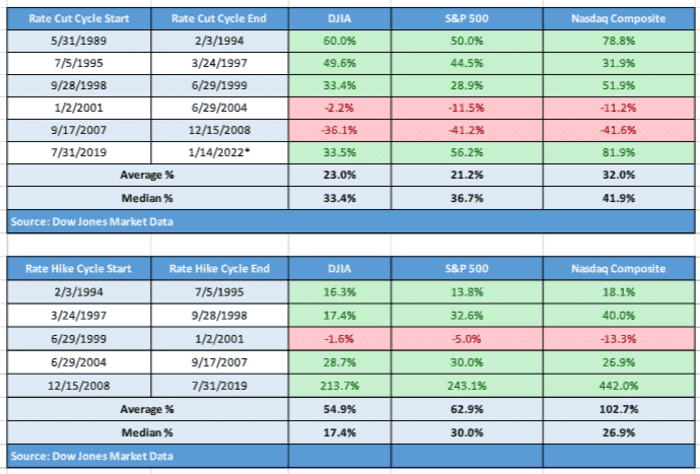

As it turns out, during so-called rate-hike periods, which we seem set to enter into as early as March, the market tends to perform strongly, not poorly.

In fact, during a Fed rate-hike period the average return for the Dow Jones Industrial Average

DJIA,

is nearly 55%, that of the S&P 500

SPX,

is a gain of 62.9% and the Nasdaq Composite

COMP,

has averaged a positive return of 102.7%, according to Dow Jones, using data going back to 1989 (see attached table). Fed interest-rate cuts, perhaps unsurprisingly, also yield strong gains, with the Dow up 23%, the S&P 500 gaining 21% and the Nasdaq rising 32%, on average during a period of Fed rate cuts.

Dow Jones Market Data

Interest-rate cuts tend to occur during periods when the economy is weak and rate hikes when the economy is viewed as too-hot by some measure, which may account for the disparity in stock-market performance during periods when interest-rate reductions occur.

To be sure, it is harder to see the market producing outperformance during a period in which the economy experiences 1970s-style inflation. Right now, it feels unlikely that bullish investors will get a whiff of double-digit returns based on the way stocks are shaping up so far in 2022. The Dow is down 4.9%, the S&P 500 is off 7.4%, while the Nasdaq Composite is down a whopping 11.9% thus far in January, at last check Wednesday.

Another factor to consider is the drawdowns that the market has experienced, leading up to the FOMC policy update, which have helped push the Nasdaq Composite into correction and had put the S&P 500 on the brink of closing there.

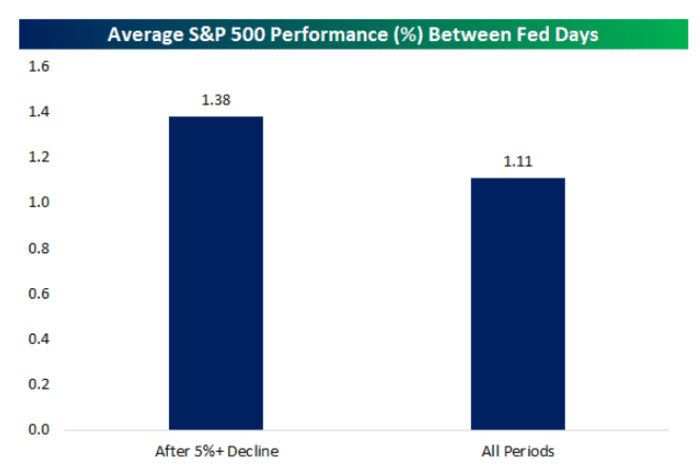

The folks at Bespoke Investment Group say, taking a shorter-run look at performance, that based on the past 13 times the S&P 500 has fallen at least 5% between meetings, “the average change in the following period between meetings was a gain of 1.38% while the median is nearly double that at 2.68%.”

BIG

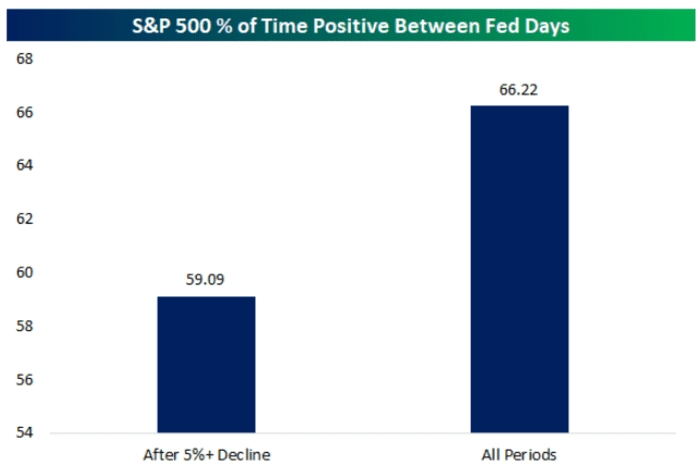

The share of times the market gains during those periods, however, is lower, only 59%, compared against 66.22% for all meetings.

BIG

—A version of this article was first published on Jan. 15