This post was originally published on this site

Value will be especially valuable in 2022.

I’m referring to the latest round in value stocks’ epic battle against growth stocks.

Over the past five weeks, value stocks have won handily. Though value advisers have declared victory before, only to have growth coming roaring back, value’s relative strength over the past few weeks is more than that — and perhaps the harbinger of more relative strength to come.

Since the end of November, the Vanguard S&P 500 Value ETF

VOOV,

has gained 8.0%, versus a 0.9% loss for the Vanguard S&P 500 Growth ETF

VOOG,

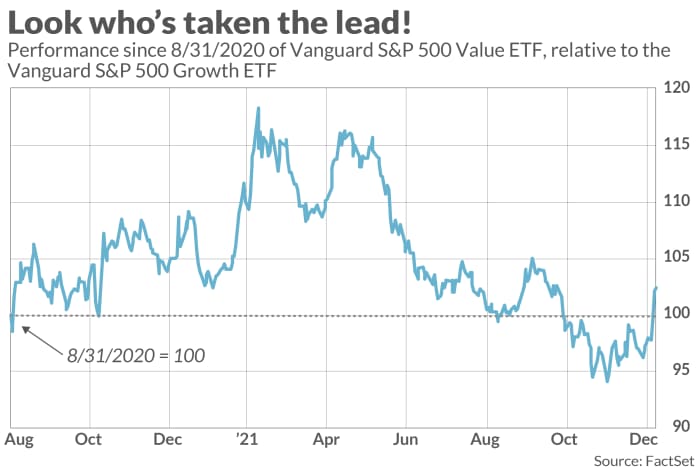

That large of a spread — 8.9 percentage points — in that short of a time period is unusual. In fact, as you can see from the accompanying chart, below, value’s resurgence over the past several weeks has been so strong that it has put the value sector ahead of growth for cumulative performance since the end of August 2020 — more than 16 months ago.

Whatever else you might be inclined to say about value’s relative strength, you can’t call it a flash in the pan.

This bodes well not just for the value sector as a whole, but especially for those value stocks that also are recommended by the top-performing investment newsletters my firm monitors.

Consider the group of such stocks that I highlighted in my November 2020 report on the most popular stocks among the top-performing letters. On average since then, they have produced a total return of 51.4% annualized, according to FactSet, versus 30.4% annualized for the S&P 500’s total return.

Or take the group of value stocks that I listed in my November 2021 report on the top letters’ top picks. On average over the eight weeks since then, they have produced a gain of 7.2%, versus 0.6% for the S&P 500.

There’s no guarantee that the value sector in the future will outperform the market by similar margins, of course, or that the top-performing newsletters’ most-recommended value stocks will perform even better.

Nevertheless, on the assumption that such stocks are a good bet, for this column I repeated the steps I took in constructing those two prior lists. I started with all stocks that are recommended by at least three of the newsletters my firm monitors, and then narrowed the list to include just those whose price/earnings and price/book ratios are below those of the S&P 500, and whose dividend yields are higher.

The table, below, lists the nine stocks that survived this winnowing process. FactSet is the source of the data on price/earnings and price/book ratios, and dividend yield.

| Stock | P/E ratio (based on trailing 12 months’ earnings) | Price/book ratio | Dividend yield |

|

Comerica Inc. CMA, |

17.0 | 1.02 | +4.9% |

|

KeyCorp KEY, |

12.9 | 1.00 | +4.5% |

|

Pfizer Inc. PFE, |

21.6 | 3.24 | +4.2% |

|

Walgreens Boots Alliance WBA, |

19.8 | 1.88 | +3.7% |

|

Leggett & Platt Inc. LEG, |

24.3 | 4.23 | +3.6% |

|

CVS Health Corp. CVS, |

12.5 | 1.29 | +2.9% |

|

Intel Corp. INTC, |

9.5 | 2.36 | +2.8% |

|

J.M. Smucker Co. SJM, |

16.8 | 1.75 | +2.7% |

|

Snap-on Inc. SNA, |

15.0 | 2.42 | +2.6% |

| S&P 500 | 29.3 | 4.84 | 1.3% |

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com.