This post was originally published on this site

Tesla Inc. is looking at a busy 2022, when the electric-vehicle maker is slated to open new factories and launch its much-awaited electric truck, but some analysts say the dozens of investigations into the safety of its driver-assistance features and its high valuation are reasons to remain cautious on the stock.

The Wall Street consensus is calling for a more than 40% jump in profit in the next year, to $8.64 a share from an estimated $5.99 for 2021, according to FactSet. Sales are expected to grow at a similar pace to $73.2 billion from around an expected $51.7 billion this year. Tesla is expected to sell nearly 1.5 million vehicles in 2022, compared with expectations of around 900,000 vehicles for 2021, according to analysts polled by FactSet.

“It will be a stronger year than 2021,” said Bill Selesky, an analyst with Argus Research. “Basically, it’s all about demand, and Tesla has had less of a problem with (supply-chain related delays) than the GMs and Fords of the world.”

General Motors Co

GM,

Ford Motor Co.

F,

and many other OEMs, however, will be launching new EVs and several electric trucks and SUVs, including the Ford F-150 Lightning and GM’s Chevy Silverado, could give Tesla a run for its money.

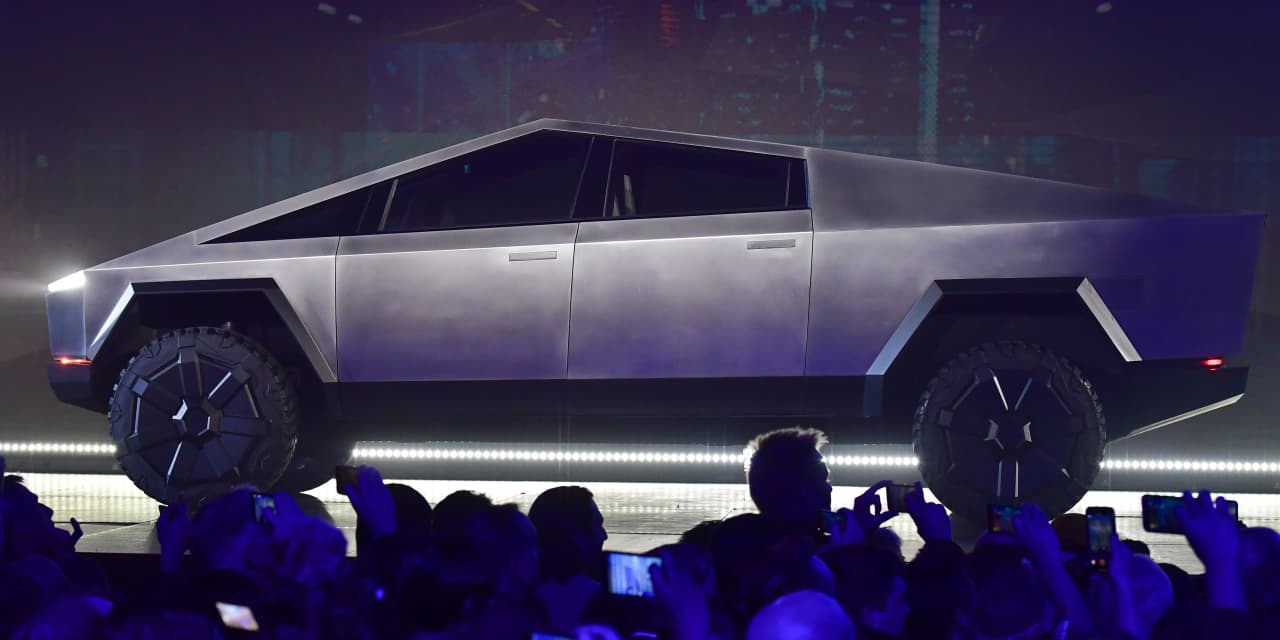

Tesla unveiled its unconventional-looking electric truck two years ago, well before other auto makers’ made public any plans for electric trucks and SUVs, the type of cars U.S. buyers have favored for years. Volume production of the truck likely would come in 2023, Tesla has said, which is behind schedule.

“‘It will be a stronger year than 2021. Basically, it’s all about demand, and Tesla has had less of a problem with (supply-chain related delays) than the GMs and Fords of the world.’”

Chief Executive Elon Musk has signaled he will be on Tesla’s fourth-quarter earnings call with an update on the Cybertruck and supply chain-related delays.

Musk earlier this year told Wall Street he was unlikely to feature on future Tesla earnings “unless there’s something important I need to say,” and he was not on the third-quarter call.

Musk, who has been selling Tesla stock for weeks, tweeted in late November he’d provide “an updated product roadmap” on the fourth-quarter call, which is likely to happen around late January. He prefaced that by calling 2021 the year of “a supply chain nightmare & it’s not over!”

So far, Tesla has weathered the chip crisis “extremely well,” said Michelle Krebs, an analyst with Cox Automotive. “No other competitors have made a dent on Tesla sales. But that’s a question going forward,” she said.

The Cybertruck may have been ahead of others, but “unveiling doesn’t mean much. You’ve got to execute,” Krebs said. “Tesla has got a super strong brand, and they’ve been first in so many things. They won’t be first in electric trucks.”

The Cybertruck is slated to be built in the plant that Tesla is currently building in the Austin, Texas area, which Musk has called “massive.”

Tesla, which has also moved its headquarters to Texas from California, a step it announced in October, plans to make the 2,000-acre property an “ecological paradise” that will be open to the public with boardwalks and trails. The factory will also build Model 3s and Model Ys for the East Coast and the Tesla commercial long-haul truck.

Tesla’s Berlin, Germany factory is also slated to start its production line in earnest in the new year, after numerous delays involving regulatory approvals.

Tesla has been “somewhat constrained in production,” Krebs said, and having other factories come in line will “ease some of the stress.”

Then there’s the stress caused by ongoing investigations by multiple safety agencies into crashes, some of them fatal and allegedly involving Autopilot, Tesla’s suite of advanced driver-assistance systems.

Tesla has been criticized for what some say amounts to “overstating” the system’s capabilities, and for not doing enough to ensure drivers are alert and ready to retake control of their vehicles at a moment’s notice in case the system fails.

See also: Opinion: It’s time for Elon Musk to start telling the truth about autonomous driving

That could dent its reputation, although its owner base is “a very enthusiastic group of people,” Krebs said.

A return to the bond market?

Vicki Bryan, CEO of the Bond Angle, said that Tesla is likely to return to the bond market in 2022, because interest rates are still low “and Tesla goes through a lot of cash.”

Bryan said there is a risk of more Tesla vehicle recalls in China and in Europe, which adds to pressure from the ongoing safety probes in the U.S. The company is likely to struggle to maintain the “momentum that it achieved this year,” she said.

“I am excited about EVs, but not all of them are going to be Teslas,” she said.

“Profitability and momentum hit peak in the second half of this year. … they will have trouble with comps next year,” and the second half of 2022 is looking especially tough with much more choice in the EV market, Bryan said.

Read more: A new Big Three? Rivian and Lucid’s valuations are accelerating past Ford, GM

Tesla’s valuation topped $1 trillion in October, but recently came off that level and the stock entered a bear market, its third of the year, defined as a loss at close of at least 20% from a peak.

Tesla’s valuation is “sustainable,” Argus’s Selesky said.

“What we have here is a growth company,” he said. “At the end of the day … Tesla is going to be the market-share leader through 2027, they deserve a premium valuation.”

Despite the slide into a bear market, Tesla is still enjoying outperformance in relation to the broader equity market. The stock is up 36% for the year, compared with gains of around 24% for the S&P 500 index.

SPX,