This post was originally published on this site

Pay yourself first, or your church?

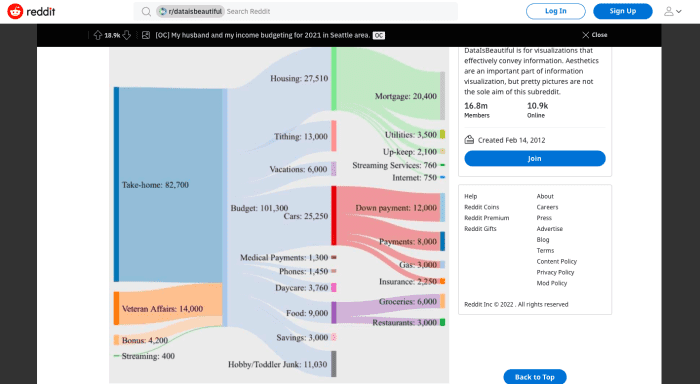

A Seattle couple’s Sankey diagram charting their annual cash flow has gone viral on Reddit, in part because they’re putting a tenth of their income toward tithing, aka a 10% contribution toward a religious organization.

Then again, they’ve got extra cash on hand because their mortgage payments are less than $2,000 a month in one of the most expensive housing markets in the country — which is also spurring a lot of chatter online.

The person posting under the handle “DaMama” uploaded the flow chart in the DataIsBeautiful subreddit on Monday, describing it as “My husband and my income budgeting for 2021 in Seattle area.” She listed their 2021 budget at $101,300, which included $82,700 in take-home income, $14,000 from Veteran Affairs, a $4,200 bonus and $400 from streaming.

But her allocations have led some commenters to remark, “This is the worst budgeting I’ve ever seen,” or “Too many questions, no time to find answers!” In fact, the post was upvoted almost 20,000 times and drew 6,000 comments in less than 24 hours, and was among the most popular threads on the Reddit homepage on Tuesday morning.

Reddit screenshot

Reddit/MHLCam

Why? Well, besides the irresistible impulse to break down someone else’s budget — which often leads Reddit posts to go viral — a couple of things jumped out at readers.

For example, the original poster wrote that they put $13,000 a year toward tithing, explaining in the comments that this is drawn from the couple’s gross pay (which suggests they earn around $130,000 before taxes.) While some in the comments disagreed with putting that much money toward a religious organization, period, what had many readers more concerned was that no retirement plan was listed anywhere in the chart. According to this data, the couple put $3,000 into savings last year, which many worried was too low.

“Your tithing is 4x more than your savings,” wrote one reader.

“Only 3% of your total income into savings and no retirement fund? That’s living dangerously. Maybe shift some of that church money,” added another.

Of course, some other readers noted that the couple could very well be contributing to an employer 401(k) plan, as they only listed their take-home pay here. That could explain why retirement contributions weren’t reflected in the chart.

So how common is tithing, anyway? A survey of 1,000 American evangelical Protestants taken last year found that only 13% of evangelicals tithed at all, and of those who followed the practice, half of them gave less than 1% of their income, rather than 10%. But there’s evidence to suggest that this Reddit poster isn’t the only one giving generously to a place of worship. A 2013 “State of the Plate” report from Christianity Today used five years’ worth of data to examine the characteristics of tithers, and found that 77% gave between 11% and 20% of their income, with 70% donating based on their gross (not net) income.

This Seattle-area couple also listed spending $25,250 on cars last year, including $12,000 for a down payment and $8,000 on subsequent payments, which could well have eaten into their savings plan. “Hopefully next year doesn’t require [a] $12K down payment on a car and that can go to savings,” wrote another reader.

What’s more, they appear to be saving a ton of money when it comes to their housing and childcare payments, which would free up more cash for charitable and religious contributions.

For example, this budget says the couple made $20,400 in mortgage payments last year, which breaks down to $1,700 a month. That’s pennies compared to what many are paying in the Seattle area. Median single-family homes in the central Puget Sound region sold for between $500,000 and $810,000 in December 2021, according to the Seattle Times. And a Zillow report last spring noted that only one in five Seattle-area renters could afford the monthly mortgage payment on a home selling for the median price, with the typical monthly mortgage payment total in the Seattle area at $2,892.

The most popular comment congratulated the poster on living in Seattle with a mortgage under $2,000 a month, while several others asked “how?” or suggested that the couple was living further afield from Seattle than the post suggested. “I lived in an apartment in Seattle and was paying $1200/mo for a BEDROOM in an apartment split between 4 people,” wrote one. “There’s absolutely no way this is in Seattle proper.”

And: America’s housing market is in the grip of an inflation storm

The original poster wrote in the comments that they bought the house eight years ago for “dirt cheap,” and that the house “needed a lot of work,” which helped them land a great deal.

She also clarified that the reason their daycare costs were kept at $3,760 for the year was because their child only started going toward the end of 2021, so this didn’t reflect the cost for a full year of childcare. But she also agreed that the service she found “is a STEAL.”

However, a category that she dubbed “Hobby/Toddler Junk” sucked up $11,030 last year, according to the chart. Check out the full post here.

It brings to mind previous viral budget charts, such as this one that claims to show how a $350,000 salary barely qualifies as middle class.

And to be sure, plenty of Americans should be saving more for a rainy day; over half of Americans don’t even have three months’ worth of expenses in a fund. Plus, 27% of U.S. adults ended 2021 worse off financially, compared to 25% who ended the year better off, according to a survey of 2,200 U.S. adults published Tuesday by the Morning Consult. And 37% of the surveyed adults found it harder to manage their finances last year.

Sign up for Personal Finance Daily for tips on saving more and spending less, as well as insight into what the news means for your wallet each day.