This post was originally published on this site

Yes, it’s safe to buy this pullback in stocks. And if you got frightened Monday and sold, which was admittedly a scary day for many investors, get back in.

Here are three reasons why, followed by three stocks to consider.

1. Sentiment is very dark

Much of the stock world was in a bear market Monday. The Russell 2000

RUT,

was down more than 20% from recent highs, the definition of a bear. The Nasdaq

COMP,

was just one percentage point away. The S&P 500

SPX,

held up better. It only slipped into a correction (down 10%).

This caused loads of pain. That’s no fun, but it tells us it’s a good time to buy, in the contrarian sense. According to this style of investing, you want to get bullish when the crowd is exceptionally bearish. That’s the case now.

For my stock letter Brush Up on Stocks (link in bio below), I track about 10 indicators to get a feel for sentiment. Here’s a summary of the bullish signal from three.

* The Investor’s Intelligence Bull/Bear ratio measures the sentiment of stock newsletter writers. I use this as a contrarian indicator. Lower means more bearishness by them, which is bullish. The indicator suggests the market begins to look attractive when this reading falls below 2. Stocks look extremely attractive when it falls to 1 or below. It came in at 1.59 last week, but it is definitely closer to 1 now. We’ll find out later this week, when this indicator gets updated.

* The Chicago Board Options Exchange’s CBOE Volatility Index

VIX,

is a popular fear gauge because it measures expected volatility. Higher levels mean more fear. It begins to show exaggerated bearishness (which is bullish in the contrarian sense) above 25. Bottoms are often marked by spikes up into the 30-40 range. It traded near 39 on Monday.

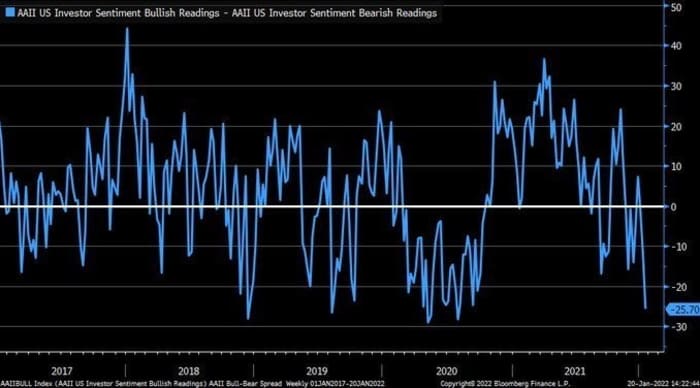

* The American Association of Individual Investors (AAII) conducts a weekly sentiment survey of investors. When this gauge is extremely bearish, it’s time to buy. That is the case now. This signal triggers a buy signal when the percentage of bulls minus the percentage of bears falls to -10, on a four-week moving average basis. We are close. The latest readings came in at 21% bullish vs. 46.7% bearish for a one-off reading of -25.7. The four-week moving average is -8.15.

This chart, courtesy of Charles Schwab

SCHW,

chief investment strategist Liz Ann Sonders, shows just how extreme the current negative signal is (which is bullish!).

The bottom line: Investor sentiment is significantly dark, which suggests we are near a market bottom.

2. Insiders aren’t steering us away from stocks

Insiders are now on lockdown because of earnings season. So, their buy/sell ratio is a little less meaningful. But we can still track this ratio because some insiders remain active.

Insiders aren’t actually bullish at the moment. But they aren’t cautious, either. They’re neutral, according to Vickers Insider Weekly, published by Argus.

I’d rather see them bullish. But anecdotally, I can tell you that on particularly sharp down days, insiders have been stepping up to buy, including in emerging tech and cyclical areas like industrials, chemicals and real estate. They are buying economically sensitive names — not defensive stocks like consumer staples — which brings us to the point #3, next.

The bottom line: Insiders aren’t bearish.

3. The economy will be fine

A key part of my belief that this is a time to get bullish is that the economy is not going into recession, and the Federal Reserve will not push it there.

Can the economy really survive Fed interest rate hikes and tapering? I think so, because there are so many embedded sources of stimulus in the economy, as outlined by strategist and economist James Paulsen at Leuthold.

They include: The home-buying binge (those houses need to be filled with stuff and many can stand some remodeling projects). Strong consumer balance sheets and income levels that support consumer spending. Low consumer sentiment, which tells us there is lots of room to improve as Covid eases. Corporate balance sheets are strong. And there’s an inventory buildup phase ahead because those levels are low due to supply-chain snags.

The very low unemployment rate is admittedly a big risk. Low jobless rates often signal the end of the economic cycle. Tight labor markets can lead to a wage-price spiral that the Fed cannot control, other than by raising interest rates until it creates a recession.

That may not happen this time, though, because capital spending (capex) at companies is so high, points out Ed Yardeni at Yardeni Research. High capex spending creates a greater mix of tech and machines compared to workers, which boosts productivity (output per worker). This takes the pressure off companies to charge customers more to offset the higher wages. Productivity short-circuits the wage-price spiral.

The bottom line: Growth will definitely slow in the first quarter because of Omicron and severe weather. But economic strength will continue throughout 2022. That slower first-quarter growth may actually be good news because it will ease inflation fears.

Near-term catalyst

The market has a habit of selling off pretty sharply ahead of Fed meetings. Traders are nervous about surprise Fed news in this era of high inflation, so they sell ahead of the meetings. This probably explains some of the current weakness. The Fed meets again Wednesday.

The market should firm up after this danger point passes, because we won’t get any surprises since inflation is calming down.

“We think inflation has likely peaked in December and that the first-quarter data will show sequential improvement,” says Art Hogan, the chief market strategist at National Securities.

This makes sense because inflation has been caused by supply-chain issues, a fixable problem.

“While everyone seems to want to predict that the Fed will raise rates more than three times in 2022, and even raise rates by 50 basis points at the March meeting, we see both of those scenarios as unlikely,” says Hogan.

Stocks

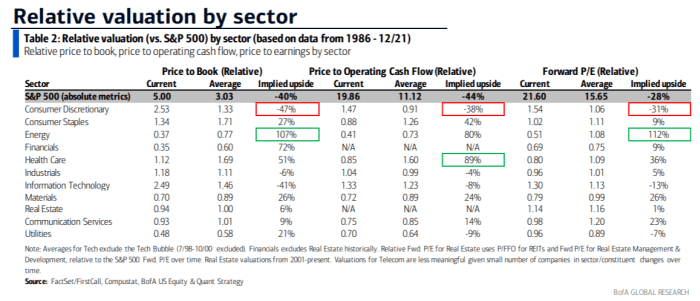

Financials and energy have been great places to “hide out” from the tech destruction. They remain interesting because of their decent relative valuations, as you can see in this chart from Bank of America

BAC,

These two groups should continue to do well, given the underlying trends highlighted below.

Banks

Shares of JPMorgan Chase

JPM,

are down over 13% since it reported earnings Jan. 14 because the bank surprised investors with high expenses. But JPMorgan is still the leading credit card, wealth management and investment, retail and commercial banking behemoth dominating U.S. banking.

So, it will benefit as interest rates rise. This helps banks earn more money as long as the yield curve stays upward sloping. Banks borrow at the short end and lend at the long end. The upward-sloping yield curve also forecasts solid growth ahead, which will help this bank do more consumer, business and investment banking.

All of this probably explains why a JPMorgan insider recently bought the pullback in the stock, suggesting you should, too.

Energy

Expectations of $100 oil this year abound, but they are not farfetched. Fundamentals are good. Morgan Stanley energy analyst Martijn Rats cites the three drivers of the “triple deficit.” There’s a deficit of inventories (they’re low). Producers have a deficit of spare capacity. That’s not likely to change because of the deficit of investment in new production, as energy companies divert development dollars to green energy.

If you want to add a name in energy, you could do worse than follow Warren Buffett. Berkshire Hathaway

BRK.B,

has been a big buyer of Chevron

CVX,

Chevron will grow production nearly 10% by 2025 compared to 2020, thanks to investments in the Permian Basin in the U.S., Kazakhstan and the Gulf of Mexico.

A disrupter

Disruptive companies are out of style right now because — egad! — ARK Investment’s Cathie Wood may have owned them! But good disrupters will continue to disrupt regardless of what the stock market does, and that will benefit their investors.

One I own that I have suggested in my stock letter, too, is Warby Parker

WRBY,

If you’ve bought eyeglasses lately, you know this space is ripe for disruption. It’s full of hidden and aggressive upsells on top of already expensive glasses.

Warby offers cool frames at much lower prices, and consumers love it. Sales advanced 32% in the third quarter. Since Warby only has 1% of the $35 billion eye-care market in the U.S., it doesn’t need glasses to see the potential for growth.

Michael Brush is a columnist for MarketWatch. At the time of publication, he owned WRBY. Brush has suggested SCHW, BAC, JPM, CVX and WRBY in his stock newsletter, Brush Up on Stocks. Follow him on Twitter @mbrushstocks.