This post was originally published on this site

Wall Street kicked off the last week of trading for 2021 with a pretty decent start to that Santa Claus rally, with more gains ahead for Tuesday, by the looks of it.

Still, there’s little to explain the rise in stocks, given volumes are drying up, wrote Michael Kramer, founder of Mott Capital Markets. “You have to go back to late August to find lower trading volumes. It seems like a combination of volatility selling and lower market participants causing buyers to just trip over themselves,” he said in a blog post.

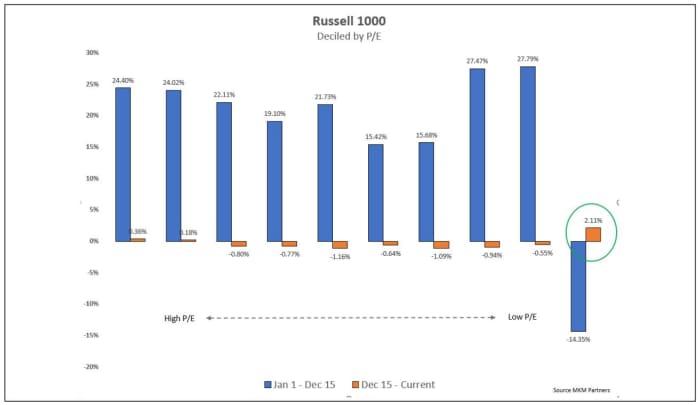

Our call of the day is about less tripping and more of a simple path forward for investors in 2022. “There has been a longer-term trend where managers start to rotate into cheap stocks (attractive valuations) at the start of each calendar year,” wrote JC O’Hara, chief market technician at MKM Partners, in a note to clients.

“We ran a simulated trading model where we bought the lowest P/E [price/earnings] decile of stocks within the S&P 1500 and rebalanced each month. This simple strategy has outperformed the benchmark over the years. We found the returns were heightened over the first quarter of each year on average,” said O’Hara.

And using a simple P/E ratio for the valuation measure, shows a rotation into “attractive valuation names” is clearly already under way, he said. “Cheap stocks saw very little inflow this year until recently. We believe this rotation will continue into 2022.”

The research found attractively valued stocks within every sector, showing what MKM Partners found were attractive technical setups. So here goes a sampling of those stocks, sector by sector:

Consumer discretionary: Ford

F,

Genuine Parts

GPC,

SeaWorld

SEAS,

Six Flags Entertainment

SIX,

Toll Brothers

TOL

and Lowe’s

LOW.

Consumer staples: There are plenty of cheap companies breaking out across the board within that defensive sector. Constellation

STZ,

Walgreens

WBA,

Kroger

KR,

Archer Daniels

ADM,

Hostess Brands

TWNK

and Altria Group

MO

are just a handful of those names.

Energy. MKM has a equal-weight ranking on the sector, but sees plenty of upside in 2022. Halliburton

HAL,

Chevron

CVX,

Exxon Mobil

XOM,

Devon Energy

DVN,

Pioneer Natural

PXD

and Murphy Oil

MUR

are among a big list of stocks.

Financials. “Banks have been under pressure given the recent movement of yields. Other areas within this sector offer better charts in our technical opinion,” said O’Hara. Wintrust Financial

WTFC,

Zions Bancorp

ZION,

Fulton Financial

FULT,

Hancock Whitney

HWC,

People’s United

PBCT,

Prudential

PRU

and Provident Financial

PFS

are among those highlighted.

Healthcare: The strategist said MKM is warming up to the sector amid expansion of “positive breadth” — more stocks advancing than declining. AbbVie

ABBV,

AmerisourceBergen

ABC,

Cigna

CI,

Allscripts

MDRX

and Supernus Pharmaceuticals

SUPN

are just a few of the mentions.

Industrials: Northrop Grumman

NOC,

United Parcel Service

UPS,

Quanta Services

PWR,

Wabash National

WNC,

Norfolk Southern

NSC,

Knight-Swift

KNX

and Boise Cascade

BCC.

Technology: While the sector is generally expensive, there are plenty of bargains, especially within chip and communications equipment makers, said MKM’s O’Hare. Among the stock picks were Lumentum

LITE,

F5

FFIV,

Arrow Electronic

ARW,

Applied Material

AMAT,

Broadcom

AVGO,

Qualcomm

QCOM,

Micron Tech

MU,

Diodes

DIOD

and NetApp

NTAP.

Materials: Look for strength in chemicals, said MKM, with AdvanSix

ASIX,

Huntsman

HUN,

Mosaic

MOS,

Avient

AVNT,

Arconic

ARNC

and Freeport-McMoRan

FCX.

Real estate: MKM has an overweight rating on the sector. Attractive valuation picks include Plymouth Industrial

PLYM,

Retail Value

RVI,

Armada Hoffler

AHH,

Apple Hospitality

APLE,

Alexandria Real Estate

ARE,

American Finance

AFIN

and Gaming and Leisure

GLPI.

Finally, industrials, the worst performing sector year to date, noted O’Hare, but “with plenty of charts we feel comfortable owning into next year.” Edison International

EIX,

Entergy

ETR,

One Gas

OGS,

NiSource

NI,

Black Hills

BKH

and Sempra Energy

SRE

all get a mention.

The buzz

The Centers for Disease Control and Prevention has shortened its recommended COVID-19 isolation time to five days, from 10, if you are symptom-free. That’s as global cases hit a record on Monday of 1.44 million. Some good omicron news? Catching that coronavirus variant could mean enhanced immunity against the delta one, according to a study from South Africa.

Meanwhile, Apple

AAPL

has temporarily shut 11 stores in New York City, owing to a surge in the omicron variant.

Holiday flight disruptions are set to continue on Tuesday, not helped by a batch of winter storms.

Tesla shares

TSLA

are up again, after the electric-vehicle maker logged a 21% gain in the past four days. Keep an eye on this key Fibonacci retracement level.

Shares of Flotek Industries

FTK

are surging, after the Houston chemistry and data group said it has received an unsolicited indication of interest for a buyout of all or some of the company.

Videogame developer Riot Games, a unit of China’s Tencent

HK:700,

will pay $100 million to settle a 2018 gender-discrimination lawsuit with California regulators and female employees.

Investors will get the S&P Case-Shiller U.S. house price index for October ahead of the market open.

The markets

Stock futures

ES00

NQ00

are higher, following an upbeat session in Asia

JP:NIK

XX:000300.

Gold prices

GC00

are moving higher, but copper

HG00

is pulling back and oil prices

CL00

are slightly higher.

The chart

Blogger The Market Ear provides this (Refinitiv) chart that shows some late chasing going on among investors and the tech sector. The index is highs of a short-term range that has held since October. “Chasing the break out in a low liquidity tape isn’t what we do. Time to book some of those mean reversion short term trades and relax…” writes the blogger.

The Market Ear/Refinitiv

Random reads

Researchers will crack the lid on a much-sought after time capsule from 1887 later Tuesday.

“Digitally unwrapping” an Egyptian Pharaoh after 3,500 years.

Legendary rocker Ozzy Osbourne will launch his “CryptoBatz” nonfungible token collection in the new year.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.