This post was originally published on this site

There always seems to be an unusual commodity that captures the attention of the market.

Last year it was uranium, which had both a theme — the need for clean energy provided by nuclear reactors — and a supply element, as an exchange-traded fund started gobbling up supplies on the open market. That ETF, the Sprott Physical Uranium

UUT,

trust, is now down 21% from its September peak (right about the time this column wrote about it), though it is up 48% from its July lows.

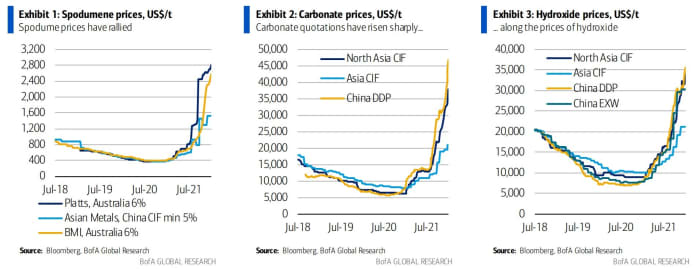

Now it’s lithium that is capturing the market’s attention. As the auto market transitions to electric vehicles, those EV companies turn to lithium-ion batteries. There are also supply issues, with Bank of America analysts noting canceled projects and discipline from miners supporting prices.

Earlier this week, Australian miner Allkem

AKE,

OROCF,

reported rising sales, production and shipments, and forecast lithium carbonate prices to rise 80% in the first half of the year. “The company continues to experience very strong demand for its spodumene concentrate and lithium carbonate as supply side tightness persists in raw materials and throughout the battery supply chain,” Allkem said.

Lithium prices are surging.

Analysts at UBS in Australia this week said lithium was in an “up crash” due to EV demand, hiking their spodumene forecast by 39% and carbonate price estimate by 70%. Allkem, the UBS team says, offers pure-play exposure to lithium, with many positive catalysts on the horizon if it can execute. Mineral Resources

MIN,

offers an “interesting entry” given its exposure both to lithium production and mining services, while diversified giant Rio Tinto’s

RIO,

lithium aspirations “appear too distant/small to gain significant exposure.”

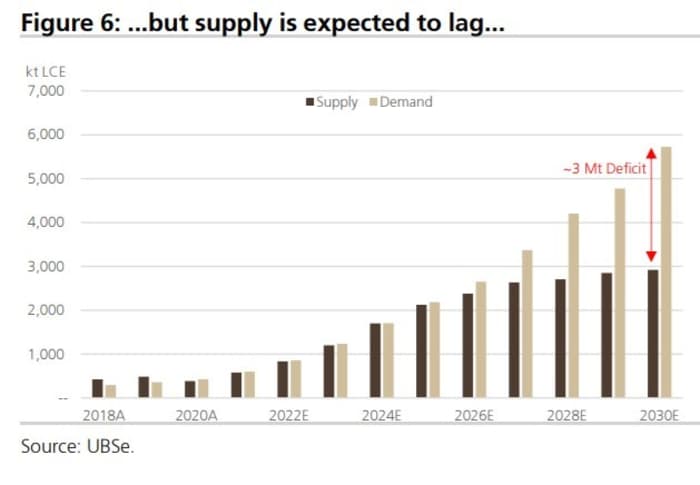

UBS forecasts supplies of lithium to lag demand.

JPMorgan analysts pointed out North American lithium and rare earth stocks have lagged behind prices. In the lithium space, the analysts are overweight IGO

IGO,

Lithium Americas

LAC,

Allkem, Piedmont Lithium

PLL,

and SQM

SQM,

and neutral on Albemarle

ALB,

Mineral Resources and Pilbara Minerals

PLS,

The chart

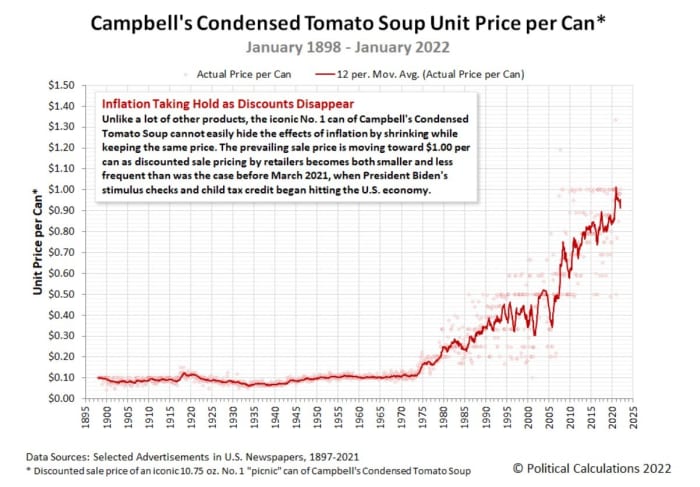

Here’s one way to view inflation — the price of a can of Campbell’s

CPB,

tomato soup. “We’ve tracked the price of Campbell’s iconic tomato soup over the past 124 years because of its remarkable consistency as an identifiable product over time. In fact, if you had a time machine and could travel to nearly any point in time from January 1898 to the present, you could likely find a 10.75 ounce size can of Campbell’s condensed tomato soup stocked for sale in American grocery stores,” writes the Political Calculations blog. As for the inflationary signal, it’s on the verge of the $1 per can level.

The buzz

Netflix

NFLX,

shares plunged 20% in premarket trade, after it reported a lower-than-forecast 8.3 million subscriber additions in the final quarter, and forecast first-quarter additions significantly below estimates. Credit Suisse, Morgan Stanley and Barclays were among the brokers immediately cutting ratings.

Peloton Interactive

PTON,

is set to rally, after denying it is entirely cutting production and prereleasing fiscal second-quarter numbers. Peloton shares rose 6%, after a 24% slide on Thursday.

Intel

INTC,

will invest at least $20 billion in a new chip-making facility in Ohio. The company said the investment, outside the Columbus area, will help meet demand for advanced semiconductors.

The famed rock singer Meat Loaf has died.

The market

It looked like a rough close to a difficult week, with both the S&P 500

ES00,

and Nasdaq-100

NQ00,

contract retreating, with market analysts noting extra volatility could be in store due to the expiration of options contracts.

The yield on the 10-year Treasury

TMUBMUSD10Y,

slipped to 1.79%.

Top tickers

Here were the most active stock market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

NFLX, |

Netflix |

|

AMC, |

AMC Entertainment |

|

NIO, |

NIO |

|

AAPL, |

Apple |

|

NVDA, |

Nvidia |

|

BBIG, |

Vinco Ventures |

|

AMZN, |

Amazon.com |

|

SOFI, |

SoFi Technologies |

Random reads

This dog was saved from rising waters — by rescuers attaching a sausage to a drone.

Cannabidiol as a COVID-19 fighter? That’s what one study finds.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.