This post was originally published on this site

When CalPlant, a northern California manufacturer of fiberboard from rice farming waste, filed for bankruptcy in October, it may not have come as a complete surprise.

The company had issued $344 million of municipal bonds since 2017 in order to build a factory and start manufacturing, but faced construction overruns even before the COVID-19 pandemic hit, according to various reports. It defaulted on a payment in 2020, but just months later tapped existing bondholders for more cash.

CalPlant is hardly the first specialty project to go bust in the municipal market. A monorail running around Las Vegas has been bankrupt twice, and the American Dream mall in New Jersey has struggled for years to get off the ground. CalPlant’s initial bond offering, with an 8% interest rate and investments from high-yield asset managers, make it very different than the tax-backed, tax-exempt bonds sold to wealthy households who simply want to preserve their capital.

“‘If our market wasn’t so bananas, they would have gone to a hedge fund or a bank loan or somebody’s parents for the financing.’”

Still, for one muni-market default-watcher, CalPlant is just the latest example of deteriorating credit quality throughout the market. State and local governments have been so austere about issuing debt that bondholders scoop up anything they can get, and the laxer lending standards involved in project financings and riskier sectors may be starting to percolate throughout the market.

“If our market wasn’t so bananas, that deal wouldn’t have gotten done,” said Matt Fabian, a partner with Municipal Market Analytics, and author of its weekly default tracker. “If our market wasn’t so bananas, they would have gone to a hedge fund or a bank loan or somebody’s parents for the financing.”

On the surface, the muni market seems placid enough. There have been only 60 defaults so far in 2021, according to MMA records, not too shoddy for the first full year of a global pandemic, as Fabian put it in an interview with MarketWatch. And the majority have been in sectors that were considered riskier even before the pandemic strained their business models, such as health care and senior living facilities.

Meanwhile, credit ratings and sectors are being upgraded as federal money flows to the cities and states.

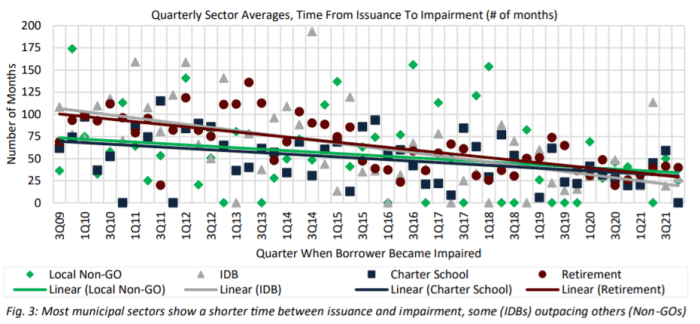

But Fabian points to what’s going on beneath the market’s surface. Among other things, he notes that defaults are happening faster than before — in both riskier and safer sectors of the market — as lenders and borrowers alike get more aggressive.

Source: Municipal Market Analytics

Projects are premised on shakier projections, he argues, even as issuers seek fewer ratings, if they seek any at all (the CalPlant issuance was unrated, and accessed the municipal market as “green bonds” issued by the California Pollution Control Financing Authority.)

Meanwhile, covenants are eroding and the amount of time issuers give borrowers to review a deal is down to hours, “take it or leave it,” in Fabian’s words, rather than a week or two, as has been traditional.

What’s more, defaults may be lower not because projects are more creditworthy, but because, as with the CalPlant saga, “investors are so desperate to stay invested so they’ll loan more money instead of forcing them into a restructuring. A broken issuer doesn’t typically get fresh cash.”

This isn’t a typical market, though. Demand for any tax-exempt paper has been so strong that one investor called it a “food fight” in an interview with MarketWatch last May. Demand for tax-exempt paper with a little extra yield is even stronger, Fabian said.

“There are not enough tax-exempt bonds so lenders capitulate,” Fabian said. “Having bonds is the most important thing. Having bonds with a thick security package is less important.”

Where does the market go from here?

Fabian believes that the erosion of credit standards may be here to stay. But in a twist, he thinks that rising interest rates

TMUBMUSD10Y,

may be helpful if that convinces some investors to stick with safer flavors of munis, rather than dabbling with more-speculative paper.