This post was originally published on this site

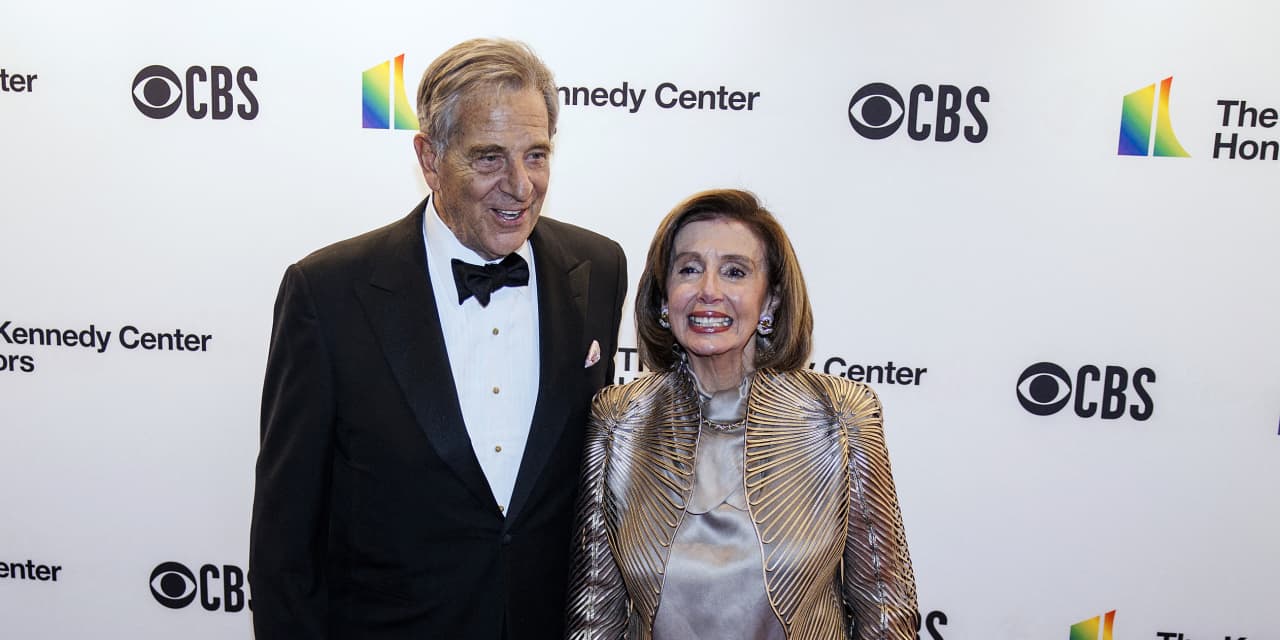

U.S. House Speaker Nancy Pelosi’s husband may be be positioning himself to profit from the ongoing rise in the share prices of some of America’s biggest companies.

Paul Pelosi, the California Democrat’s spouse, bought call options that give him the right, but not the obligation, to purchase shares in Google parent Alphabet, Inc.

GOOG,

memory-chip company Micron Technology Inc.

MU,

Salesforce.com Inc.

CRM,

and Walt Disney Corp.

DIS,

at prices that are upwards of 45% below their closing trading levels on the days in which he made the transactions, according to a periodic transaction report filed with the government.

Federal law requires members of Congress to file reports within 45 days after they or their spouses purchase or sale of securities exceeding $1,000, along with a rough estimate of how much the transactions were worth.

Pelosi purchased between $500,000 and $1 million worth of call options in Alphabet stock with a strike price of $2,000 and an expiration date of Sept. 16, 2022, about 30% below the closing price of the stock on Dec. 17, 2021, the day of the transaction, according to FactSet. He bought between $250,000 and $500,000 in call options in Micron shares with a strike price of $50 and an identical expiration date, about 45% below the closing price on Dec. 21, the day of the transaction.

The Speaker’s husband also bought between $600,000 and $1.25 million in call options in Salesforce shares with a strike price of $210 and an expiration date of Jan. 20, 2023, about 15% below the stock’s closing price of $247.21 on the day of the transaction, Dec. 20. He bought between $100,000 and $250,000 worth of call options in Walt Disney shares with a strike price of $130 and an expiration date of Sept. 16, 2022, roughly 13% below the stock’s closing price of $148.76 on the day of the transaction, Dec. 17.

The value of the call options has likely increased substantially in recent days as the market has been buoyed by a late-year Santa Claus rally. The purchase of call options with a strike price below the market price requires payment of a large up-front premium that accounts for the difference, but that premium can act as leverage that can serve to magnify gains if the price increases thereafter. Each of the companies listed in the report have risen in value since the time that Pelosi made the purchases.

Stock trading by members of Congress and their family members has become a matter of public debate after several instances in the past year when they have been accused of using nonpublic information gathered in the course of their duties to profit from stock trades.

In October, the Office of Congressional Ethics concluded that there “substantial reason to believe” that the wife of Pennsylvania Republican Rep. Mike Kelly used nonpublic information before purchasing stock in an Ohio steelmaker.

In 2012, Congress passed the Stock Act, signed into law by then President Obama, which made it illegal for congresspersons and their spouses to use nonpublic information to trade securities. But in the the nearly ten years since the law’s passage, nobody has been prosecuted under it.

Earlier this month, Pelosi argued against stricter measures, like banning members of Congress and their families from trading individual stocks altogether. ““We are a free-market economy. They should be able to participate in that,” Pelosi said.