This post was originally published on this site

Investors may have kicked off 2022 by unloading technology stocks, but they also have poured into U.S. investment-grade corporate bond funds, according to data from Refinitiv Lipper.

Conventional investment-grade corporate bond funds attracted $2.9 billion of inflows in the week ending Thursday, the sector’s biggest weekly influx since early July, accord to Refinitiv Lipper.

Overall, U.S. debt and equity funds attracted $13.4 billion for the week, according to the data, despite a sharp selloff that hit the tech-heavy Nasdaq Composite Index

COMP,

particularly hard.

Investors dumped growth stocks after the Federal Reserve minutes of its December meeting showed policy normalization, including higher rates, could be in the cards sooner than anticipated only weeks ago.

Higher borrowing costs could become particularly troublesome for growth stocks that are richly valued on the promise of high future earnings. The Nasdaq booked its worst start to a year since 2008 on Wednesday, and was down 3.6% for the week, through Thursday.

Tighter borrowing conditions also can pinch risky companies, although U.S. companies have been on a record borrowing spree, sopping up low-cost financing during the pandemic.

Still, junk bonds tend to come under pressure when equities get rocky, even through the S&P 500 index

SPX,

includes many of America’s most profitable companies, while junk bonds historically finance companies considered a relatively high default risk.

Junk-bond ETFs tend to be among the first things corporate-debt investors sell when volatility rears up, since they trade instantly, while “cash bonds,” or the actual debt issued by companies, can sometimes take days for a seller and buyer to find the right price to transact.

See: What trades more in a day than most Dow stocks? It’s a big junk-bond ETF

The sector’s large iShares iBoxx $ High Yield Corporate Bond ETF

HYG,

attracted $761 million for the week through Thursday, according to Refinitiv Lipper. Shares were on pace for a 1.1% weekly decline, according to FactSet.

However, the smaller SPDR Bloomberg High Yield Bond ETF

JNK,

saw $411 million in outflows for the week. Shares were on pace to shed 1% for the week.

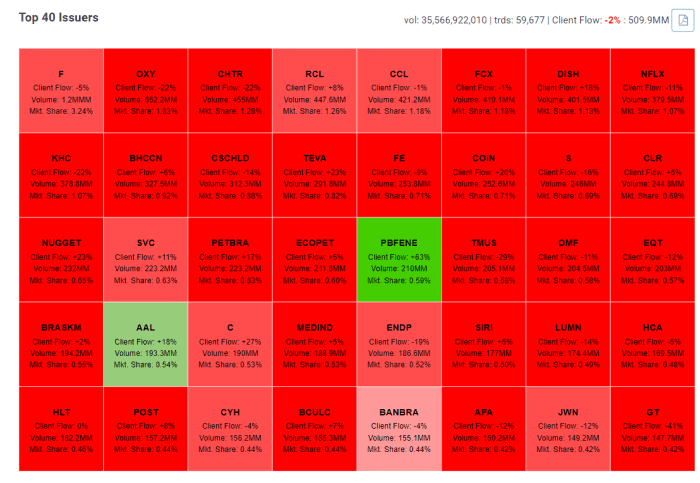

The more than $1.5 trillion “cash” U.S. junk-bond market also was seeing turbulence through Thursday, according to BondCliq data. This chart shows debt issued by Ford Motor Co.

F,

Occidental Petroleum Corp

OXY,

and Charter Communications Inc.

CHTR,

as the most-active junk bonds in a sea of red during that stretch:

High-yield bonds, rated BB+ to D, slump to start 2022.

BondCliq

“Coming off a banner year of earnings recovery, supportive monetary/fiscal policy, credit quality improvement, and 15-year tights in spreads, conditions are set to transition in 2022,” a team led by Brian Zinser, chief corporate-bond strategist at Mizuho Securities, wrote in a Thursday client note.

Read: Corporate debt investors brace for tighter financial conditions in 2022