This post was originally published on this site

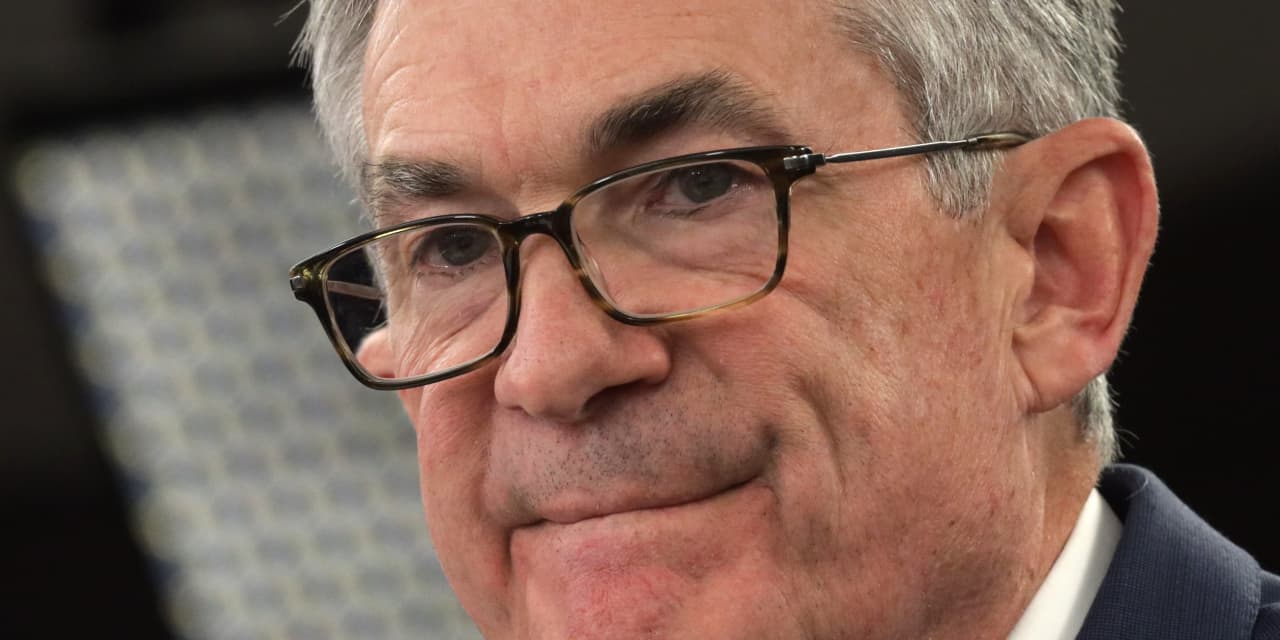

Fed Chairman Jerome Powell is set to tell Congress Tuesday that the U.S. central bank will take steps to make sure higher inflation seen over the past year will not be allowed to develop deep roots in the economy.

“We will use our tools to support the economy and a strong labor market and to prevent higher inflation from becoming entrenched,” Powell will say, according to a copy of his prepared remarks to the Senate Banking Committee released Monday.

The panel is holding a hearing on President Joe Biden’s nomination of Powell for a second four-year term.

Powell has support from both sides of the aisle and experts think he will be confirmed. But Powell may face some criticism for the sharp spike in inflation over the last year. The Fed chairman stressed for months that inflation would prove transitory.

Read: Four mistakes the Powell Fed has made — from a former insider

The Fed has engineered a remarkable pivot and is now expected to move quickly away from the easy policy stance that has been in place since the pandemic started in early 2020.

JP Morgan Chase & Co Jamie Dimon said Monday said he expected more than four rate hikes this year.

Read: ‘If we’re lucky, Fed can engineer a slowdown,’ Dimon says

Powell said that the Fed knows that high inflation exacts a toll on the poor who see prices rising for their essentials.

“We are strongly committed to achieving our statutory goals of maximum employment and price stability,” Powell said.

Sen. Elizabeth Warren, a Democrat from Massachusetts, who did not support Powell’s renomination, signaled Monday that she would press Powell on what he’s doing in the wake of a trading scandal among senior Fed officials, including Powell’s top deputy, Fed Vice Chairman Richard Clarida.

The New York Times reported last week that Clarida quietly amended his financial disclosure forms that raise doubts about his earlier justification for buying into a stock fund in late February 2020 when the Fed was developing its plans to try to protect the financial market and the economy from the rapidly spreading coronavirus pandemic.

At first, Fed officials said Clarida was only rebalancing his investment portfolio. But the new disclosure shows he sold the stock fund earlier in February and then repurchased it.

In a move seen by at least one Fed watcher as aimed at defusing Warren’s criticism, Clarida announced Monday that he will leave his post on Jan. 14, two weeks before his term ends. Clarida, appointed by President Donald Trump, was not going to be renominated by the Biden administration.

Two other Fed officials — Dallas Fed President Rob Kaplan and Boston Fed President Eric Rosengren — left the Fed last year after records of their active trading in financial markets during 2020 were disclosed. Last October, the Fed announced new trading restrictions for top officials.

Stocks

DJIA,

SPX,

closed off session lows on fears of higher interest rates. The tech-heavy Nasdaq

COMP,

saw a slight gain.

The yield on the 10-year Treasury note

TMUBMUSD10Y,

hit a fresh 52-week high of 1.779% before retreating.