This post was originally published on this site

Prominent market technician Ralph Acampora says the recent bout of market volatility has him uneasy and now he’s forecasting a deeper drop in a market that has already delivered a significant bruising to Wall Street in the first few weeks of 2022.

“I really didn’t like yesterday’s action. That wasn’t cool,” said Acampora in an interview with MarketWatch late Friday morning from his residence in Minnesota, referring to an intraday reversal on Thursday — when the Nasdaq Composite Index

COMP,

was up 2.1% at its peak only to end down 1.3%. It was the second such reversal for the Nasdaq, and the folks at Bespoke Investment Group said that Thursday’s backslide marked the first time the Nasdaq Composite erased “an intraday gain of 1%+ and closed lower by 1%+ on back to back days in over 20 years.”

“That’s not climactic activity, that’s a reversal pattern,” Acampora said.

Acampora, who began his career on Wall Street in 1967, said that the recent pullbacks are bearish for the outlook in stocks.

“I’ve lived through too many bear markets,” he said via phone, noting that the lengthy bullish run for stocks, which has been primarily fueled by easy-money policies from the Federal Reserve to combat COVID, may be coming to a conclusion.

“If we’re honest with ourselves, this market really, really did unbelievable things in the last year and a half,” Acampora said.

Markets have been unsettled since November and fears about a Federal Reserve that will be aggressive in its current battle with rising inflation — stemming from supply-chain bottlenecks and increased demand as COVID fears take a back seat to consumerism — appeared to culminate on Wednesday with the Nasdaq Composite entering correction for the first time since March and crossing below a long-term trend line, its 200-day moving average for the first time in nearly two years within days of each other.

Many chartists refer to Acampora affectionately as the “godfather” of technical analysis.

A pioneer in the field of price-chart based trading, Acampora says he has mostly advised clients to be cautious.

He told MarketWatch on Friday that his own sentiment has shifted toward stocks: “If you had spoken to me on Tuesday I would have said that the market is going to correct [a decline of at least 10%] and I’m now talking 20% or more,” he said of his expectations for declines in stock benchmarks.

What’s changed for Acampora, besides the unsavory intraday action?

He says that signs that bullish appetite is waning is one reason, and that includes the decline in bitcoin

BTCUSD,

which he says isn’t an asset that he’s a fan of but does gauge it as a good sign of investor attitudes. He says that bitcoin sentiment has also aligned with technology, suggesting that those assets are moving more in tandem.

“The Nasdaq’s breaking down…technology is going to pull us down, and bitcoin below $40,000 is a significant breakdown for sentiment,” Acampora said.

The market technician also said that he pored over a number of components of the Dow Jones Industrial Average

DJIA,

including American Express

AXP,

Goldman Sachs Group Inc.

GS,

JPMorgan Chase & Co.

JPM,

and Honeywell International

HON,

and spotted negative weekly chart patterns.

“So, I am a little concerned,” he said. “Now we’re talking a bear phase,” he said.

That said, the analyst said that investors shouldn’t feel too sorry for themselves.

“Come on,” he said. “We had a phenomenal market. Every other day you were looking for all-time highs.”

In this new regime, however, Acampora said don’t expect any near-term records. “I just don’t see new highs any time soon.”

What should investors be looking for to determine when to wade into the market with more gusto? Acampora said that he would look for the CBOE Volatility Index

VIX,

also known as the VIX, for its ticker symbol, rise to 38 or 40 before the market can be said to be bottoming. The VIX itself, which uses S&P 500

SPX,

options to measure trader expectations for volatility over the coming 30-day period, tends to rise as stocks fall and is often therefore referred to as a guide to the level of investor fear. Its historical average ranges between 19 and 20 and it was trading around 27 on Friday, up 40% on the week.

One of Acampora’s other concerns is that the economy faces stagflation, a period of rising rates and rising inflation. Stagflation can cause real incomes to stagnate or decline and erode purchasing power. Such a scenario could be a yearslong dampener on the market’s uptrend.

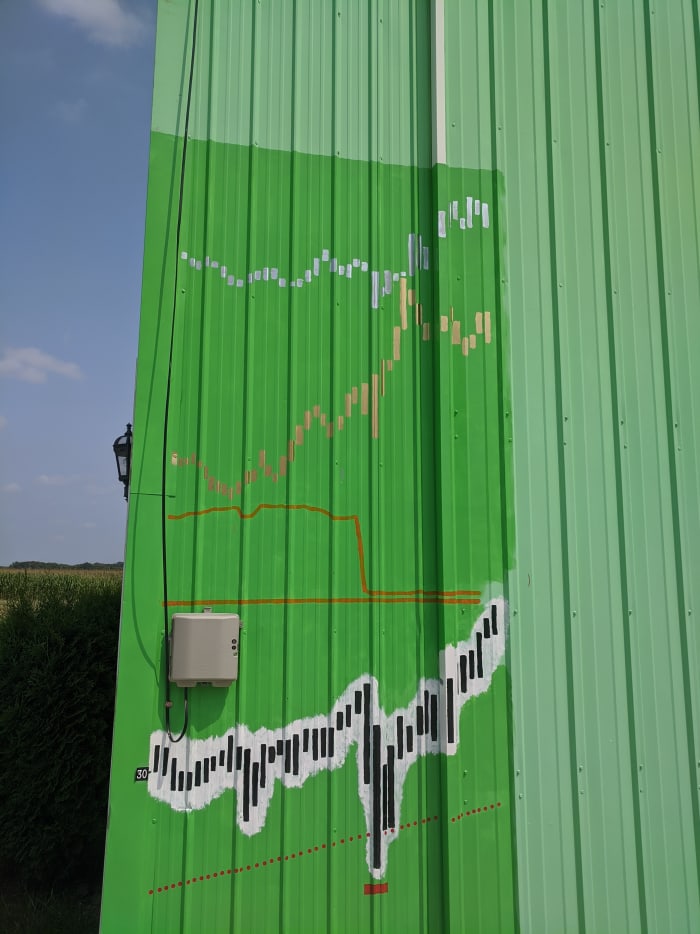

This image shows Acampora’s latest update to his barn chart, reflecting the Dow’s moves to June of 2021.

Ralph Acampora

He would advise investors to wait for a bottoming pattern, a process of the market putting in higher lows, and higher highs, before seeing the downturn as a buying opportunity.

Read: ‘Good luck! We’ll all need it’: U.S. market approaches end of ‘superbubble,’ says Jeremy Grantham

All the wild moves in markets of late will make for fodder for Acampora, who is painting a massive chart of the Dow on the side of his Minnesota barn, which he continues to update. The octogenarian also said he’s now planning to write a book on the history of the financial markets, that offers context and insights to those who may be new to the markets and economy.

“Other men like to collect garbage, I like to collect history,” he said.

Read:Why 2022 appears ‘a perfect negative storm’ for tech stocks, according to Deutsche Bank