This post was originally published on this site

Expect the gap between short- and long-term yields to keep shrinking in 2022, extending a prevailing trend from last year, according to Subadra Rajappa, head of U.S. rates strategy at Société Générale.

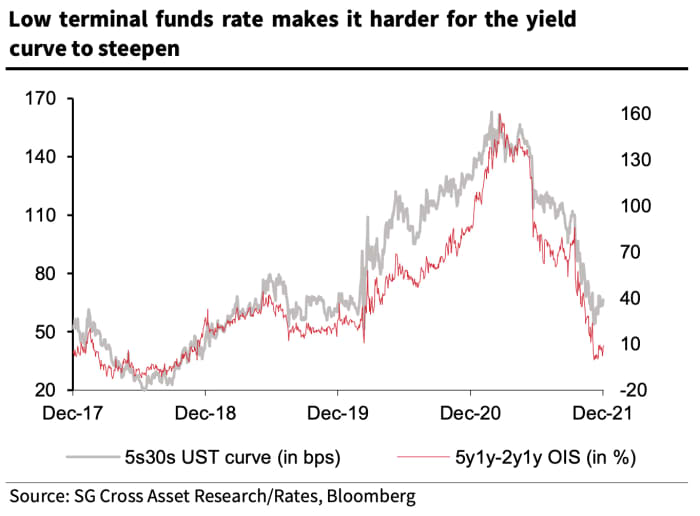

The broad “flattening” trend in the Treasury yield curve “is likely here to stay,” she said in a research report released Tuesday. “We also do not see any catalysts for the curve to steepen meaningfully from current levels,” even as the Federal Reserve embarks on a faster pace of tapering bond purchases.

Société Générale, Bloomberg

A Treasury curve that continues to flatten — even as the Fed gets ready to deliver its first rate increase as soon as March, according to some traders — would be significant for a number of reasons, one of which is that it might catch even the most sophisticated investors off guard, as it did last year. Generally speaking, a steeper curve signifies improving sentiment on the outlook for U.S. growth, and takes into account the likelihood of higher interest rates from the Fed. A flatter curve points to more worrisome concerns that can also bring to mind the prospects of an inversion, the bond market’s warning of an approaching recession.

But in Société Générale’s view, the curve has become “detached from the growth and inflation outlooks,” and will have trouble substantially steepening. One reason is that global bond yields remain “strongly correlated” to pandemic-based lockdowns or flight-to-quality rallies in government bonds. Other factors are continued demand for Treasurys from foreign investors, a still-growing Fed balance sheet, and the likelihood of significant volatility that should include a selloff in short-term debt and contribute to the flattening.

Taken together, that’s all a recipe for gains in short-term yields that outstrip those of the longer end, according to Rajappa.

While spreads between 2-

TMUBMUSD02Y,

and 10-year rates

TMUBMUSD10Y,

and 5-

TMUBMUSD05Y,

and 30-year yields

TMUBMUSD30Y,

steepened somewhat last week, the market still expects the Fed to fall well short of its projected endpoint for rate hikes — making it harder for the curve to steepen, Société Générale said.

Sign up for our Market Watch Newsletters here.