This post was originally published on this site

The numbers: The U.S. employment cost index rose 1% in the fourth quarter, down from the record 1.3% gain in the July-September quarter, the Labor Department said Friday. Economists polled by the Wall Street Journal had forecast a 1.2% increase.

Over the past 12 months, the employment cost index rose an unadjusted 4%, up from 3.7% in the year ended in September.

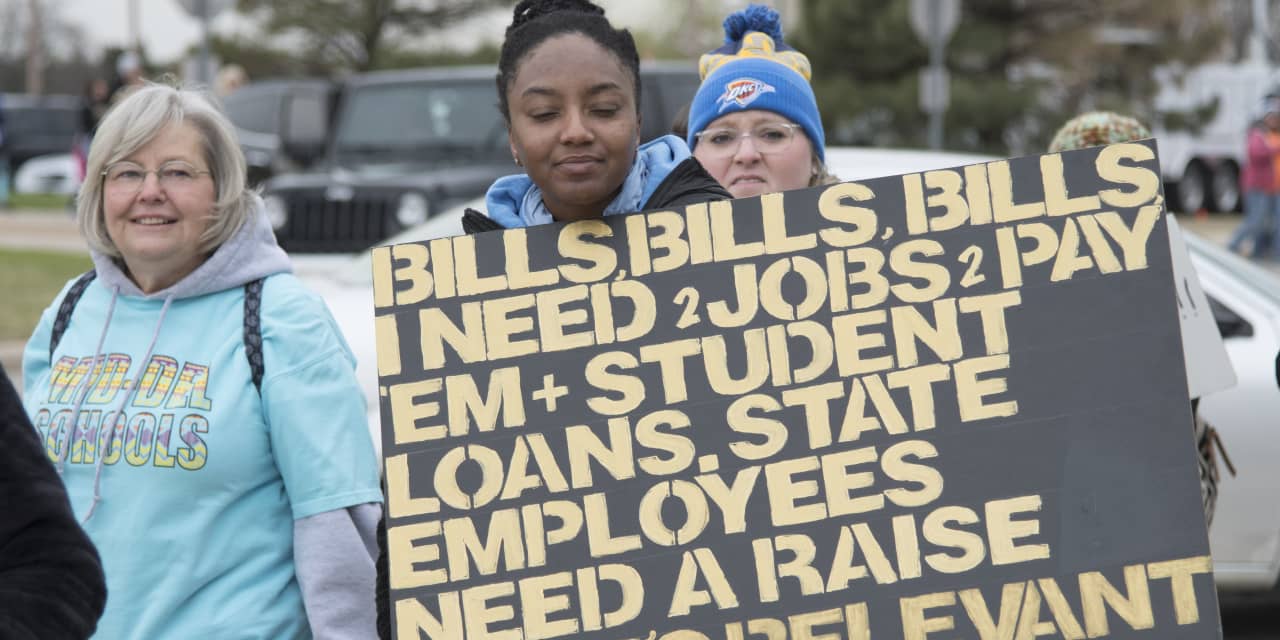

Key details: Wages and salaries rose 1.1% in the fourth quarter, down from 1.5% in the July-September quarter. Over the past 12 months, wages are up 4.5%, faster than the 4.2% rate in the year ended in September.

Benefits rose 0.9% in the fourth quarter, the same rate as the prior quarter. On an annual basis, benefits rose 2.8%, faster than the 2.5% rate in the year ended in September.

Big picture: The ECI is the broadest measure of labor costs. The Federal Reserve is attentive to signs that wages will accelerate and add to existing inflationary pressures.

Last month, Fed Chairman Jerome Powell said that the strong rate of gain in wages was a major factor in the Fed’s pivot away from its easy monetary policy.

Market reaction: Stocks

DJIA,

SPX,

were set to open lower on continued fears of tighter Fed policy.