This post was originally published on this site

Yields for U.S. government debt edged up on Thursday, with the 10-year touching a peak overnight at 1.76%, ahead of economic reports on wholesale inflation and weekly joblessness benefit insurance in America.

Meanwhile, Federal Reserve Gov. Lael Brainard is set to testify in front of the Senate Banking Committee as a part of her confirmation hearing to take the No. 2 spot at the central bank that will be vacated by Vice Chairman Richard Clarida on Friday.

What are yields doing?

-

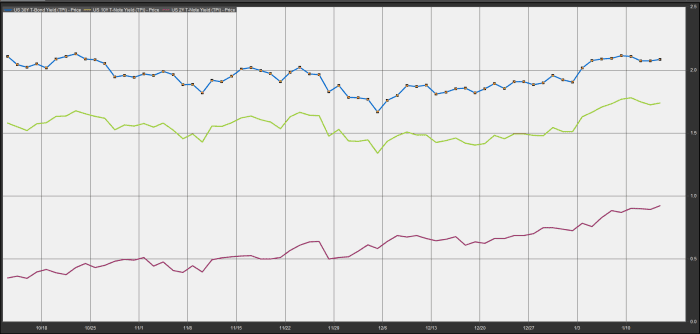

The 10-year Treasury note

TMUBMUSD10Y,

1.743%

yields 1.747%, up compared with 1.724% on Wednesday at 3 p.m. Eastern Time. Yields for debt fall as prices rise. -

The 2-year Treasury note

TMUBMUSD02Y,

0.927%

rate was at 0.923%, up from 0.905% a day ago, which marked a new 52-week high for the short-term debt, its highest level since Feb. 27. -

The 30-year Treasury bond

TMUBMUSD30Y,

2.084%

yields 2.090%, rising from 2.071% on Wednesday afternoon.

What’s driving the market?

Yields across maturities have persistently risen to start the year as investors are bracing for a period of higher-than-usual inflation and a Federal Reserve that wants to stomp it out.

Brainard, in prepared remarks, ahead of her confirmation hearing later Thursday morning, described inflation as “too high,” adding that “working people around the country are concerned about how far their paychecks will go.”

She said that the Fed’s monetary policy is focused on getting inflation “back down to 2% while sustaining a recovery that includes everyone.”

Some analysts are starting to wager that yields to end 2022 will be substantially higher, with the 10-year touching 2%, particularly if pricing pressures require more than the three benchmark interest rate increases that market-based projections are showing. St. Louis Fed President James Bullard on Wednesday said that four interest-rate rises were likely this year.

FactSet

On Wednesday, consumer prices rose 0.5% in December to push the increase in the cost of living last year to an almost 40-year high of 7%, with inflation soaring due to strong customer demand and labor and supply shortages.

Investors on Thursday are expecting data on wholesale prices in December to continue to rise at the fastest pace in 40 years but the index was recalculated in 2014 using different methodology.

Meanwhile, consensus estimates are for initial jobless claims for the week ended Jan. 8 are projected to come in at 205,000, after applications for U.S. unemployment benefits rose slightly last week to 207,000 and clung near a 52-year low, suggesting that soaring coronavirus cases tied to omicron haven’t caused mass layoffs.

Looking ahead, investors will watch for an auction of $22 billion in 30-year bonds at 1 p.m. Eastern Time that could influence Treasury trading.

What strategists are saying

“The data calendar is very light today, but the focus will remain squarely on central banks given the nomination hearing of Lael Brainard,” wrote analysts at UniCredit in a daily research note. “A relatively hawkish tilt may further shift the balance in favour of an early hike. Other Fed officials have also recently hinted that more than three hikes in 2022 could be appropriate,”