This post was originally published on this site

Debt investors in top American companies aren’t freaking out, even as turbulence on Monday briefly threatened to land the S&P 500 in correction territory.

Investment-grade corporate bond spreads came under continued pressure to start the week, with many investors expecting the Federal Reserve on Wednesday to provide a clearer road map for increasing rates and reducing its nearly $8.8 trillion balance sheet to fight inflation.

But Matt Brill, Invesco’s head of North America investment grade, pointed out that investment-grade corporate bonds generally have been outperforming stocks, despite the recent ruction in markets, and are “seeing no signs of panic.”

The closely tracked iShares iBoxx $ Investment Grade Corporate Bond ETF

LQD,

was down 3% on the year through Monday, versus the S&P 500 index’s

SPX,

7.5% decline in January and the Nasdaq Composite Index’s

COMP,

11.4% drop into correction territory to start 2022.

“Corporate fundamentals are still very strong,” Brill told MarketWatch. “Companies have the capacity to add leverage or refinance existing debt without much downgrade risk.”

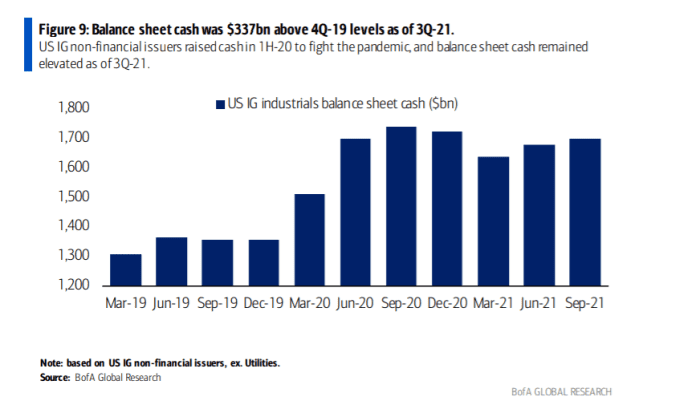

Companies also borrowed a record amount in the U.S. corporate bond market during the pandemic at ultralow rates, resulting in bolstered balance sheets and a cash pile still roughly $340 billion above pre-2020 levels (see chart), as of the third quarter, according to BofA Global.

Highly rated U.S. companies, after excluding financial and utilities, still had a more than $1.6 trillion cash stash as of the third quarter.

BofA Global

With the recent rate selloff and credit-spread widening, Brill said “yields are still on the historically low side,” making it “tempting for corporations to borrow,” particularly in the early part of 2022 as issuers fear higher rates.

That said, companies could face a less supportive Fed when it comes to steadying jittery stock and bond markets, as the central bank’s focus turns to tamping down inflation running at a 7% annual rate.

“I think the real economy is likely to do better than financial assets this year,” said Mark Heppenstall, president and chief investment officer at Penn Mutual Asset Management, in a phone interview.

“The Fed clearly wants to keep credit available and doesn’t want financial instability. But I do think they are going to have a lot more tolerance than recently for weakness across credit markets, given that inflation now is at a level where the Fed has to address it.”

The 10-year Treasury rate

TMUBMUSD10Y,

a benchmark for pricing corporate bonds and a host of other debt instruments underpinning the economy, was at 1.735% on Monday.

That is up nearly 25 basis points on the year, with expectations running high for Fed Chairman Jerome Powell this week to provide more guidance on how quickly the central bank expects to reduce its balance sheet and lift rates from the current 0% to 0.25% range.

Read: How Jerome Powell may try to calm the market’s frazzled nerves

“What I would have liked to have seen is rate hikes three months ago, and an end to QE three months ago,” said David Norris, head of U.S. credit at TwentyFour Asset Management, speaking of the Fed’s quantitative easing, or large-scale bond buying, program over the past two years.

“I am hoping that they do end QE,” Norris said, by phone. “I hope they would actually implement a 25-basis-point rate hike, because after this January meeting there’s another six weeks before the next meeting.”

“There’s a real fear now that inflation is causing demand destruction, which wouldn’t be good.”