This post was originally published on this site

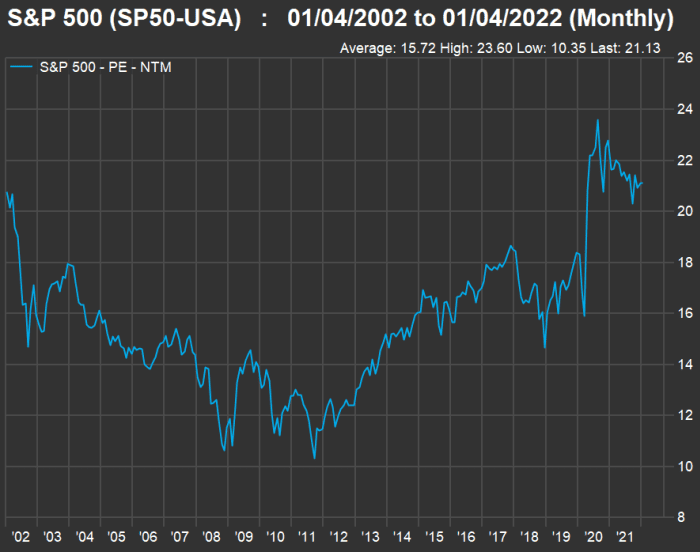

Stocks are expensive. You’ve probably been hearing that for years, and based on traditional price-to-earnings ratios it’s true.

If you invest now in a broad index, such as the benchmark S&P 500

SPX,

you are “buying high,” at least according to this 20-year chart, which shows forward price-to-earnings ratios based on rolling 12-month consensus earnings estimates among analysts polled by FactSet:

FactSet

The weighted forward price-to-earnings ratio for the S&P 500 Index is 21.1, compared with a 20-year average of 15.72.

So how do you increase your chance of good performance when going in at high prices?

Mark Hulbert makes the case for quality dividend stocks as an area for investors to focus on, because dividend-growth has kept pace with corporate earnings growth over the very long term. Over the past 20 years, dividends on stocks have grown at twice the pace of earnings per share, according to Hulbert’s data. He used the SPDR S&P Dividend ETF

SDY,

as an example of a portfolio of stocks of companies that have raised dividends for at least 20 consecutive years.

What about individual stocks?

Exchange-traded funds and mutual funds might be the best way to invest in dividend-paying companies. But some investors might want to hold shares of individual companies with attractive dividend yields or those they expect to increase their payouts significantly over the years.

Here’s a dive into the S&P 500 Dividend Aristocrats Index

SP50DIV,

(which is tracked by the ProShares S&P 500 Dividend Aristocrats ETF

NOBL,

) to find the 12 companies that have been the best dividend compounders over the past five years.

A broader stock screen

What follows is a screen for quality dividend stocks among all S&P 500 components using criteria described in May 2019 by Lewis Altfest, CEO of Altfest Personal Wealth Management, which manages about $1.7 billion for private clients in New York.

Altfest advised investors to steer clear of stocks with the highest current dividend yields. “Generally those companies are ones that have weak growth and are vulnerable to dividend cuts,” he said.

He suggested beginning with stocks that have dividend yields of at least 3%, with “growth of at least 4% to 5% a year in revenue and profit.” He then added another factor: “You want quality stocks with lower volatility — in a beta of 1 or below.”

Beta is a measure of price volatility over time. For this screen, a beta of less than 1 indicates a stock’s price has been less volatile than the S&P 500 Index over the past year.

Here’s how we came up with a new list of quality dividend stocks within the S&P 500:

- Beta for the past 12 months of 1 or less, when compared with the price movement of the entire index: 275 companies.

- Dividend yield of at least 3%: 57 companies.

- Sales increases of at least 5% over the past 12 months: 32 companies.

- Sales-per-share increases of at least 5% over the past 12 months: 24 companies. We added this filter because a company’s shares may be diluted by the net issuance of shares to fund acquisitions or to raise money for other reasons.

- Then we skipped earnings because any company’s earnings for a 12-month period can be skewed by one-time events, accounting changes or noncash items.

- We then narrowed the list further to the 23 companies that increased their regular dividends over the past 12 months.

Here are those that met all the criteria, sorted by dividend yield:

| Company | Ticker | Dividend yield | Sales increase | Sales per share increase | Dividend increase |

| Kinder Morgan Inc. Class P |

KMI, |

6.61% | 38% | 38% | 3% |

| Williams Cos. Inc. |

WMB, |

6.19% | 22% | 22% | 2% |

| Exxon Mobil Corp. |

XOM, |

5.54% | 25% | 25% | 1% |

| Philip Morris International Inc. |

PM, |

5.22% | 6% | 6% | 4% |

| Pinnacle West Capital Corp. |

PNW, |

4.87% | 7% | 6% | 2% |

| Chevron Corp. |

CVX, |

4.49% | 30% | 26% | 4% |

| AbbVie Inc. |

ABBV, |

4.16% | 36% | 23% | 8% |

| Edison International |

EIX, |

4.15% | 10% | 7% | 6% |

| Amcor PLC |

AMCR, |

4.04% | 6% | 9% | 4% |

| Gilead Sciences Inc. |

GILD, |

3.91% | 20% | 20% | 4% |

| Southern Co. |

SO, |

3.87% | 13% | 11% | 3% |

| Entergy Corp. |

ETR, |

3.63% | 13% | 13% | 6% |

| Newmont Corp. |

NEM, |

3.61% | 11% | 12% | 38% |

| Kellogg Co. |

K, |

3.59% | 5% | 5% | 2% |

| American Electric Power Co. Inc. |

AEP, |

3.52% | 9% | 8% | 5% |

| Bristol-Myers Squibb Co. |

BMY, |

3.49% | 15% | 12% | 10% |

| Evergy Inc. |

EVRG, |

3.36% | 12% | 12% | 7% |

| Sempra Energy |

SRE, |

3.33% | 13% | 9% | 5% |

| 3M Co. |

MMM, |

3.33% | 11% | 11% | 1% |

| Federal Realty Investment Trust |

FRT, |

3.13% | 7% | 5% | 1% |

| Public Service Enterprise Group Inc. |

PEG, |

3.08% | 10% | 10% | 4% |

| WEC Energy Group Inc. |

WEC, |

3.03% | 11% | 11% | 15% |

| NRG Energy Inc. |

NRG, |

3.03% | 141% | 144% | 8% |

| Source: FactSet | |||||

You can click the tickers for more about each company.

Then read for Tomi Kilgore’s detailed guide to the wealth of information available for free on the MarketWatch quote page.

Don’t miss: Wall Street analysts’ favorite stocks for 2022 include Alaska Air, Caesars and Lithia Motors

Sign up: For intel on all the news moving markets before the day starts, read the Need to Know email.